“My absolute priority will be to strengthen Europe as quickly as possible so that, step by step, we can really achieve independence from the USA.” – Friedrich Merz

New German chancellor-in-waiting Friedrich Merz has been quite candid in his remarks about the deterioration of the allegiance between the transatlantic neighbours and the need for European nations to implement initiatives to stimulate their own economies.

In our previous weekly update, ‘A reset for Europe’, my colleague Jon Pope discussed the requirement for European nations to secure their own borders and become self-sufficient in defending themselves without being dependent on the US.

Further east, authorities in China have pledged to pump billions of dollars into their economy. While the measures were by no means exclusively in reaction to tariffs declared by the US on Chinese imports, it is certainly likely the proposed implementation of such initiated a level of urgency, due, in part, to the anticipated impact on Chinese company revenues.

Proposed policies and those already implemented by the Trump administration, as the above has alluded to, appear to be acting as the catalyst for regional nations to enact stimulatory measures to strengthen their own economies. Various regions, such as the EU and China, have announced their intention to introduce retaliatory tariffs on specific US industries, which, as you can imagine, hasn’t gone down well with President Trump.

Furthermore, on a balance of trade basis the EU and China have two of the largest trade deficits with the US (see table 1), at the same time a trade war between the US and the US’s largest trading partner, Canada, has recently intensified.

Source: Wikipedia - List of the largest trading partners of the United States

Resultantly, the US is fighting a trade war on numerous fronts, which arguably is causing sentiment toward the country’s stock market to sour as investors consider the anticipated impact on growth caused by hostile trade policies. It should, however, be noted that a World Bank analysis from 2022 indicated only 27% of US GDP is reliant on international trade, compared to the global average of 63%, suggesting the US economy is somewhat insulated from a protracted international trade conflict.

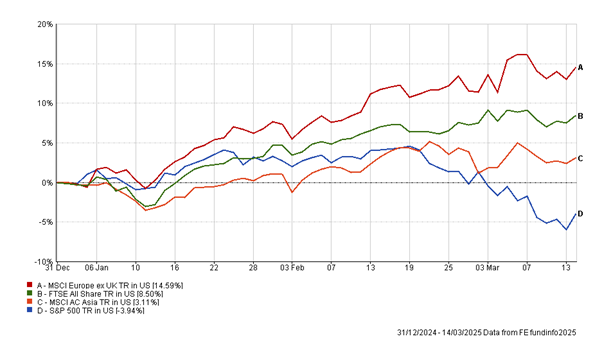

In contrast to the US, stock indices internationally have been performing exceptionally well (see figure 1). After a sustained period of US exceptionalism and global stock indices being dominated by mega-cap US stock returns, there is an indication the breadth of the market is broadening out. Though in its infancy, leadership within the market looks to be rotating away from the US toward a broader market dynamic with European and Asian markets taking up the baton.

Source: FE Analytics

It remains to be seen whether the outperformance of non-US stock returns will persist. The backdrop, however, is encouraging. Defence spending aside, governments within Europe have been announcing expansionary policy intentions. Returning to Friedrich Merz, last week he announced the planned creation of an enormous infrastructure fund putting aside €500 billion for infrastructure projects, on top of €500 billion for defence spending.

Additionally, stimulatory initiatives from China have been providing a tailwind for emerging economies. Announced as a ‘special action plan’, measures will be introduced to boost domestic consumption through, amongst other elements, increasing incomes and credit availability.

We are hopeful that the rotation away from the US should have a positive impact on our portfolios. We have been underweight Magnificent Seven stock exposure and mega-cap stocks in general while at the same time having an overweight to emerging market equities. Moreover, a dedicated infrastructure theme we have been running should also benefit from the increase in fiscal spending in Europe.