David Le Cornu’s weekly note published on the inauguration of President Donald Trump was a brilliant, wide-ranging analysis of what the future might hold for financial markets in 2025 as the effects of Trump 2.0 are felt in the US and further afield. Other recent notes written by our discretionary investment team and Boscher’s Big Picture by Kevin Boscher, our Chief Investment Office, have all quite rightly focused on equity markets, bond markets, inflation, unemployment, GDP, geo-politics, trade wars, interest rates and taxes.

In the US and globally, Donald Trump’s re-election and immediate presidential orders have grabbed the headlines. Closer to home, Chancellor Rachel Reeves’ budget measures have come under intense scrutiny due to a slump in the value of sterling, a rout in UK bond prices and a commensurate increase in the cost of government borrowing. Was Reeves about to suffer the same ignominious fate as Liz Truss and Kwasi Kwarteng? Fortunately for Reeves she was saved by the markets – not by the Bank of England riding to her rescue but more by virtue of the fact that the bond rout wasn’t confined solely to the UK but also affected US and EU bonds as investors digested the ramifications of greater government spending and the absence of tax rises to fund the future outlay.

In the face of such momentous events, which have already been covered in depth and with intellect, we wondered whether there was anything in the world of cash that could possibly get the same attention.

What about the outlook for interest rates?

The collective expectation is that UK and US interest rates will fall but, because of sticky inflation, not by as much as previously thought. I am of the opinion that our cash management service is second to none but “monetary policy stagnates because of sticky inflation” is hardly a headline to set the world on fire.

So, what else is occurring in cash markets that could possibly fire the imagination given what’s been covered so eloquently in other recent articles?

It’s a new year and like many businesses this is a time to review the past 12 months and to get ready for the year ahead. For the cash team, one of those tasks is to review our counterparty list – that is the list of banks with whom we entrust our clients’ cash. We subscribe to Moody’s Rating Agency, which allows us to obtain bank ratings that, importantly, we can include in reports to our clients.

In carrying out this exercise it occurred to us that this is possibly an area of our work which is little known outside the cash management world and we felt that, whilst not as exciting as Trump 2.0, it was worthy of inclusion in this week’s note.

In 2024 ratings downgrades of note affected one major Canadian bank, the Republic of France and, consequently, a number of French banks.

The Canadian bank was Toronto Dominion Bank whose Moody’s rating was cut by one notch from Aa1 to Aa2.

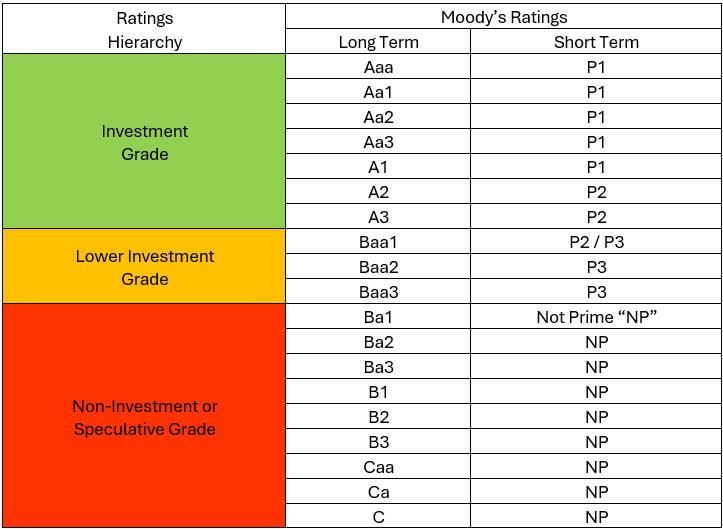

For context we have included a rating hierarchy table below:-

Moody’s Rating Hierarchy Table

On 10th October 2024 it was announced that Toronto Dominion Bank (“TD”), one of Canada's biggest lenders, had agreed to pay a fine of more than $3bn (£2.3bn) and pleaded guilty to criminal charges in the US after prosecutors found that the bank operated with inadequate money laundering safeguards for nearly a decade.

The severity of the fine reflects the length of time the failings had been allowed to prevail but having already made provisions of $3.05 billion the actual fine of $3.09 billion was largely covered. Despite TD’s overall capital position remaining stable, Moody’s announced that "the downgrade of TD's Baseline Credit Assessment reflects the scale and severity of the bank's risk management failures as evidenced by its BSA/AML (US Bank Secrecy Act / Anti-Money Laundering) settlement with the Department of Justice and regulators, which has changed Moody’s view of the effectiveness of TD's governance”.

TD’s ongoing rating of Aa2 is still very good and we haven’t seen any change in the tradability of TD’s Certificates of Deposit therefore, following an internal risk review, the bank remains on our counterparty list.

Turning to the issue of the French downgrades, the catalyst was the political turmoil in France following the shock outcome of the snap election in July. President Macron’s party lost its majority in the French Assembly, creating significant uncertainty about the government’s future spending plans and its ability to raise taxes. The turmoil led to a no-confidence vote that resulted in Prime Minister Michel Barnier being replaced by Francois Bayrou in December. An attempt to break the political deadlock, time will tell if it was effective.

However, financial markets are not renowned for patience and French bond prices immediately came under pressure given the political vacuum developing in the Elysee. The concerns were shared by the world’s major rating agencies and on 14th December Moody’s “downgraded the Government of France's domestic and foreign currency long-term issuer and domestic currency senior unsecured ratings to Aa3 from Aa2 and changed the outlook to stable from negative”.

Rating methodology dictates that a country’s banks cannot have a better rating than that country’s Sovereign rating. As a result, a number of French banks were downgraded despite not having been the subject of any wrongdoing or financial loss.

The affected banks on our counterparty list are BNP Paribas, Credit Agricole and Crédit Industriel et Commercial, all of whom had their Moody’s ratings cut from Aa3 to A1 on 17th December. As with our view on TD Bank the residual ratings of these French banks remain investment grade and we have seen no deterioration in the liquidity of their Certificates of Deposit nor the rates of interest they pay. This suggests that they are not suffering any stress as a result of the downgrades and we regard them as suitable banks to remain on our counterparty list.

Monitoring of bank ratings is a core part of our service and any changes are discussed at our cash investment committee meetings and escalated to our Group Risk Committee as necessary. The aim is to ensure that our clients’ cash is put to work but remains safe, secure and accessible. The issues highlighted hopefully demonstrate our proactive approach to monitoring and willingness to move money should the slightest concern of unacceptable risk arise.

So, not quite the exciting world of stocks and shares but a vital component of all our cash management service.