“In this bright future

you can’t forget your past!”

No Woman No Cry – Bob Marley and the Wailers, 1974

For many of us the run into Christmas and the New Year comes with a mixture of reflection and contemplation: taking into account the year just past while considering that to come.

This is particularly pertinent in 2025 since, as you know, we have recently been acquired by UK-based Titan Wealth. We are very clear that it remains business as usual for our clients – you are always at the forefront of our thoughts and actions. Nevertheless, the transaction clearly signals the end of one successful chapter and the exciting transition to another.

Our discretionary business first opened its doors in September 2008, just as Lehman Brothers collapsed and the world’s financial system hit crisis point. Whilst such episodes are extremely challenging – especially so when starting a business – they also present the opportunity to learn. In our case not just about investing but, also and most importantly, meeting and exceeding clients’ needs. You will not be surprised that we learnt an awful lot! Moreover, much of the knowledge we gained, including enduring lessons from earlier episodes like the 2001 technology crash, remains at the heart of what we do today.

Out of interest I recently looked back through our first quarterly investment commentaries for inspiration. The earliest we have on record is from Q1 2009 and contains the following line: “Underlying the current environment is a seriously heavyweight economic duel between the prospects for either deflation or inflation.”

Fast-forward fifteen years and that very dynamic is at play today, particularly given geopolitical tensions and Donald Trump’s promise of immediate post-inauguration tariffs. In many ways, although the world moves on, the fundamentals of successful investing remain the same.

The key to providing fruitful outcomes for clients is a profound understanding of your investment requirements. We then apply that knowledge to the creation of portfolios that meet those demands: investing into assets and themes that will stand the test of time – relevant now and remaining so into the future. Such portfolios must also be sufficiently liquid that profiles can be easily adjusted should objectives change (or if clients simply desire to have their money returned). Our goal is to create portfolios that are easily understood by one and all; put simply, to know what you own and why you own it!

All of this is ingrained into our process. Indeed, we aim to build on those foundations by continuously and incrementally improving both outcomes and quality of service. We consider that working with Titan offers us that opportunity through access to more research, more ideas and more highly skilled and talented individuals – all working towards a common goal.

As Bob Marley once wailed: “in this great future you can’t forget your past.” We think that applies equally to clients and their investments, both historically and, even more importantly, in the future. On that note we’d like to say thank you for your continuing support. We look forward to working together to ensure a happy and prosperous New Year.

Cautious Portfolios

Lower Risk

by Robert (Bob) Tannahill

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue chip equities with strong cashflows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

Our Cautious portfolios fell -0.4% (1) over the quarter modestly lagging the sector (2) which fell -0.2%. This leaves the portfolios up 4.9% (3) on the year versus 4.5% (4) for the sector.

The quarter was dominated by politics. In the US we had the greatest media show on earth with Donald Trump securing a second term as US President. While markets had him as the marginal favourite going into the election, they had not anticipated a Republican sweep giving the party control of both houses of Congress. This gives President Trump significantly more ability to push through more of his policy agenda and markets reacted to price this in. Given the typical gap between rhetoric and reality, markets are somewhat guessing at the implications at this stage, and we have seen this reflected in some broad moves based on Trump’s perceived preferences. US equities and the US dollar rose, outperforming the rest of the world. This was compounded by Chinese policymakers disappointing markets with the scale of their stimulus package announced over the month. On the other side, interest rate-sensitive bonds fell on inflation fears while environmental plays sold off on Trump’s scepticism towards the space. Only time will tell if these initial moves were correct or not.

Within the portfolio our equity positions were flat to modestly up on the quarter with a pleasing performance from Pacific, which bucked the general negativity around the emerging world to end the quarter up 3.6% (5). On the other hand, KBI had a tough quarter falling -7.7% (6) thanks to a combination of negative sentiment towards “green” assets and rising interest rates, which are a headwind to some of their stock valuations. By our measures, KBI sits at a very attractive valuation following this sell-off so we are holding our position and cautiously optimistic about returns from the fund in 2025.

On the bond side, long-term interest rates rose and concerns over credit risk remained low in the expectation that a Trump administration will run the US economy hot (coupled with growth data generally holding up well). Against this backdrop we were not surprised to see the more interest-rate-sensitive bond funds lag over the quarter: Rathbone, M&G and Jupiter were all down between -0.7% (7) and -3.6% (8). The winners were our more credit-focused funds, such as Titan and Schroder, which both rose a little over 1% (9).

We made one change over the quarter, which was to sell one of our direct bonds (International Finance Corporation) at a profit and re-invest the proceeds into the TwentyFour European Monument Bond Fund. The TwentyFour fund offers a higher yield than the direct bond it replaces, c6%, without a material increase in risk profile.

In our diversification allocation, Fermat posted a strong quarter, up 3.3% (10), despite a small loss being incurred at the start of the quarter due to Hurricane Milton. This caused the fund to post a fall of -0.6% in early October before rebounding over the rest of the quarter. Ruffer had a difficult quarter as the impact of Trump’s win negatively impacted some of their core positions, such as the Japanese Yen and long-term inflation-linked bonds. Ruffer fell -3.7% (11) over the quarter. This leaves Ruffer down -0.8% (12) on the year, which, while a drag on the rest of the portfolio, is tolerable (and broadly as we would expect Ruffer to behave in a year when markets have been favouring higher risk assets). If 2025 proves a tougher year from general assets we would expect Ruffer to come into their own.

Looking forward, the portfolio remains in decent shape albeit valuations are not quite as attractive as they were at the start of the year. Equities look broadly fair value today, bar KBI which looks notably attractive. On the bond side, the expected returns to maturity (yield to maturity) on core bond funds, such as Rathbone, are over 5% today, which positions the portfolio well to outperform cash over the next few years. A key risk we see in markets remains the high levels of concentration in a small number of large companies. Specifically, those at the centre of the AI and weight loss drugs trends. The portfolio’s exposure to these hot spaces, however, is very limited and as such we are comfortable that this risk is well managed.

Higher Income

Medium Risk

by Robert (Bob) Tannahill

Objective: The Higher Income portfolio’s objective is to provide investors with a current income that is higher than cash rates. The current income target is 6%. The portfolio invests across a diverse range of assets including dividend paying equities, investment grade and high yield bond and infrastructure investments. The cash generated is taken as an income stream.

The Higher Income portfolios fell -0.1% (13) over the quarter. This leaves the portfolio up 5.4% (14) on the year.

The quarter was dominated by politics. In the US we had the greatest media show on earth with Donald Trump securing a second term as US president. While markets had him as the marginal favourite going into the election, they had not anticipated a Republican sweep giving the party control of both houses of Congress. This gives President Trump significantly more ability to push through more of his policy agenda and markets reacted to price this in. Given the typical gap between rhetoric and reality, markets are somewhat guessing at the implications at this stage, and we have seen this reflected in some broad moves based on Trump’s perceived preferences. US equities and the US dollar rose, outperforming the rest of the world. This was compounded by Chinese policymakers disappointing markets with the scale of their stimulus package announced over the month. On the other side, interest-rate-sensitive bonds fell on inflation fears while environmental plays sold off on Trump’s scepticism towards the space. Only time will tell if these initial moves were correct or not.

Within the portfolio our equity positions where generally flat on the quarter with a pleasing performance from Pacific which bucked the general negativity around the emerging world to end the quarter up 3.6% (15).

On the bond side, long-term interest-rates rose and concerns over credit risk remained low in the expectation that a Trump administration will run the US economy hot (coupled with growth data generally holding up well). Against this backdrop we were not surprised to see the more interest-rate-sensitive bond funds lag over the quarter with Rathbone down -0.7% (16). Our other bond funds, being higher income and therefore more credit focused did well returning between 0.3% and 2.0%.

Looking at the investment trusts there was a clear laggard in the form of The Renewables Infrastructure Group (TRIG), which fell a painful -15.6% (17). This position has been a laggard for some time and in December we took the difficult decision to sell it. While we remain happy with the assets and the management team, the fund is unavoidably exposed to a number of factors, such as sentiment towards the UK investment trust sector, which are outside its control. While we are conscious that these factors could turn in its favour at some stage we don’t know when this might be. Given that we have other trusts in the portfolio that offer us similar returns with less uncertainty, we decided to focus on those. We split the sale proceeds from TRIG over our other two investment trusts, namely Sequoia Economic Infrastructure Income (SEQI) and TwentyFour Income (TFIF).

In our diversification allocation, Fermat posted a strong quarter, up 3.3% (18) despite a small loss being incurred at the start of the quarter due to Hurricane Milton. This caused the fund to post a fall of -0.6% in early October before rebounding over the rest of the quarter.

Looking forward, the portfolio remains in decent shape albeit valuations are not quite as attractive as they were at the start of the year. The estimated income yield on the portfolio remains slightly over 6% and we are happy with all the underlying holdings in the portfolio. This puts us in a good place, going into 2025, to keep delivering on our goal of offering a higher income than cash combined with a stable or rising capital value over the medium term. Thank you, again, to all of our clients for their continued support in 2024 and we wish you all a happy and prosperous 2025.

Balanced Portfolios

Medium Risk

by David Le Cornu

Objective: The Balanced Portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

The Balanced strategy made progress over the final quarter of the year returning +0.9% (19) ensuring that the 2024 return of +6.1% (20) is ahead of cash returns and inflation as well as in line with the peer group return of +6.1% (21) (IA 20-60 Index). The final quarter was very much a tale of two halves: strong gains being recorded, then many of those gains being given back as investors pondered what a second Trump presidency means for America, the global economy and investment markets. The world will watch the first 100 days intently to get a better understanding of the reality of the Trump presidency.

The performance of bond and equity markets didn’t rhyme in 2024. The best performing equities were typically long-duration assets such as growth-orientated technology stocks with profits and cashflows anticipated many years in the future. In stark contrast, long-duration bonds were amongst the worst investments to hold in 2024 as future cashflows were discounted more aggressively as expectations of future interest rate cuts were moderated and moved further out in time causing the yield curve to steepen.

It will come as no surprise that the best performing equity funds held in the Balanced strategy during 2024 were the Blue Box Technology fund and Sanlam AI fund which returned 19% (22) and 27% (23). The latter fund is the only fund we have with exposure to Tesla shares, which have rocketed +60% since 5th November when Donald Trump was elected as the next US President. Polar Global Insurance fund also delivered strong returns but was sold mid-year as the returns delivered had got ahead of our expectations.

Despite the challenging interest rate environment, Fermat Cat Bond fund and Titan Hybrid Bond fund both delivered double-digit returns. The former adds value through its assessment of catastrophe insurance risks whereas the latter adds value through its ability to identify anomalies in complex capital structures. The worst-performing holdings (Allianz Strategic Bond Fund and Robeco Smart Materials) were sold mid-year. Both are interest-rate-sensitive and were impacted by the changing interest rate environment. Lazard Global Equity Franchise Fund and Ruffer Total Return Fund (Reference) both disappointed but have been retained. The Lazard fund performance is broadly in line with expectations and can be attributed to its value bias, whereas Ruffer was too cautious. The Ruffer position was halved earlier in the year and continues to be closely monitored.

2024 saw a more positive tone in our asset allocation to reflect our improving views of the global economy and the prospects of investment markets. Equity exposure increased from 52% to 58.5% whilst cash/near cash and a specialist fund (Ruffer) were halved. At the same time, we rebalanced the split between global and thematic equity exposures and implemented changes from our deep dive review of investment themes and fund holdings. Collectively, this saw the introduction of eight new equity funds, Aberdeen Emerging Markets Smaller Co’s, AB International Healthcare, Blue Box Technology, Brown Advisory Global Leaders, Fundsmith Equity, Pacific EM Equity Income Opportunities, Pictet Global Environmental Opportunities and Polar Asian stars.

This has left the equity exposures within the Balanced strategy positioned as follows:

- No pronounced style bias across the collective global equity fund holdings.

- Materially underweight America and overweight Asia, emerging markets and Europe.

- A broader geographic spread across Asian and emerging markets.

- In-line technology but materially underweight the Magnificent Seven.

- Materially overweight healthcare with a double-weight exposure to Biotechnology.

In contrast, we have introduced one new bond fund, the Fermat Cat Bond. This has left the bond exposures within the Balanced strategy positioned as follows:

- Yield to maturity circa 6%.

- Emphasis of short-dated bonds, specialist bonds and the IG credit crossover point.

As we enter 2025, we anticipate a much lower level of portfolio activity. The Balanced fund is positioned for a year where economic activity holds up, inflation is stubborn but stays within tolerable limits and interest rates moderate but do not fall as much or as quickly as analysts predict. Equity exposure at 58.5% is towards the upper end of what we consider appropriate for a medium-risk Balanced strategy but is being underpinned

by a portfolio yield of 2.9%.

2025 is shaping up to be a reasonable year for investors in our Balanced strategy. Whilst there will inevitably be bouts of volatility and there are no performance guarantees (any investment may fall or rise in value) we believe we are positioned to deliver returns ahead of cash rates, inflation and the long-term average return of the Balanced investment strategy. Outperformance will be determined by whether the market focus broadens (and some of the out-of-love regions and sectors that we have exposure to begin to perform) or returns continue to be dominated by a small part of the market.

I would like to take this opportunity to thank our investors for their support in 2024 and to wish them a happy, healthy and prosperous 2025.

Growth Portfolios

Higher Risk

by Samantha Dovey

Objective: The Growth Portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

For the final quarter of the year the Growth strategy returned 0.8% (24) versus the IA Sector 40-85% at 1.2% (25), this brings the 2024 year for the strategy to 5.5% (26) and the sector 8.9% (27).

The last quarter closed on a relatively upbeat note to end 2024, with the only blip coming from December, which posted a negative equity return of 1.1% (28) – sterling investors were also supported by sterling weakening to the US dollar. Despite this, the standout performers remained the “Magnificent Seven”, returning around 24%, which was partially driven by gains in the US market following Trump’s election in November. Elsewhere, investors showed pessimism toward Europe (-3.6%) (29) and emerging markets (-1.7%) (30), citing weaker earnings potential in Europe and structural challenges such as employment issues, real estate concerns, and property-related impacts in China.

As expected, technology and AI-driven assets emerged as the top performers, with Sanlam Global Artificial Intelligence (+13.2%) (31) leading the way, bolstered by its significant holdings in Nvidia and Amazon. BlueBox Global Technology (+6.9%) (32) also played a strong role in the positive performance. We were equally pleased with the performance of our emerging markets managers, especially given the broad market dip. Notably, Aubrey Global Emerging Markets (+7.2%) (33) benefitted from its robust positions in Chinese semiconductors and Indian equities, thanks to its overweight exposure in these sectors.

On the downside, the main detractors were Schroder Energy Transition (-16.3%) (34) and Polar Healthcare Opportunities (-5.4%) (35), both of which experienced heightened volatility and presented considerable challenges. The energy transition fund, in particular, struggled due to policy reversals on renewable energy and pricing considerations. After careful consideration and deliberation, we made the difficult decision to exit this fund and the sector exposure.

In line with previous changes across the strategy post thematic deep dives, over the quarter we completed a review of our focused environmental solutions allocations.

We began by selling both the Schroders Global Energy Fund and Schroders Energy Transition Fund in November; this was a heavily debated investment decision. When we invested energy security was at the forefront of people’s minds due to the invasion of Ukraine by Russia, coupled with an inflationary environment, which caused us to research this investment opportunity. Now two years on, despite the ongoing Ukraine Russia conflict, as well as escalating tensions in the Middle East, the price of crude oil has remained range bound, and natural gas and renewables has been incredibly volatile in light of changes to net-zero targets and the number of countries involved in various climate agreements around the world.

As both funds, to differing degrees, have struggled in this environment, and the outlook for both traditional energy and renewables looks uncertain in the medium term, we have made a decision to move on and focus capital in other more diversified growth opportunities available.

To replace these positions, we have introduced several new investments. We allocated 5% into the Regnan Global Mobility and Logistics Fund. The fund offers a compelling opportunity aligned with evolving global dynamics, as global supply chains and the need for modern transport infrastructure intensifies. The investment includes holdings from equipment manufacturers to related technologies associated with freight,

delivery and logistics.

We also introduced Atlas Global Infrastructure Fund with a 5% allocation, this is a dedicated infrastructure fund run by a leading team in the space. Similar to the above, it is aligned with investing in solutions in light of a growing global population which is placing increasing pressure on global infrastructure such as electricity systems, water supplies and management and energy storage facilities.

Additionally, we made the decision to alter our healthcare mix. While we continue to see value in healthcare as a sector, we sold the Polar Healthcare Fund and introduced both Polar BioTech (4%) and AB International Healthcare (4%). Both funds target promising growth opportunities in the healthcare and biotechnology sectors, areas where innovation and advancements are expected to drive significant returns in the years ahead.

Finally, we increased our position in Fermat to 5%. Fermat specialises in catastrophe bonds and insurance-linked securities and has continued to perform well, delivering stable returns. This increase aligns well with the portfolio’s long-term growth objectives and further enhances our exposure to high-growth sectors while offering a unique, risk-mitigated investment opportunity.

Going into 2025, we continue to monitor key factors that can add to market volatility such as anticipated interest rate cuts from the Bank of England (Feb 2025) and the Federal Reserve (Jan 2025), alongside Trump’s inauguration. However, our strategy remains focused on growth through diversified investments across our long-term global themes.

Global Blue Chip Portfolios

Higher Risk

by Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

The fourth quarter combined conditions from the second and third quarters. Despite the US election, October was benign. November saw the ‘Trump Pump’ with market reactions to his policies and RFK Jr’s Health Secretary nomination. December’s market optimism was halted by Jerome Powell’s comments, leading to volatile trading.

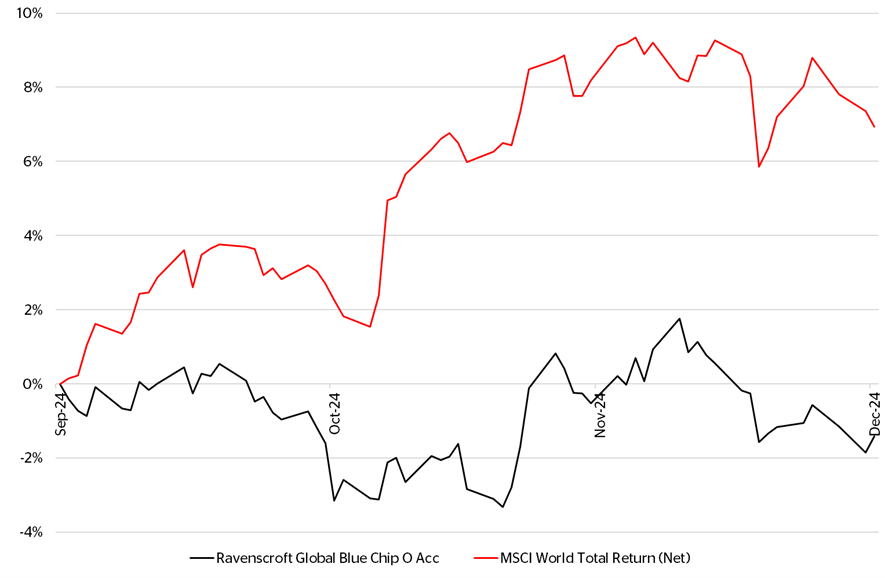

Chart 1. Ravenscroft Global Blue Chip Performance Against MSCI World (Net) and the MSCI World Equal Weighted for Q4 2024, in GBP

Nonetheless, despite the damp ending to the year, Q4 was another good quarter for equity investors with the MSCI World returning 7.03% in GBP (36). Global Blue Chip was unable to capture this level of upside, returning -1.4% (37).

For our year-end review, please refer to our quarterly Global Blue Chip Insights newsletter.

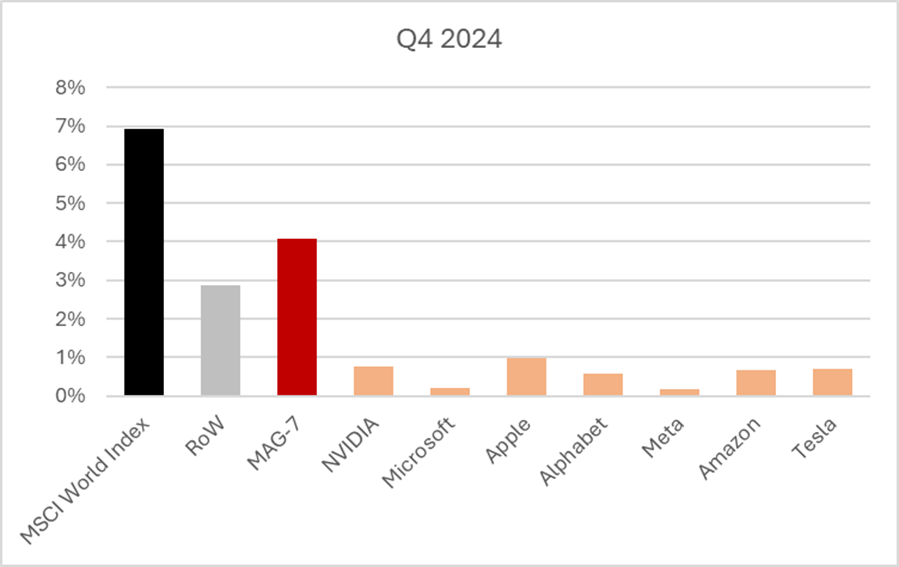

Chart 2. Magnificent Seven Influence

One of the main reasons for the market’s strong performance was the influence of the Magnificent Seven (Mag 7). By our calculations, this was the strongest quarterly return for this cohort in 2024, delivering just over 4% in absolute terms, representing some 60% of the MSCI World’s overall return.

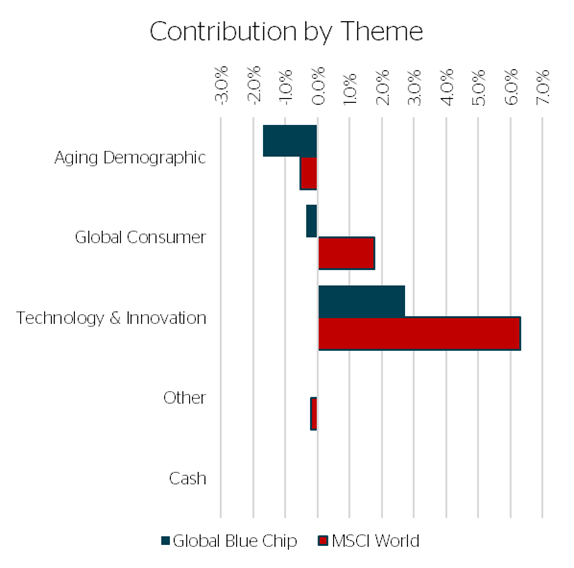

Performance assessment by investment theme

Chart 3. Sector Allocation, Sector Performance and Contribution by Sector for Q4 2024

Ageing Demographics – Healthcare Sector (including the life sciences)

After a brief period of good performance during Q3, the sector was rotated out of in favour of risk-on sectors such as technology. It is now obvious in hindsight that the market believed Trump would win and that it was highly likely that RFK Jr would be awarded some position of influence. Maybe investors were factoring that proposition in during October? Even so, the impact RFK Jr’s nomination had in November and through December certainly placed a dark cloud over the sector.

It wasn’t all doom-and-gloom though, with Edwards Lifesciences producing a solid return as the stock was awarded some upgrades from sell-side analysts.

Global Consumerism – Consumer Staples and Discretionary Sectors (including Visa)

Discretionary was one of the market’s strongest performing sectors despite the bleak news surrounding China and the somewhat mixed data on the strength of the US consumer. However, much of sector’s strength was down to the influence of Amazon and Tesla. Our exposure has a greater weight to the Chinese consumer and, whilst there was some good news regarding stimulus measures in December, many of these holdings ended up in the top five detractors list.

Estée Lauder was one such holding as shares took a notable dive after announcing earnings in early November. However, this was counterbalanced by payments business Visa delivering strong earnings in November.

Technology & Innovation – Technology and Communication Services

The biggest contributors to our technology and innovation investments were our streaming companies, with both Netflix and Disney making the top five contributors list. Positive developments at Disney with regards to its streaming business have been warmly received by the market, whilst Netflix rode a very strong wave of optimism following its earnings results in October that beat expectations on both the top and bottom lines.

We initiated two new investments in the semiconductor industry which has, outside of AI-related products, been going through a downturn, reminding investors that this is a highly cyclical industry. We bought ASML, the only maker of high-end, ultraviolet lithography machines, used to manufacture all leading-edge semi-conductors, and KLA Corporation, another ‘pick-and-shovel’ play (the buying stocks of companies that provide essential tools, services, or infrastructure for a booming industry, rather than investing directly in the industry itself).

We also reintroduced an old friend in Honeywell Inc. to the strategy after activist investor Elliott Management persuaded the Board to consider splitting the business into two entities: one focused on aerospace and the other on automation. This split is expected to create significant value, as the conglomerate structure previously hindered value recognition. Honeywell is one of the few remaining industrial conglomerates considering a split, and others that have done so have seen substantial returns. Independent business units can create more value for shareholders, and investors are more likely to be attracted to pure plays. We anticipate management’s decision in early 2025.

2024 has been particularly gruelling for our strategy for a variety of reasons which we have explained throughout the year. In this quarter’s Blue Chip Insights newsletter, we intend to consolidate that commentary and pick through some of the lessons learned and how these will feed through into our process, ensuring we capture more of the value on offer in markets without necessarily undoing much of the good process that has made Blue Chip what it is.

We would like to thank all our investors for their support to date and we look forward to seeing what the markets will bring in 2025.

To receive the Blue Chip Insights directly, please email marketing@ravenscroftgroup.com

Global Solutions

Higher Risk

by Shannon Lancaster

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

For the final quarter of the year the fund returned -3.5% (38) this brings the 2024 year for the strategy to -1% (39).

Performance

At the top level for the quarter the top three were:

- Polar Smart Energy 7%

- Wellington Global Stewards 2.2%

- Nordea Climate Engagement 1.6%

Nordea and Wellington are the more market-like funds in the portfolio which benefitted from financials and technology exposure. These funds should be less volatile than satellite positions and have behaved this way over Q4. Polar Smart Energy, which sits in the energy transition theme, outperformed its peers due to its efficiency, big data and AI exposure. Marvell Technology, which is a key holding, profited from comments about strength in business fundamentals which bodes well for the company’s outlook for next year. Vertiv Holdings, a supplier of electric power equipment and thermal management to data centres, increased its expected 2024 top-line growth having already indicated its expectations for 2025 organic sales growth to accelerate further compared to 2024.

The bottom performers over Q4 were:

- Schroder Energy Transition -16.3%

- KBI Sustainable Infrastructure -8.2%

- Candriam Oncology -7.9%

Underlying fund data as stated, GBP Total Return 30/09/2024 to 31/12/2024.

Source: Ravenscroft CI Limited and FE fundinfo. Collated 15/01/2025.

Energy transition and infrastructure names were under pressure in Q4 as interest rates have fallen more slowly than investors originally expected. Healthcare was also under pressure as Novo Nordisk fell hard in December after a strong year of performance on the back of the increasing popularity of GLP 1 drugs (medication that helps manage blood sugar levels for people with Type 2 diabetes).

Changes

Schroder Global Energy Transition and Brookfield Sustainable and Renewable Infrastructure were both sold. These funds were replaced with Atlas Global Infrastructure and Regnan Mobility and Logistics. After a challenging period for the energy transition theme, we evaluated the space and found better investment opportunities that are aligned with this long-term structural trend.

Regnan Mobility and Logistics is focused on the movement of goods, services and people globally. The investment covers holdings from equipment manufacturers to related technologies associated with freight, delivery and logistics. Top holdings include FedEx, which runs a global network of express deliveries from parcels and e-commerce solutions, and BYD, which has a broad remit covering commercial vehicles to rail transportation construction.

Atlas Global Infrastructure Fund is a dedicated infrastructure fund run by a leading team in the space. It is aligned with investing in solutions in light of a growing global population, which is placing increasing pressure on global infrastructure from electricity systems, water supplies and management and energy storage facilities.

Their central aim is to construct portfolios of high-quality infrastructure assets that meet their clients’ investment objectives, and which deliver sustainable returns over long time periods. The benchmark is a CPI+5% in this respect and outperformance has been achieved.

Outlook

The investments in Global Solutions are targeting companies that are addressing critical global challenges. The fund is diversified across key themes such as environmental solutions, basic needs, energy transition, emerging equality, and resource scarcity.

Despite recent volatility, the fund’s underlying investments are anchored in strong fundamentals, positioning them for recovery and growth. Demand for innovative solutions continues to grow, driven by global policies and technological advancements. Global initiatives and regulatory frameworks are increasingly directing capital into clean energy sectors. Continuous advancements in renewable technologies are making clean energy more competitive, further driving investment.

The recent confirmation of Trump’s victory has resolved significant uncertainties in the energy transition sector, stabilising valuations and boosting investor confidence. With earnings normalising and management optimistic about future performance, the outlook remains strong. Additionally, decreasing interest rates and lower inflation volatility are expected to benefit the fund’s underlying assets.

Valuations are looking very attractive across the board and these market conditions have created opportunities for our fund managers to acquire incredible businesses at multi-decade valuation lows. As earnings normalise, the potential for significant upside exists.

At a time when the market is experiencing record-high concentration, the benefits of diversification should be highlighted. Global Solutions has minimal exposure to the most commonly held Magnificent Seven (Mag 7) names. With exposure to one of these seven names, our underlying businesses provide a valuable diversification strategy for investors. Even though we do not own Nvidia, the portfolio includes companies poised to benefit from the expansion of AI infrastructure and the push for fossil fuel-free operations by major corporations like Microsoft and Amazon. It is a great way to access the AI theme while avoiding the lofty valuations associated with the Magnificent 7.

As the world’s population continues to grow, the demand for essential resources such as water, energy, food, and healthcare is increasing. This fund is strategically investing in businesses that are positioned to meet these needs while also innovating to find solutions to global challenges. While it has been a challenging period since launch, we are confident the themes we have exposure to are very much still in play.

Fund in Focus

Global Equity

by Tom Yarwood

In line with the reviews of our core themes over the year, the Ravenscroft multi-manager team reassessed the healthcare allocation and decided to access the theme differently via a blended exposure of AB International Healthcare and Polar Biotechnology. In Growth, this trade has been funded by the sale of Polar Healthcare Opportunities.

Balanced and Growth have had direct exposure to the healthcare sector for over a decade, with healthcare a core investment opportunity that we continue to believe will remain one of the main growth sectors going forwards. For the past two years, Balanced and Growth have used different funds to gain exposure to the theme. For Balanced, this was via Polar Biotechnology and, for Growth, this was via Polar Healthcare Opportunities. The latter has played an important role in our portfolios since the very beginning in December 2011, contributing positively to returns as a flexible healthcare strategy and outperforming its MSCI World Healthcare benchmark until its sale in December. The decision to divest was not taken lightly but it was decided that the blend would provide dedicated allocations within healthcare and more control over the specific subsectors.

AB International Healthcare is a long-only global healthcare equity fund that invests in a broad-based exposure of healthcare and healthcare-related companies. Investments are selected through meticulous bottom-up research, with the team looking to identify companies with long-term growth potential in various market conditions by focusing on the business fundamentals of companies rather than trying to predict scientific success. This requires the team to concentrate on stocks with a history of high returns on invested capital, strong free cash flows and attractive valuations. This focus on business strength should provide better healthcare outcomes, helping to drive cost savings in the system whilst also generating profits for the company itself. The companies that make their way into the portfolio will often attract healthcare spending, either through new treatments and therapies or through cost reduction opportunities.

The emphasis on the business models of companies, instead of on the science and innovation, is what differentiates AB International to other healthcare funds available. Predicting the clinical success of drug trials is difficult and the likelihood of approval from phase one is very low; only c.8%. In lieu of relying on such a low and binary outcome, understanding the true economic performance of a business has led the strategy to produce consistent investment returns with lower levels of volatility. Portfolio risk is then balanced around multiple companies rather than a few stocks delivering outsized individual performance, to create a portfolio with limited exposure to companies with significant binary risk. Over the last 10 years, the Fund has returned 198% (40) in GBP vs 151% (41) for the MSCI World Healthcare.

This process produces a high conviction portfolio of 40-60 stocks, with a bias towards the US market. Company names include well-known players in the healthcare industry like, Eli Lily & Co, UnitedHealth Group and Novo Nordisk, whilst the portfolio’s highest allocation is towards the pharmaceutical sector at c.40%. The pharmaceutical subsector is considered a defensive investment and has historically proven resilient during economic downturns: having a high allocation to this space pharmaceuticals can act as a ballast during challenging market periods, helping to dampen overall portfolio volatility and protect on the downside.

Polar Biotechnology has been known to us for many years and held in Balanced for the last two. The fund provides dedicated exposure to a sector that is synonymous with innovation, cutting-edge technology and the potential to generate very high earnings growth. We remain confident in manager David Pinninger’s consistent outperformance of the broader sector in a space where stock selection is vital given the levels of volatility. By combining the science-tilted biotechnology fund with the business-focused healthcare fund, we consider that the blended exposure will provide an improved dedicated allocation to the healthcare space. With healthcare valuations trading attractively following the recent sell-off, we are excited about the prospect for the blended healthcare allocation’s performance in 2025.

Boscher's Big Picture

A year of big change for the global macro, geopolitical and market environment

By Kevin Boscher

As we start the New Year, there is a broad consensus that the second Trump presidency will be positive for the US economy and financial markets thanks to his strong reflationary agenda, which includes tax cuts, deregulation, lower energy costs, a weaker dollar and a re-industrialisation of the US.

The impact of these policies on the rest of the world are less clear as an escalation of a global trade war and increased geopolitical uncertainty would likely negatively impact both China and Europe at a time when they are already facing a cyclical and structural slowdown. There are also big question marks around the outlook for US inflation given the Trump agenda and whether the Federal Reserve Fed will be able to cut rates as much as markets currently expect. I remain positive on the outlook for markets, especially equities, but the early part of the year could be volatile and more challenging as we await clarity on some of the big issues at play and as markets go through a reset of expectations.

There are three key themes that are likely to dominate the investment outlook for 2025 and beyond. This includes the return of supply-side economic policies in the US; an increased acceptance of fiscal loosening in Europe, China and the UK; and the escalating battle between globalism and protectionism. Trump’s economic policies and “America First” principle are similar to the supply-side policies adopted by Thatcher and Reagan in the early 1980s, which led to a surge in US labour productivity, falling inflation, strong nominal and real growth and the booming 1990s. Financial markets worry less about how unconventional Trump might be and focus more on the positive impact his reflationary policies might have on US growth and asset markets. However, there are several inconsistencies in Trumps policies, most notably tax cuts and deregulation versus tariff hikes and restricted immigration. Also, it will take some time to work out exactly how those policies will be executed, what the reaction of other countries will be and what the impact will be on US inflation and Fed policy. However, markets are anticipating a net positive impact and it is likely that US growth will continue to be well supported for the next year or so and could be in the early stages of a productivity-led boom.

One of the key reasons why the US economy has consistently outperformed its major peers over recent times is that it is the only country to have consistently loosened fiscal policy during crises or recessions. Most other governments fear that a sustained rise in indebtedness will eventually lead to fiscal ruin and so have adopted a more conservative approach targeting balanced budgets and deficit and debt reduction. It is perhaps ironic that countries that have pursued such a strategy have experienced economic pain and political turmoil, such as France, Germany and the UK. Whilst it’s true that rising debt levels and fiscal deficits can lead to major economic and financial difficulties, it’s also true that fiscal conservatism presents significant risks in a world still burdened with excess private savings. For example, in Japan, excess savings amount to 11% of GDP. Excess savings represent a demand deficit and put downward pressure on growth (consumption and investment), inflation and bond yields. Other major governments will need to adopt easier fiscal policies to boost growth, help inflate away their growing indebtedness and as they face multiple spending challenges including income and wealth inequality, a fragmenting global economy, climate change and an ageing demographic.

China has been hit by a collapsing property market, increasing trade tensions and falling consumer and business confidence at the same time as it attempts to re-balance its economy towards domestic consumption higher-end manufacturing. With nominal growth having fallen below real growth, this risks a real crisis and demands more robust government action. It is likely that the government will continue to proceed cautiously given its long-term objectives. However we will see further monetary and fiscal stimulus as the year progresses. Should China abandon its conservatism and act aggressively, this would be a major boost for the global economy but also a threat to inflation elsewhere.

The Eurozone economy will continue to struggle in 2025 as it faces a number of cyclical and structural issues, including a shrinking workforce and ageing demographic, poor productivity growth, an excess of private sector savings, and a weak China and rising US protectionism. The Maastricht Treaty has institutionalised fiscal conservatism, and the tough macro backdrop is resulting in major political change with a move to both the extreme left and right in many countries and the unseating of incumbent governments, most notably in Germany and France. Without a decisive shift in fiscal policy, it is likely that Europe will face more economic pain and political unrest. The UK economy also faces multiple challenges and if the government is to turn around the long-term decline in growth and labour productivity, it really needs to copy some of the supply-side reforms favoured by Trump and loosen fiscal policy.

Economic prosperity usually coincides with rising globalisation, as was evident from the experience since the fall of the Berlin Wall in the early 1990s and China’s entry into the World Trade Organisation in the early 2000s. The last major protectionist era emerged in the 1920s and 30s, when rising tariffs contributed to a global economic collapse, a salutary lesson which is very relevant today. It is ironic that the US is leading the anti- globalisation charge despite having the strongest economy and despite US companies having been significant beneficiaries. Rising discontent over income inequality and declining middle-class living standards have fuelled the anti-globalisation sentiment and been a major factor in the rise of Trump. These trends are expected to continue over the next few years with tensions between protectionism and globalisation likely to escalate.

Having said that, the world now has some experience in navigating these challenges and there are many mechanisms to help offset the negative impacts from tariff hikes such as currency depreciation, tax rebates, and export incentives. Central banks can also ease monetary policy if required. If the world can avoid a 1930s- style trade war, then the impact of trade tensions should not derail the global economy in the near-term. It is also possible that a potential positive surprise for this year will be that trade tensions ease a little as Trump finds a way to agree deals with China, Europe, and Japan.

We will see further monetary easing from the major central banks this year, but perhaps not as much as currently expected in markets, and expectations have already shifted in this direction. In the US, there are strong reasons to take encouragement that longer-term growth potential is increasing thanks to rising productivity, a deleveraged and more confident consumer, and accelerating money supply and credit creation. This implies a higher neutral interest rate going forward. The Fed is also acutely aware of the potential impact of Trump’s policies on both growth and inflation. Given this backdrop, the markets are broadly right to assume that the Fed is unlikely to ease much this year, especially if Trump’s policies result in an economic boom and inflation starts to rise again. Having said that, 2% now appears to be the floor for US inflation rather than a target and the Fed will be happy to tolerate inflation in a 2-3% range, even if it can’t explicitly confirm this. The real risk is if inflation starts to move back above this level, forcing the Fed to resume rate hikes. This would certainly be a market changing event. Elsewhere, the Bank of England may also struggle to cut rates as much as expected and despite weaker growth as inflationary pressures appear to have troughed and are rising again. The European Central Bank will likely cut rates more aggressively whilst the Bank of Japan will buck the trend and raise rates, albeit gradually.

The macro environment continues to favour equities and the US, in particular. Hence, we very likely remain in bull market, although there are plenty of reasons for caution in the near-term. Markets have already discounted many positives, which may not occur as quickly as anticipated or with the expected outcomes. Also, most measures of equity sentiment and positioning suggest that momentum and bullishness may be over extended. Valuations also look stretched in some areas, most notably large-cap US, and especially after the recent rise in bond yields. In addition, and as already explained, Trump’s actual policies and their impact could differ materially. from expectations, whilst interest rates may not fall as much as expected. From a longer-term perspective, however, there are several reasons to stay positive on equities. Both monetary and fiscal policy should be positive for global reflation, especially if Europe eases its fiscal restraint and China becomes more aggressive in targeting higher growth. This will be positive for company earnings and help alleviate some of the valuation concerns. Lower rates will also add to the reflationary impulse and enable some multiple expansion at the same time as valuations in many markets and sectors (outside of the US) look reasonable. In the US, equities should also benefit from Trump’s pro-growth policies and lower rates.

Data sources:

- GBP Ravenscroft Cautious Model Performance Data, Total Return 30/09/2024 to 31/12/2024.

Source: Ravenscroft CI Limited - Investment Association (“IA”) Mixed Investment 0-35% Shares Sector, GBP Total Return Total

Return 30/09/2024 to 31/12/2024. Source: FE fundinfo. - GBP Ravenscroft Cautious Model Performance Data, Total Return 31/12/2023 to 31/12/2024.

Source: Ravenscroft CI Limited - Investment Association (“IA”) Mixed Investment 0-35% Shares Sector, GBP Total Return Total

Return 31/12/2023 to 31/12/2024. Source: FE fundinfo. - Pacific North of South Emerging Equity Income Opportunities; GBP Total Return 30/09/2024

to 31/12/2024. Source: FE fundinfo.. - KBI Global Infrastructure, GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- Rathbones Ethical Bond; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.o.

- Jupiter Global Dynamic Bond; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- Schroder Strategic Credit and Titan Hybrid Capital Bond; GBP Total Return 30/09/2024 to

31/12/2024. Source: FE fundinfo. - Fermat Cat Bond; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- Ruffer Total Return; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo

- Ruffer Total Return; GBP Total Return 31/12/2023 to 31/12/2024. Source: FE fundinfo.

- GBP Ravenscroft Higher Income Model Performance Data, Total Return 30/09/2024 to

31/12/2024. Source: Ravenscroft CI Limited - GBP Ravenscroft Higher Income Model Performance Data, Total Return 31/12/2023 to

31/12/2024. Source: Ravenscroft CI Limited - Pacific North of South Emerging Equity Income Opportunities; GBP Total Return 30/09/2024

to 31/12/2024. Source: FE fundinfo. - Rathbones Ethical Bond; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- Renewables Infrastructure Group; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE

fundinfo. - Fermat Cat Bond; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- GBP Ravenscroft Balanced Model Performance Data, Total Return 30/09/2024 to 31/12/2024.

Source: Ravenscroft CI Limited. - GBP Ravenscroft Balanced Model Performance Data, Total Return 31/12/2023 to 31/12/2024.

Source: Ravenscroft CI Limited - Investment Association (“IA”) Mixed Investment 20-60% Shares Sector, GBP Total Return

31/12/2023 to 31/12/2024. Source: FE fundinfo. - BlueBox Global Technology; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- Sanlam Global Artificial Intelligence; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE

fundinfo. - GBP Ravenscroft Growth Model Performance Data, Total Return 30/09/2024 to 31/12/2024.

Source: Ravenscroft CI Limited. - Investment Association (“IA”) Mixed Investment 40-85% Shares Sector, GBP Total Return

30/09/2024 to 31/12/2024. Source: FE fundinfo. - GBP Ravenscroft Growth Model Performance Data, Total Return 31/12/2023 to 31/12/2024.

Source: Ravenscroft CI Limited - Investment Association (“IA”) Mixed Investment 40-85% Shares Sector, GBP Total Return

31/12/2023 to 31/12/2024. Source: FE fundinfo. - MSCI World, GBP Total Return 30/11/2024 to 31/12/2024. Source: FE fundinfo.

- MSCI Europe, GBP Total Return 30/11/2024 to 31/12/2024. Source: FE fundinfo.

- MSCI Emerging Market, GBP Total Return 30/11/2024 to 31/12/2024. Source: FE fundinfo.

- Sanlam Global Artificial Intelligence; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE

fundinfo. - BlueBox Global Technology; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- Aubrey Global Emerging Markets; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE

fundinfo. - Schroder Global Energy Transition; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE

fundinfo. - Polar Healthcare Opportunities; GBP Total Return 30/09/2024 to 31/12/2024. Source: FE

fundinfo. - MSCI World, GBP Total Return 30/09/2024 to 31/12/2024. Source: FE fundinfo.

- GBP Ravenscroft Global Blue Chip Model Performance Data, Total Return 30/09/2024 to

31/12/2024. Source: Ravenscroft CI Limited. - GBP Ravenscroft Global Solutions Performance Data, Total Return 30/09/2024 to 31/12/2024.

Source: Ravenscroft CI Limited. - GBP Ravenscroft Global Solutions Performance Data, Total Return 31/12/2023 to 31/12/2024.

Source: Ravenscroft CI Limited - Polar Healthcare Opportunities; GBP Total Return 31/12/2014 to 31/12/2024. Source: FE fundinfo.

- MSCI World Healthcare; GBP Total Return 31/12/2014 to 31/12/2024. Source: FE fundinfo.

All performance data above was collated on 15/01/2025.

*Data is based on sterling based model portfolios net of a 0.75% per annual management fee. The models are run in real-time in line with our equivalent client portfolios and provide a fair representation of actual performance achieved by clients in our opinion. The models are maintained internally and are not subject to external auditing. It is important to note that past performance is not a reliable indicator of future results.

Source data: Ravenscroft (CI)

Limited and FE fundinfo; collated 15/01/2025.