Life has a way of throwing curveballs when you least expect them. One moment, you’re navigating market cycles and discussing long-term investment themes; the next, you’re sitting in a consultation room having an in-depth conversation about a part of your anatomy that you’ve historically given very little thought to.

In mid-January I was diagnosed with prostate cancer – fortunately it was good (on a relative basis!) news in that we have caught it early and it is hopefully curable. Nevertheless, it has triggered a predictable period of self-reflection. I have thought about everything from my health and family to, surprisingly, the sheer awkwardness and, as at it turns out, highly amusing discussions I’ve been having in preparation for surgery. Let’s just say there are certain aspects of the human body that no amount of life experience can quite prepare you for. I’ve spent decades analysing risk and reward, but never once did I consider how much a conversation about catheterisation could test one’s ability to maintain eye contact. To be honest there are now many “personal” conversations that I’ve had with consultants, nurses and physiotherapists - if you know, you know!

But beyond the personal side of this experience, what’s struck me most is just how far medical technology has come. The treatment I’m about to undergo—a single-port robotic prostatectomy—was simply not an option a couple of decades ago. What was once a major operation with a long recovery time is now minimally invasive, with far better outcomes. It’s a reminder that, just like in investing, long-term progress is often underestimated.

Medical innovation: The silent bull market

Over the years, healthcare has quietly been one of the most transformative and innovative sectors. We often think of technology in terms of consumer gadgets, AI, and automation, but some of the most profound advancements have been in medicine. From robotic surgery to immunotherapy, the landscape has changed dramatically, and survival rates for many diseases—including prostate cancer—have improved as a result.

Take my upcoming procedure as an example. A single-port robotic surgery involves just one small incision, reducing recovery time and minimising complications. Compare that to the open surgeries of the past, and the progress is remarkable. The implications go beyond just patient outcomes—shorter hospital stays, and fewer complications reduce strain on healthcare systems, improving efficiency and cutting costs.

This isn’t just good news for patients; it’s also a compelling case for investors.

The healthcare investment opportunity

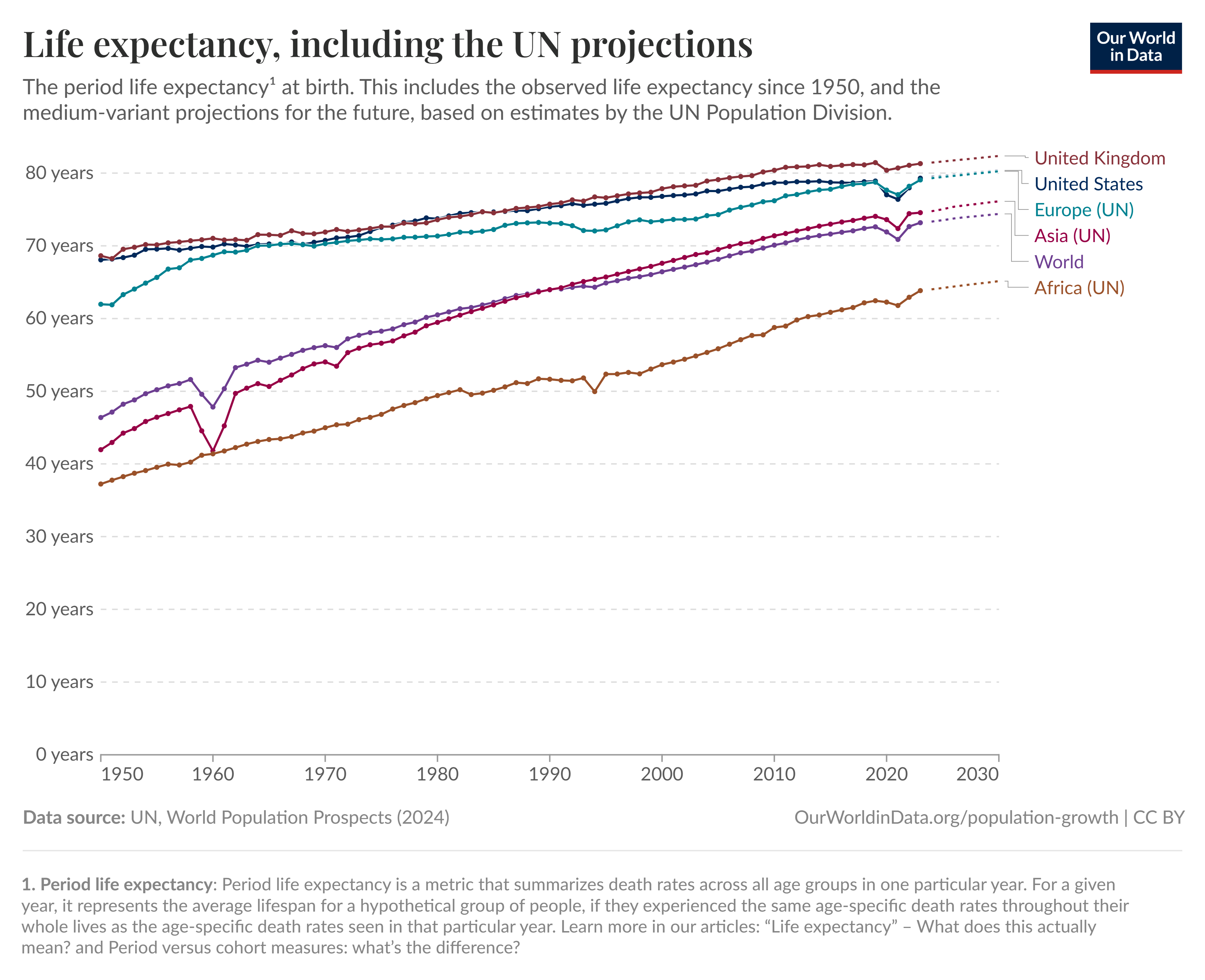

As much as I would love to think that my diagnosis was a one-off event, the reality is that healthcare demand is only going in one direction—up. An ageing global population, rising chronic disease rates, and increasing access to healthcare in emerging markets all point to sustained long-term growth.

Yet, despite this clear trajectory, healthcare stocks are trading at some of the most attractive valuations we’ve seen in years. After a period of underperformance relative to broader markets, many high-quality companies in the sector are now offering compelling entry points.

- Pharmaceuticals & biotech - advances in personalised medicine and gene editing are reshaping treatment options.

- Medical technology - robotics, AI-driven diagnostics, and minimally invasive procedures are improving outcomes and efficiency.

- Healthcare services - as demand rises, so too does the need for infrastructure, from hospitals to telemedicine platforms.

The market often focuses on short-term headlines, but history shows that investing in innovation whether in technology, healthcare, or any other sector tends to pay off over the long run. The trick, of course, is patience.

Looking ahead

As I head into surgery, I am optimistic not just about my own outcome, but about the future of healthcare more broadly. The sector is at the forefront of some of the most exciting developments in science and technology and, for those willing to take a long-term view, the investment opportunities are compelling.

Of course, in the short term, my focus will be a little more personal: navigating recovery, avoiding embarrassing (although maybe I’ll embrace them in the future) post-op stories, and appreciating the wonders of modern medicine first-hand. But one thing is certain: whether in health or investing, change is inevitable, progress is real, and as the Foo Fighters point out: "It's times like these, you learn to live again”.

And, if you’re a male and over 50, go get your prostate tested!