It’s been almost two weeks since I had my prostate operation, and I’m pleased to report that I’m recovering well. Part of that process is, for want of a better description, evolution. Without wishing to overshare (or patronise half the population!) I’m discovering and working with muscles I never really knew I had: pelvic floor muscles are quite the revelation! Meanwhile, I’ve learnt that recovery isn’t just about healing – it’s about adapting. In the weeks since my operation, I’ve had to adjust to a “new normal” that, though different, remains effective. It’s also occurred to me that adapting or, for this article, evolving, is the absolute mainstay of everything we do and, of course, a key part of managing investment portfolios effectively over the long term.

Whilst in hospital and, latterly, at home, I have indulged myself in a habit that I intend swiftly to unwind: doom-scrolling apps such as X (still Twitter to me). Dopamine hits aside, it isn’t particularly productive and, if we’re honest – other than serving as an avatar for freedom of speech – is of little use to man or beast. What it has done, however, is to reinforce one undeniable truth: the world is evolving at a breakneck pace. Geopolitical tensions, disruptive actors and a constantly shifting economic landscape all underscore that change is a constant. It’s hard to ignore the recent news flow and headline-grabbing events, from Elon Musk in the White House with his son (yes, X) on his shoulders blurring the lines between business and government influence to the bewildering debates about who started the war in Ukraine—a question so seemingly absurd it underlines the chaos of modern geopolitics. Then there’s the ongoing drama in Gaza and, almost a minor distraction, Germany’s big swing to the right.

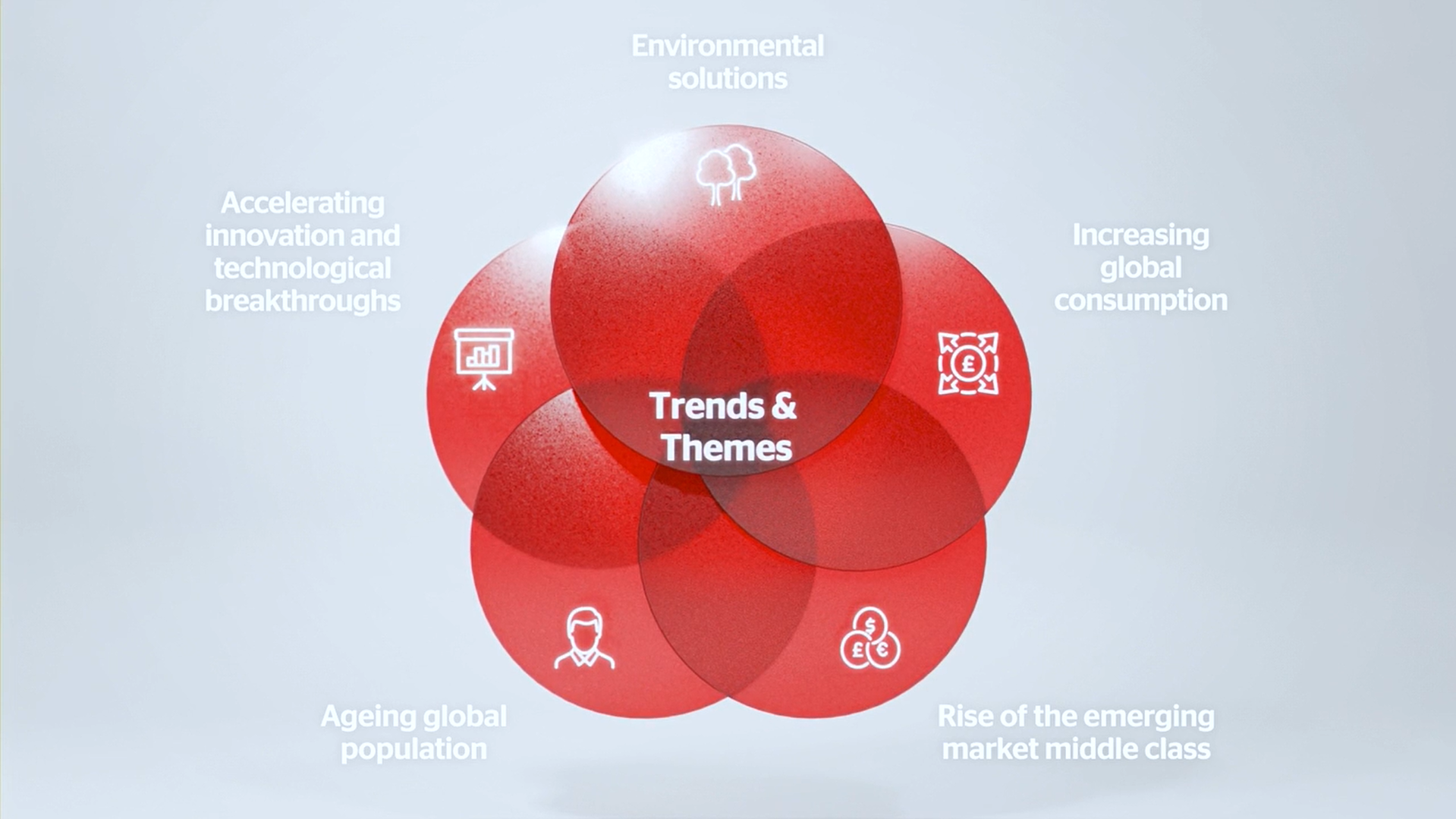

I’m acutely aware that I have written about this before, but it is worth reiterating that at the heart of our investment approach is a belief that, in order to provide long-term successful outcomes, we need to ensure that your portfolios are invested into themes that will stand the test of time: not just surviving but even thriving as we navigate change and upheaval. In the midst of such turbulence, those themes remain our steadfast guide.

Although short-term news often paints a picture of disarray, enduring trends offer stability and promise; the balance shapes our philosophy and underpins every decision we make.

We firmly believe certain themes will stand the test of time, irrespective of day-to-day upheavals. Healthcare, as discussed in our previous piece, is one such pillar; several other themes warrant equal attention:

- Technology & artificial intelligence:

Global technology spending is forecast to reach c£2.3 trillion by 2025, growing at an approximate compound annual growth rate of 5%. Within this sphere, NVIDIA has emerged as a market darling and a source of fierce debate. Consequently, its earnings report on 27th February will come under intense scrutiny and set the tone for the broader tech landscape. Nevertheless, while its high valuation remains controversial, NVIDIA continues to embody the innovative drive shaping our digital future. - The emerging consumer:

As traditional markets mature, emerging consumer segments are taking centre stage. With rising disposable incomes and expanding middle classes across Asia and Africa, this market is projected to grow at an annual rate of 4-6%. These consumers represent a seismic shift in global economic and geopolitical power, reshaping demand and creating new opportunities for growth. - Economic rebalancing – West to East:

The economic centre of gravity is steadily shifting eastward. As Asian economies increasingly outpace many Western counterparts, investors are turning their gaze east for growth opportunities. This isn’t just about market figures – it reflects a fundamental realignment of global influence that we factor into constructing your portfolios. - Energy for future generations:

Global energy demand is expected to grow by about 1.3% per year through 2040. The pursuit of sustainable and renewable energy sources remains a critical long-term theme. Addressing future energy need is essential for both environmental sustainability and economic stability; it conditions all our investment decisions.

Even though many of these sectors have enjoyed strong performance (and may, as a consequence, appear expensive) the fact remains that the underlying themes are here to stay: they are the pillars that will support your portfolios through whatever storms lie ahead.

Evolving at the margins: Adapting to market dynamics

While long-term themes remain steady, market dynamics at their margins are anything but. The rise of Exchange Traded Funds (ETFs) has significantly altered market weightings, concentrating exposure in a small number of stocks. This concentration risk poses a unique challenge: if those market darlings provide a large portion of annual investment returns (as they did last year) then portfolios that are significantly underweight will underperform. Equally, if this trend changes then having too much exposure will be equally detrimental!

We have wrestled with this issue for some time. The solution lies in evolving our strategy: striking the right balance by maintaining exposure to our time-tested, long-term themes while adapting to capture emerging opportunities and value. This active management helps mitigate risks associated with market concentration while still harnessing the potential upside of enduring trends – as always, with your best interests at heart.

A core tenet of our thematic investment philosophy is evolution: continuous adaptation to meet new challenges and seize fresh opportunities. Just as my body is learning to function differently post-op, the portfolios we manage are evolving to navigate today’s volatile geopolitical and economic landscape. Long-term success, whether in life or investing, isn’t about resisting change, it’s about embracing it as a catalyst for growth that directly benefits you.

So, while the news may scream uncertainty and pundits debate every twist in global events, we remain committed to our guiding principles. By focusing on quality, diversifying exposure, and maintaining a long-term perspective, we aim not only to weather the storm but to thrive amidst change.

Looking forward

Evolution is inevitable: both our personal journeys and the strategies we use to manage your investments are narratives of adaptation and resilience. As I continue my recovery, I’m inspired by the principle that guides our investment approach: the need to evolve to ensure long-term success. By keeping an eye on enduring themes and remaining nimble at the margins, we strive to build portfolios that are robust enough to withstand today’s uncertainties while retaining sufficient agility to seize tomorrow’s opportunities.