This week's update comes from Alex Finer

This week, the Paris AI Summit took centre stage, with significant discussions surrounding the global tech landscape and AI regulations. The two-day summit, co-chaired by France and India, highlighted a key trend shaping the market: the growing dominance of Chinese tech, especially in the realm of artificial intelligence. One standout was DeepSeek, a disruptive AI company we've covered over the past few weeks, which exemplifies this shift.

The summit provided some core themes that will be difficult to achieve simultaneously. AI must serve humanity, as President Macron exclaimed, but at the same time, it must cut back on any hindering red tape that could damage a transformative industry, promote growth, and ensure global safety and security—no easy task. However, there was broad consensus, with about 60 countries signing on to a Statement on Inclusive and Sustainable AI. This included Canada, the European Commission, India, and China, while both the US and the United Kingdom declined to sign.

Further to discussions about the future of AI, potential regulatory shifts in Europe, and the increasing push for global collaboration in tech, the summit also highlighted the surprising acknowledgment from Western companies that working with Chinese tech firms might be more feasible than previously thought. The market reaction, particularly from a US perspective, saw the stock valuations of the "Magnificent 7" (the top US tech companies) fall dramatically.

Sam Altman, CEO of OpenAI, indicated that he would be open to liaising with competitors like DeepSeek, a Chinese AI company that has gained significant attention for its purported cost-effective, powerful AI solutions. This marks a stark contrast to the more adversarial tone set by previous US policies aimed at limiting Chinese access to advanced AI technologies.

Meanwhile, top chip designer Nvidia has made DeepSeek's R1 model available to users of its NIM microservice, stating that the model provides "state-of-the-art" reasoning capabilities.

With this momentum, investors have been revisiting Asian equities (not just technology), year-to-date performance has been notable, with the investment thesis remaining clear: Chinese equities are still trading at a discount and remain cheap, while US equity multiples are arguably stretched on most valuation metrics.

From a macro perspective, "Trump 2" policies are providing elevated market volatility from a US context, given the uncertainty they are creating, while China’s property and regulation issues appear to be diminishing and are now out of investors' focus.

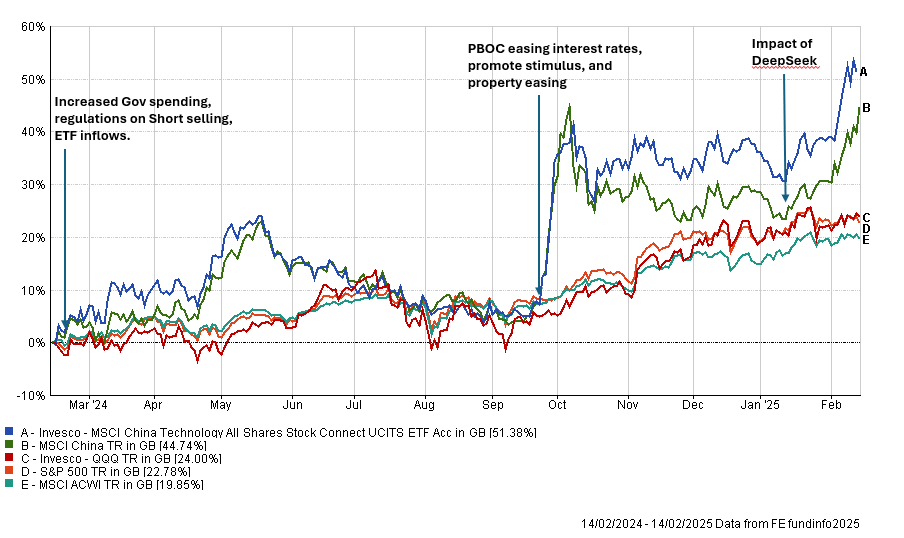

Main Chinese indices have outperformed their global counterparts over the last 12 months, with performance concentrated in three distinct periods. The start of 2024 saw stimulatory measures announced, including government spending, regulations on short selling, and flows into ETFs. Chinese tech stocks advanced 11.6%, the broader market rose 9.1%, compared to 6% for the S&P 500 in sterling terms.

In September 2024, a series of further stimulatory policies were announced by China’s three top financial officials to support the stalling economy, including a relaxing of interest rates, capital replenishment for large state-owned banks, and measures to support the housing and stock markets.

The market reacted positively, with the broad China market up 21.4% over the month, Chinese technology up 24.9%, while the broader MSCI World index was relatively flat for September 2024. Finally, the impact of the DeepSeek news prompted significant falls in late January 2025 for US semiconductor and AI-associated companies, with Nvidia falling 17% in one day. Other companies like Broadcom, ARM, etc also fell by similar degrees. Subsequently, we have seen a diverse set of Chinese sectors continue to rally into February.

Our portfolios, especially the Global Growth and Global Balanced funds, have benefited from exposure to Asian equities during this recent period. Of the underlying, Polar Asian Stars holds a substantial 23% allocation to China and 34% to the broader technology sector. Among its top ten holdings, the fund includes semiconductor giant, TSMC and Chinese technology leader, Tencent. Similarly, the Pacific North of South EM Equity Income Opportunities fund also has a strong allocation to Asia, with diverse sector exposure, including Consumer Discretionary, Financials, and Communications, among others.

While we want to highlight this emerging trend, it’s important to note that short-term performance is not always indicative of long-term trends. Investors in emerging markets, particularly Chinese technology stocks, have faced significant losses in recent years, and patience is paramount when it comes to long-term return expectations.