Since I last penned one of our weekly updates, the ability to write a week or even a couple of days in advance has diminished greatly…

As discussed by my colleague Sam Dovey in last week’s update, we’ve seen the effect narrative has on markets, and, specifically, the impact errant tweets can have. Last week, Donald Trump said on social media “Powell’s termination cannot come fast enough!”, sparking fresh fears that Trump is considering firing the Federal Reserve (“Fed”) chair Jerome Powell (who he nominated in place of Yellen back in 2017/8) before his term is up in 2026. So, why is this important?

Trump has been vocal in his desire for the Fed to lower interest rates, arguing that the cost of borrowing for consumers and businesses needs to be lower. Powell, as chair, has been on the receiving end of much of Trump’s demands and is clearly in the presidents’ crosshairs.

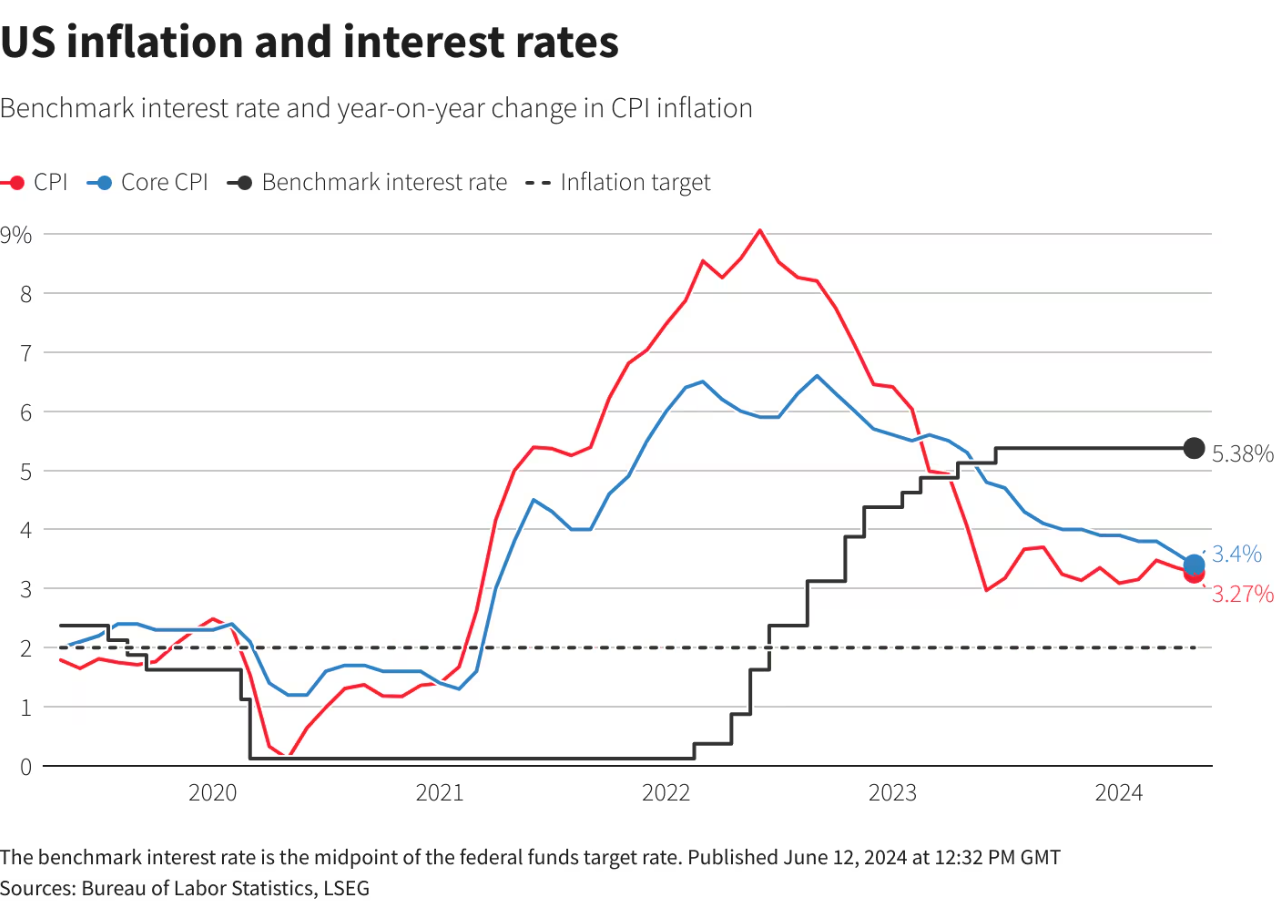

The Fed manage the money supply in the US (primarily by setting interest rates). When setting interest rates, the Fed considers the inflation rate and the labour market, what it calls its dual mandate (price stability and full employment). Higher interest rates could bring down inflation, but negatively affect the labour market, while lower interest rates could do the opposite. Following Covid and the Ukraine/Russia war, the central bank has been trying to bring down inflation by increasing interest rates, which reached their highest levels since the 2000s.

- So how does Powell and the Fed Open Market Committee respond? They can do one of three things…

Ignore Trump and remain data-dependent - Yield to Trump, and potentially make a policy mistake on the dovish side

- Err on the hawkish side, to avoid the perception of giving in to Trump

All these scenarios are possible and the best case for markets would be to see Powell complete his term as chairman. Legally, presidents can’t fire Fed leaders, however, as we’ve seen, Trump doesn’t always abide by the law. This also wouldn’t be the first time that Powell and Trump have sparred over monetary policy.

In 2018, then-President Trump openly criticised Powell’s interest rate hikes, calling the Fed “loco” and even considered firing Powell. Despite the political pressure, Powell continued to raise rates and shrink the Fed’s balance sheet through quantitative tightening. This suggests Powell either ignored Trump entirely or leaned hawkishly to assert the Fed’s independence. This would point to points one or three on the scenarios outlined above.

At the time, the Fed’s preferred inflation measure—the personal consumption expenditures (PCE) index—was above target, unemployment was low, and job openings were rising, all of which supported continued rate hikes. However, by late 2018, inflation began to cool, and the Fed eventually paused its tightening. In 2019, as inflation dropped below target, Powell cut rates, maintaining a data-driven stance.

Nevertheless, some argue the Fed remained too tight for too long—possibly in part due to Trump’s vocal calls for easier policy. Core inflation was stable in late 2018, and short-term inflation indicators were already weakening. Moreover, inflation expectations in bond markets remained benign, suggesting less urgency for continued tightening. Critics argue the Fed should have paused earlier and been quicker to cut in 2019. Ironically, Trump’s aggressive public pressure may have had the opposite of its intended effect, pushing the Fed to maintain hawkish policies to defend its credibility.

Trump may have had a valid complaint that the Fed was overly restrictive, but his confrontational approach likely reinforced the Central Bank’s resistance to political influence.

This time around might be different. If Trump replaces key Fed personnel, as he would have to do, given that firing Powell alone wouldn’t be enough, the dynamics could shift. However, as long as Powell remains in charge, he is expected to prioritise data and resist political threats – potentially erring on the hawkish side again.

This week serves as another reminder that this Trump presidency is going to be somewhat of a rollercoaster.