To say that global markets were volatile over the course of last week, rife with global superpowers trading tariff blows, would be a marked understatement. Keeping up with the back and forth between the US and the rest of the world has been quite the task. Some of the key moments from the last week include:

- Wednesday 2nd April: “Liberation Day” – Trump’s two tier tariff system announcement

- Thursday 4th April: China retaliates with 34% tariff

- Tuesday 8th April: US tariffs on Chinese imports increases to 104%

- Wednesday 9th April: China raises retaliatory duties on US imports to 84%

- Wednesday 9th April: 90-day pause on implementation of planned tariffs on most, except China where tariffs raised to 125%

- Thursday 10th April: White House clarifies that tariffs on China are actually 145%, once 20% fentanyl tariffs are accounted for

- Friday 11th April: China raise Tariffs on US to 125%

Following President Trump’s “Liberation Day” tariff announcement, markets have been proverbially rocked, experiencing huge losses and the odd short-lived recovery. It shouldn’t be a surprise to any market participant that the US suffered various forms of retaliation to their global tariffs, however what surprised markets further was the willingness of China to stand its ground against the US. As expected, Trump retaliated again and the refusal from either side to back down left little room for any form of trade negotiations. It’s probably fair to say that the trade relationship between the two largest economies in the world is heavily fractured and we’ll have to watch and see if the weekend’s discussions on smartphones, computers and other electronic devices come to fruition.

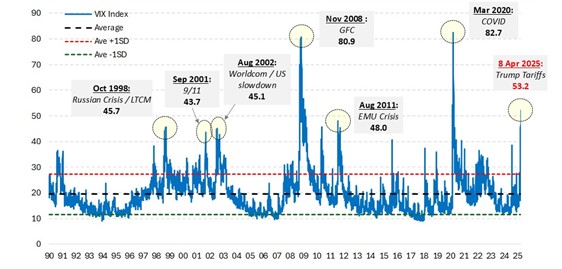

A visual way to grasp the scale of this week’s market turmoil, relative to other market shocks, is by observing the VIX (1), a measure of the implied volatility of the S&P 500 index. While still a long way behind the distress felt in 2008 and 2020, this continues to be a hugely significant period for markets and one that has wiped trillions off the market’s value.

There were very few areas of the market that escaped the effects of last week’s announcements, including our core investment themes. As you would expect, we have been keeping a close eye on the results.

Technology

The technology sector showed heightened sensitivity to policy changes throughout the week as the Nasdaq tumbled 12% following the Liberation Day announcement, managing to claw back 10% after Trump hit pause, before falling again as China retaliated further. The technology sector dominated markets throughout 2024, and in the first months of 2025. Given the sector’s dominance in respect to concentration and ownership levels, it’s unsurprisingly vulnerable to larger swings during periods of market downturns. Tech Is also heavily impacted by the tariff situation, where a large proportion of materials, such as semiconductors needed for computers and smartphones, are manufactured in China.

Some tech companies proved to be more proactive in their approach to the proposed tariffs by stockpiling and fast-tracking shipments before the deadline, such as Microsoft, who managed to remain flat across the week.

Healthcare

Healthcare companies also face headwinds as the US looks to shrink its dependency on foreign drug manufacturing. Trump announced that he would impose tariffs on pharmaceutical products, which had previously been spared from past trade disputes due to potential harm to patients. Whether he follows through on this is yet to be seen, however, the market still reacted negatively to the news with the MSCI World Healthcare down 6.45% (2) across the week. This wasn’t the only headwind for the sector, as production of medical devices is also set to be hit as large volumes of materials needed for production are imported from China.

Consumer

Perhaps one of the most heavily affected sectors is the consumer industry, where retailers face the prospect of paying up to 125% more for imports. Retailers across the world are due to be troubled with rising import prices and consumer price sensitivity, adding to uncertainty within the sector. With China producing a significant amount of the western world’s goods, consumers can expect to pay a higher price for everyday goods or face shortages all together as retailer’s supply chains are disrupted.

The increasingly harsh reality of a trade war between mega powers will leave many of us feeling rather uncomfortable, and whilst the 90-day pause allows more time for a sensible resolution to be found, we will likely see further volatility over the coming weeks and months.

How the world adjusts to these new conditions is yet to be seen but this is not the first time our themes, or the companies aligned with them, have adapted and evolved in order to provide long-term returns.

We want to take this opportunity to assure our clients that, as always, we are closely monitoring global events and adjusting portfolio holdings where we feel action is appropriate. Should you wish to discuss anything further, please don’t hesitate to get in touch with a member of the team.

- Sources:

(1) VIX is the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. - (2) MSCI World Healthcare, USD Total Return 02/04/2025 to 14/02/2025. Source: FEFundInfo