When governments meddle in free markets, despite their good intentions their actions can often be clumsy and ill-considered and so result in interesting and unanticipated outcomes. We have an example of this unfolding in the UK at the moment. In an effort to cut CO2 emissions from motor vehicles on UK roads, the government is waving both a carrot and a stick to entice consumers to buy more (electric vehicles) EVs and force manufacturers to sell more EVs.

As the ‘carrot’ has a cost for the government, it is small, whereas the ‘stick’ generates income and could be large. It is also questionable whether the ‘carrot’ is being waved in the right direction.

The ‘carrot’, in this case, is EV grants. These are available for purchasers of wheelchair-accessible vehicles, motorcycles, small and large vans, and taxis when purchasing a new EV. The grants can range from 20% to 35% of the vehicle cost and are subject to a maximum of between £150 and £25,000. There is presently no grant for private cars as the plug-in car grant expired in June 2022. Grants are not available for hybrid cars nor for first-time buyers of EVs who are buying a second-hand car.

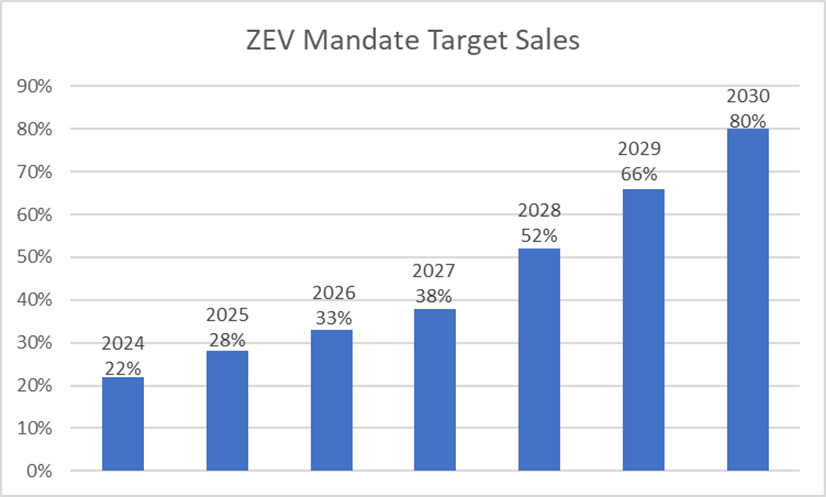

The ‘stick’ is penal fines for motor vehicle manufacturers who fail to meet new EV sales quotas. I expect you will hear a lot about this over the coming months and years. Carmakers selling cars and vans in the UK are mandated to sell an increasing number of EVs under the Zero Emission Vehicle (ZEV) mandate. The progression of the annual ZEV Mandate targets between 2024 and 2030 is shown below.

Car makers that can’t meet these quotas could face a fine of £15,000 per car sold that isn’t compliant. If car makers exceed their EV targets, they can bank the excess for future years or trade them with other firms that have fallen short of their targets.

The likes of MG, Polestar, Smart and Tesla are already well ahead of the initial 22% target set for this year. In sharp contrast, manufacturers such as Alfa Romeo, Dacia and Seat are just starting their EV journey. However, being part of automotive groups with multiple brands they may be able to borrow quota from other parts of the group. E.g. Seat being part of the Volkswagen group could borrow from Audi, Cupra or Volkswagen.

The adoption of EVs is growing fast but has been hampered by a number of factors including the price of EVs, high depreciation rates, lack of charging infrastructure, range anxiety, charging rates and battery life.

We are starting to see some unanticipated outcomes. Some car manufacturers fearful of potential fines are pushing delivery of petrol-powered vehicles into next year and only selling EV cars for the balance of this year. Until recently there was an overhang of second-hand EVs with sales consistently outpacing purchases, although this appears to be being addressed by aggressively cutting prices. Motor advises the average EV now depreciates 50% over three years (this rate does vary from model to model).

There is pressure upon car manufacturers to rapidly bring EV costs down to make them more affordable. They also have to compete with government-subsidised Chinese EVs. They face a conundrum, they aren’t charities so need to retain profit margins, but they can’t aggressively cut specifications to reduce costs as there is no point in producing a car that no one wants to buy.

Some interesting statistics to consider: -

- As of March 2024, there were 41.4M licensed vehicles on the road in the UK. 33.7M (81.5%) were cars, 1.1M (2.7%) were zero-emission vehicles of which 1.01M were zero-emission cars. (Source: UK Government)

- The average age of cars in the UK is now nine years old. (Source: Auto Express)

- 2023 used car sales were 6.14 times new car sales (7,242,692 versus 1,179,298). New EV sales were 193,221, being one-sixth of new car sales. This is compared to second-hand EV sales being 1/60 of second-hand car sales. (Source: Society of Motor Manufacturers and Traders)

- The average price of a new car in the UK in 2023 is £41,738 (Source: Auto Trader) whereas average earnings in the UK are £35,828 per annum (Source: UK Government)

It seems clear to me that if the UK government is serious about meaningfully cutting CO2 emissions on UK roads, they need a bigger ‘carrot’ and they need to wave it in a different direction. The majority of vehicles on the road in the UK are private cars so if they want to affect change, private cars need to be covered by EV grants or some other incentive scheme. As annual used car sales are six times more than new car sales, a grant should be available for first-time buyers of an EV who are buying in the second-hand EV car market. The average cost of a new EV in the UK is £46,000. So, let’s be candid, if you can afford to buy a new EV you probably don’t need the incentive, so why not introduce larger grants but include means testing to enable the provision of larger incentives for those who need them to be able to make the transition?

In terms of investment markets, if you are investing in car manufacturers this highlights the importance of their EV range and the execution of their EV strategy. You also need to consider the impact of government meddling (however well-intentioned) in free markets and accept that, at times, it will create noise and volatility within the sector that will present both opportunities and challenges.