All eyes have been on the Federal Reserve (Fed) for the last year or so, questioning when they were going to start cutting interest rates to avoid a recession, or provide what markets have called a “soft landing” – in other terms a slowdown in the economy, without breaking it.

In October last year, the market got very excited around the narrative on rate cuts and priced in six cuts in the forthcoming year; 11 months on and there has been just one rate cut, which took place in the middle of September, all be it a mighty one of 0.5%. This spurred on both equity and fixed income markets.

Shortly after, on the 24 September 2024, the People’s Bank of China (PBOC), who plays a similar role to that of the Fed, stepped in with a stimulus package that also happened to include the magic number of 0.5%!

For investors in our multi-manager range, we have always had a substantial allocation to our emerging market theme. We have a number of exposures to this space, which we access though our dedicated emerging market managers, who invest in emerging market-listed companies.

The drivers of this theme stem from the economic transformation that occurs when countries transition out of relative poverty and begin to develop. As these nations grow, their citizens experience rising incomes, leading to increased spending and saving. This presents multiple business opportunities and means that companies in these regions can not only survive but start to thrive.

Quite simply, as consumers become wealthier, their shopping lists change. This is a predictable pattern. At its simplest, the portfolio managers are focused on finding companies that provide goods or services that make their customers lives more comfortable, congenial, or convenient.

The challenge in the emerging market space over the last year or so has been due to our exposure to China. The Chinese economy has struggled post-Covid, subsequently experiencing a housing crash, poor equity market performance and all-round very difficult conditions for residents.

During recent discussions with a fund manager, they explained quite simply that they prefer to invest in countries where economic growth is high, incomes are improving, and which enjoy a stable or business-friendly political environment. Unfortunately, over the last four years, China has not experienced any of this. Instead, our UK peers tend to be underweight emerging markets, preferring to allocate to the UK instead. The performance differential between these two markets (UK and emerging markets) over the last four years has been 43% in the UK’s favour – that is some headwind!

Therefore, the PBOC decided to step in and give the country and their residents a helping hand. They did this in various ways, but all consisted of the magic 0.5%.

Some macro writers have summed up their measures as the “Three Arrows”, targeting the problem of monetary contraction, the meltdown in housing and the slump in the equity market. More specifically:

- Monetary easing - The reserve requirement ratio (RRR) was cut by 50 basis points, releasing RMB1 trillion (US$143 billion) in liquidity. More RRR cuts are possible, if needed.

- Housing market - Aligning existing mortgage rates with those on new mortgages, effectively reducing the average mortgage rate by 50 basis points. This will help 50 million households, with an average saving of $428 annually per household as a result of lower mortgage costs.

- Equity market - The PBOC now allows non-banking financial institutions to use “swap facilities” to obtain liquidity by using their equity holdings as collateral.

This monetary stimulus package is more aggressive and comprehensive than any previous reflation efforts by the PBOC.

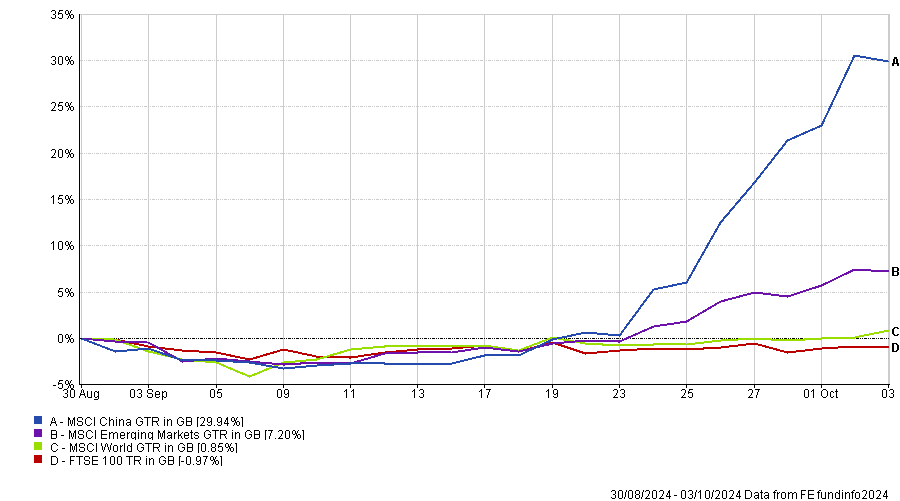

So, did it have the desired affect? Since the announcement the regional stock markets have posted gains of around 20% which have been very helpful to our emerging market exposures, as the majority of our holdings rallied on the back of this news.

I suppose the next question is, is this just a quick shot in the arm or will this be more permanent in nature? I have always been a half glass full girl, rather than a glass half empty, but only time will tell. Fingers crossed we can start closing that gap…