There was much anticipation ahead of the UK’s Autumn budged announcement last Thursday, with many expecting measures focused on increased spending and tax changes.

Chancellor Reeves’ budget set out greater increases in UK government spending than financial markets had expected, however. Further, the increases in National Insurance contributions raise employment costs for businesses, therefore increasing the risk of above-target CPI inflation next year. As a result, we expect the Bank of England’s Monetary Policy Committee (“MPC”) to reduce bank rates by only 25bp (0.25%) per quarter, until it hits 3.75% at the end of 2025.

A 25bp easing at the MPC meeting later this week remains a possibility but given the fact that the spending pledges will be implemented with immediate effect (whereas the tax rises do not take effect until April 2025) there is likely to be an upward pressure on inflation meaning that we expect the MPC to refrain from cutting bank rates again in December.

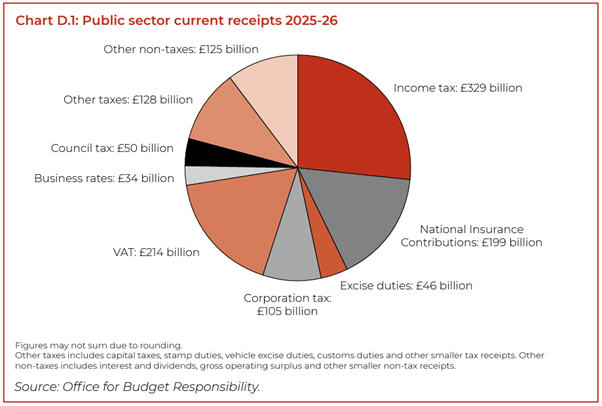

As a result of the budget, UK government borrowing will be higher despite a large package of tax hikes. Nearly all of next year’s tax increase (in April) will come from a hike in the main rate of employers’ National Insurance Contributions (“NICs”) from 13.8% to 15% and the lowering of the annual income threshold for employers’ NICs from £9,100 to £5,000. This latter change means that more of an employer’s workforce will be caught by the change, meaning the employer has to pay a higher rate of tax on a greater proportion of their employees.

In summary, this first budget of the newly elected Labour Party is designed to be expansionary – few would have expected anything else – and the increased spending has been funded by a mixture of tax increases and increased borrowing.

Crucial to the budget was the financial markets’ reaction, which has not been universally positive.

In the bond markets gilt yields rose immediately with a consequent fall in gilt prices. In UK equity markets the main FTSE 100 has fallen, however, the smaller AIM market has been positive, the latter reflecting the muted effect of the planned National Insurance rises. It is early days but overall, the reaction has not been anywhere as bad as the fall-out which followed Liz Truss’ infamous mini-budget of September 2022. Readers will recall that the reaction to that budget was so extreme that the Bank of England stepped and announced that it would support the gilt market; actions which, according to Governor Andrew Bailey, were taken to “ensure financial stability”.

This time, it seems markets have accepted Ms Reeves’ maiden budget for the time being in the hope that the immediate increase in spending boosts activity so that by the time the tax hikes take effect the economy is on an upward trajectory.

Turning to budget items of interest to Channel Island residents, the following are worthy of mention:-

- Abolition of the UK “Non-Dom” tax regime – As well as the obvious impact on UK non-doms this is likely to have significant implications for offshore trusts who have UK resident settlors who are either non-domiciled or deemed domiciled.

- Inheritance tax – This will now be determined by a residence-based system.

- Capital gains tax (“CGT”) – CGT for basic-rate taxpayers increases from 10% to 18%. CGT for higher-rate taxpayers rises from 20% to 24% commencing April 2025.

- Carried interest – Part of the UK budget, this will be a major focus of many Channel Islands-based private equity funds and their managers. In the budget it was announced that CGT at a higher rate of 32% will apply from April 2025. Included with this change was the announcement of a formal review which proposes to subject the “unique characteristics” of carried interest to the income tax regime.

The Chancellor, therefore, has chosen to spend as much as she can now, increasing the risk that future adverse economic shocks will be met with further tax rises. Disappointingly, the extra upfront government spending was not accompanied by measures to boost the economy’s supply potential.

The initial reaction from Kevin Boscher, our chief investment officer and MD, Jersey, is this:-

This budget will be remembered for one of the biggest tax-raising budgets on record, which may boost growth in the short-term but is unlikely to improve growth prospects longer-term. Looser fiscal policy likely means fewer interest rate cuts over the next year, especially as inflation is expected to start rising again soon. The gilt sell-off is not a surprise. In our view, this does little to improve the UK’s long-term prospects but is the first step towards a looser fiscal policy, in line with the US and Europe, and indicative of the changing global macro and political backdrop which we have raised in a number of recent internal and external presentations.