“Diversification is about more than spreading your investments. It also means choosing investment vehicles with low correlation.” – David F. Swensen

Famed Yale Endowment fund manager and co-inventor of the “Endowment Model”, an application of Model Portfolio Theory, David Swensen was a prominent proponent of diversifying investment portfolios across low correlating assets to maximise risk-adjusted returns. His investment strategy received widespread acclaim and even comparisons to investing heavyweights Benjamin Graham and Peter Lynch, amongst others.

Since the advent of the global financial crisis, more specifically, the response by global central bankers in addressing the ramifications of the crisis, this idea of diversifying investments within a multi-asset balanced portfolio has encountered criticism.

Simplistically, within a balanced portfolio comprising the two largest asset classes—equities and fixed income—using the MSCI World and Bloomberg Global Aggregate indices as proxies, the correlation of returns between the two from 31st December 1990 to 31st December 2007, was just 0.15, indicating an exceptionally low level of correlation. The coordinated measures implemented by global monetary policymakers—lowering interest rates and buying government bonds through ‘quantitative easing’ for instance—have had the effect of increasing this correlation between the two asset classes to 0.39 from 31st December 2007 to 31st December 2021.

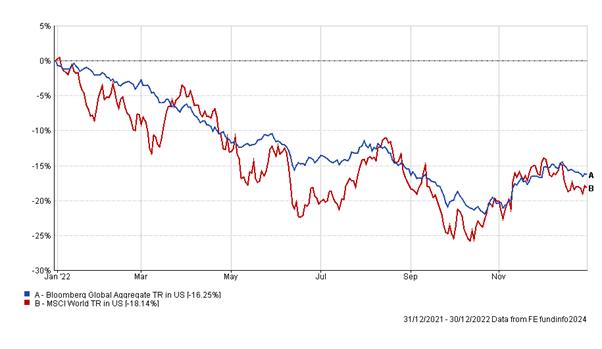

Recent factors, namely policies to reduce inflationary pressures via interest rate hikes, have deepened this relationship between equity and fixed-income asset returns, culminating with the selloff in 2022 where both asset classes had dire years (see Fig 1). In this scenario, correlations spiked to 0.81 triggering many investment commentators to pronounce the idea of the ‘60/40 Balanced Portfolio’ to ‘be dead’.

The idea, however, has started to have a resurgence of late and the current macroeconomic environment, we would argue, is highly supportive of this investment strategy with various forces providing tailwinds that we believe will allow balanced portfolios to deliver attractive risk-adjusted returns going forward, rewarding patient investors.

Inflation data eased rapidly over 2023 and has continued to trend downwards during 2024 toward central bank target rates. Whilst we expect there to be some volatility in the respective rates over the short term, we do not expect to see rates rise to 2022 levels again. This, therefore, provides support to fixed-income assets.

From an economic growth perspective, the recessionary fears that gripped Europe and the US during 2022 and into 2023 have diminished (ex-Germany). Energy prices in Europe have moderated, economic growth data is improving (the US has remained consistently robust) and encouraging employment numbers and the easing of inflation data provides a basis for equity market gains.

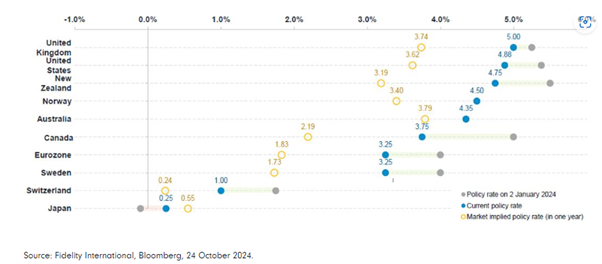

Moreover, the majority of global central banks are amidst interest rate-cutting cycles (see Fig 2), which historically have been constructive for both equities and bonds. The magnitude of the cuts is up for debate and highly dependent on the inflation data observed. However, the scale of cuts aside, the trajectory, as indicated by policymakers, we believe will be falling.

Source: Fidelity International, Bloomberg

Lastly, we think current yields on offer are very appealing, particularly from a short maturity perspective. We do not believe that fixed-income investors are being fairly compensated for taking on the risk associated with longer-duration assets. As such, the shorter end of the curve we view as compelling delivering good risk-adjusted returns irrespective of whether we see a deterioration of the economy and/or a resurgence in inflation.

However, we are cognisant of the fact that there are currently any number of risks that could impact asset market returns and subsequently client portfolios. We believe the current macroeconomic backdrop and fundamentals within asset classes, of which we invest our multi-asset portfolios, are well positioned to endure short-term market volatility while delivering good risk-adjusted returns for our clients. Importantly, the factors influencing these returns are autonomous to one another enhancing the benefits and smoothing out the returns of a diversified portfolio.