Individual stock price volatility, especially around earnings announcements, has picked up markedly over the past few years even though overall market volatility has been declining. It is usually accepted that the current price of a stock (and its valuation) will reflect all known and expected stock specific as well as broader economic/geopolitical information that may impact a company. Updates to either will result in ‘the market’ adjusting its view by moving prices higher or lower. It is often the case that unexpected information may cause prices to move beyond what is usually observed in either a positive or negative direction depending on its nature. However, over the past few years, we’ve been mystified by the increasingly aggressive nature of these moves, especially given the news flow on which they move.

Some examples would include;

Sanofi, the €118bn market cap pharmaceutical company, which shed over 20% of its value in a matter of hours after management announced they would be prioritising investment in future growth opportunities over one year’s earnings growth in their Q3 ’23 sales update. We wrote about this incident in our Q3 2023 Insights.

In Q4 ‘23, Estée Lauder, the $47bn cosmetics business, fell a precipitous 18% in one day after it announced a small topline miss with a big beat on the bottom line. Comments from management were also broadly positive, suggesting the inventory issue that had plagued the company’s sales growth had bottomed out.

In Q1 '24, the streaming juggernaut Netflix beat expectations handsomely and raised guidance only to see its shares slide some 10%. We suspect the ‘crime’ was management’s warning that they would not be sharing subscriber growth or average revenue per user numbers from Q1 2025. We feel the desire to change the market’s focus on certain key performance indicators is reasonable given the changing nature of its revenue model as advertising becomes a bigger piece of the pie. The market clearly thought otherwise.

There have been many more examples that have left us somewhat frustrated as share prices overreact to the smallest of indiscretions. It’s a phenomenon that has caught the media’s attention who attribute ‘Wall Street’s’ unforgiving reactions to an ‘expensive’ market within a macro economic environment where interest rates may now stay higher for longer, placing further pressure on valuations. This may be so, although we’d argue neither Sanofi nor Estée were especially expensive during their period of respective turmoil.

It also doesn’t fully explain the speed at which stock prices have reacted, in most cases the maximum amount of damage has occurred within the first day of trading following the ‘adverse news’. In their periodic review, Ruffer – more accurately Henry Maxey in his ‘Something new under the sun’ article - attempted to shed some light on some of the new forces (and potential risks) at work within today’s markets. The two evolutions that caught our eye as those most likely to increase stock specific volatility are the rise of ‘pod shops’ and the booming zero day to expiration option market.

Pod shops are effectively hedge funds that allocate their capital to individual portfolio managers, known affectionately as ‘pods’. They are often given access to credit lines enabling them to leverage their trades to improve returns - three to five times is typical. Growth within this market has been such that it is estimated that they control somewhere between $300bn - $600bn. Demand for talent to manage this money has also skewed incentive schemes, resulting in handsome performance fees for successful pods, promoting a potentially reckless risk appetite. There are many different types of strategy, most of which are computer based (algorithms) and manage their risk using tight pre-determined stop-losses. Once set-up the need for human involvement is redundant, save for the odd adjusting tweak to the programme. The problem when too much money chases a particular strategy (a crowded trade) is that risk unintentionally rises if the trade does not go the way it was positioned to. Should large stop orders start getting filled, prices can move rapidly the wrong way if liquidity at the stop loss price dries up and desperate traders seek to close out their leveraged position at any price. We don’t know for sure that pods are levering up around key events such as earnings in an attempt to capture part of a bigger move, but they might be…

Zero day to expiration options (0DTE) are option contracts that are opened and closed within the same trading day. In 2023 such contracts made up 43% of all option volume traded on the Chicago Board Options Exchange and their influence is starting to be felt on the market. The smaller premium paid for short-dated options results in higher embedded leverage, potentially magnifying their impact on underlying stock prices due to the way option sellers manage their exposures and hedge their risks by purchasing or selling the underlying stock when it moves meaningfully against their option position in order to reduce their losses.

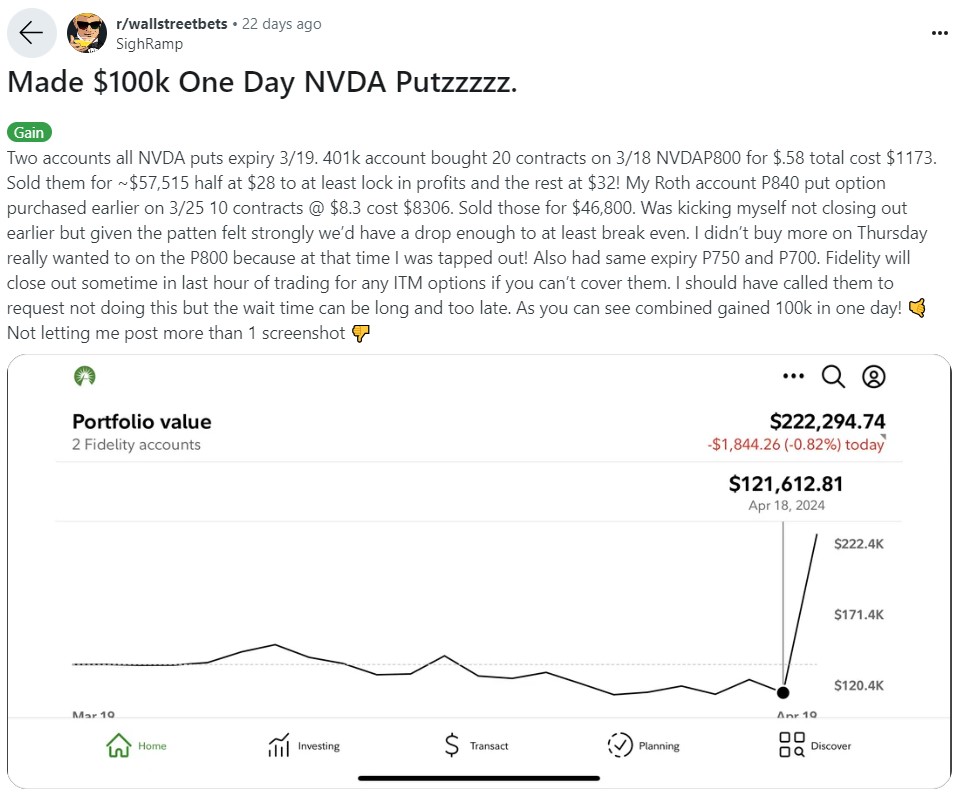

Advocates of 0DTEs suggest they are more effective tools for managing market hedges due to the embedded leverage and lack of time premium a buyer has to pay. Detractors suggest their use is fuelling ‘stonk’ style gambling habits that were not uncommon during Covid. This Wallstreetbets brag, where a trader made ~$100,000 from a ~$1000 bet within one day, highlights the latter point (and the embedded leverage).

We would argue that NVIDIA is very unlike meme stocks such as Game Stop (which would appear to be under the spell of retail traders once again) but it doesn’t stop the retail crowd from having a go and making it big on relatively small bets. If it’s happening with NVIDIA, is it happening within other large-cap stocks? Possibly…

Unfortunately, there is no one, all-knowing person who can say what exactly is going on at any given moment in any given stock. The market price is an aggregation of billions of dollars being won and lost by a host of different market participants, from pod traders to investment banks, market makers, asset managers, retail investors, and everyone in between.

Fortunately, our style of portfolio management doesn’t rely on short-term trading algorithms or short-dated options. While this aggressive price action can have a disproportionate impact on performance, especially within a conviction-led portfolio, such moves do create opportunities to buy great companies at better prices. We call this time arbitrage and we recently added to a handful of existing positions during the latest earnings season.

The big takeaway? Know what you own and why you own it. When something moves disproportionately to expectations or fundamental reality, it may be due to these unseen forces at work, leaving the long-term-minded investor a great opportunity to either initiate or add to a position.