Whilst the cash team has an opinion about the ongoing general election and England’s chances at Euro 2024 – and arguably both might make a more interesting weekly note – our focus will remain on the outlook for interest rates.

The European Central Bank (ECB) cut borrowing costs earlier this month, which was in line with expectations, and the accompanying statement was cautious. In subsequent statements, committee members have suggested that any future rate move would be data-dependent and carefully considered. The earliest that the committee appear likely to sanction another cut is September if the data is supportive. Of course, the French general election has increased geopolitical tensions in the area, which has the potential to affect this timetable.

Across the Atlantic, the Federal Reserve (Fed) has further cooled expectations of an imminent US rate cut. At the end of March, the Fed was anticipating cutting interest rates three times this year. Their latest forecast is that rates will only be cut once in 2024. US Inflation has been uneven over the last 12 months; it fell rapidly late last year before increasing again in the first quarter of this year. This has led to caution in the Fed and they will need concrete economic evidence that inflation is under control before sanctioning a cut. This has led some commentators to raise the prospect of the Fed making a policy error in keeping rates too high for too long and so causing a recession.

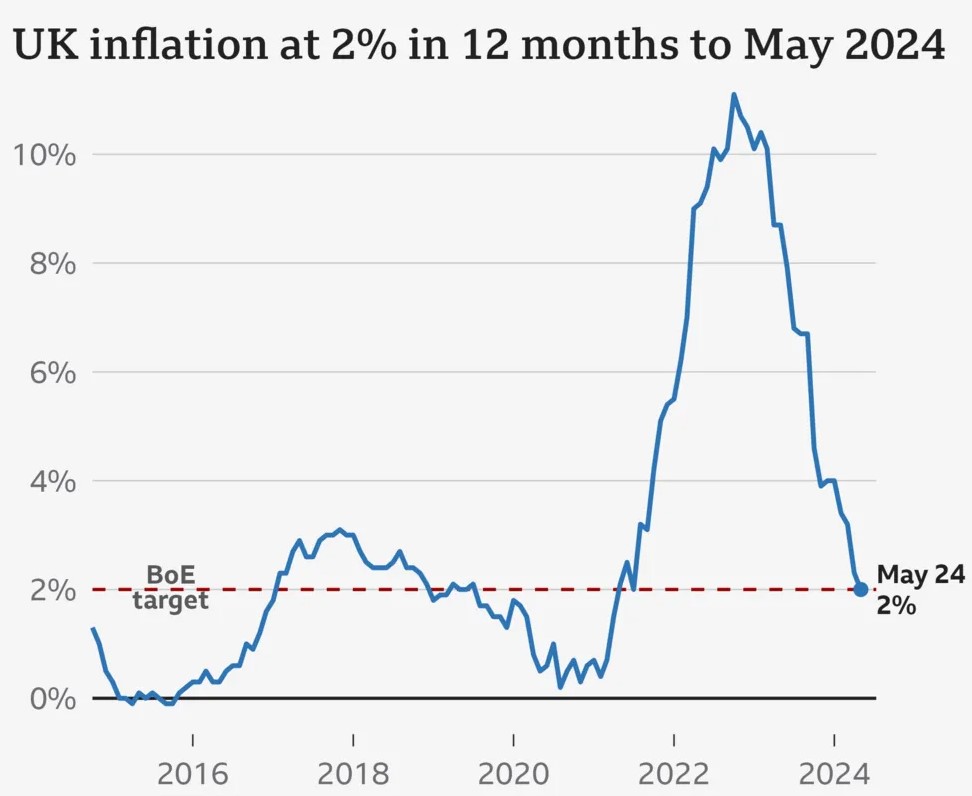

Closer to home the latest UK inflation data was released last Wednesday and the headline number revealed that the pace of increase in CPI inflation fell to 2% in May. This is bang in line with the Monetary Policy Committee (MPC) target for the first time since July 2021 so should be cause for celebration and could unlock the path to lower interest rates. However, the devil was in the details with CPI services inflation coming in at 5.7%. The Bank of England’s (BoE) MPC met the next day and no one was surprised that rates were left on hold. The UK General Election is clouding the issue because no committee member will comment publicly whilst the election is ongoing. The vote was 7:2 again, with two committee members calling for a cut. The Governor of the BoE, Andrew Bailey, commented after the meeting that the MPC ‘need to be sure that inflation will stay low and that’s why we have decided to hold rates at 5.25%’ *.

The services inflation figure is still too strong for the MPC and will probably mean that any rate cut is delayed until September. Interestingly it is likely that headline UK inflation will strengthen again towards the end of the year. The reasons for this are that various base events fall out of the data and it is expected that the energy price cap will rise again in the Autumn.

However, even if UK services inflation, mainly driven by wage growth, remains persistent the overall picture for inflation in the UK is that it is far more under control now than 18 months ago. So, with a better outlook for inflation, it is reasonable to expect the MPC to sanction modest interest rate cuts. However, they will proceed slowly and with caution.

That really is the case for all three central banks we look at closely. To use a football analogy: the role of central banks over the next 12 months will be that of a holding midfielder - they will not be taking too many risks.

While inflation is more under control and so easing monetary policy is appropriate, much uncertainty remains and the number of economic and geopolitical challenges ahead probably means that inflation will remain a concern. For this reason, we think that the era of ultra-low interest rates is over and the low point of interest rates for the next cycle will be much higher than the previous one.

You might also be interested in our podcast "Cash management in a changing environment".

Source:

- *Bloomberg