The meteoric rise of NVIDIA’s market capitalisation from $300 billion to a smidge under $3 trillion[1] in just seven calendar quarters has placed it on the cusp of becoming the world’s most valuable company. Of the market’s 9% year-to-date gain[2], NVIDIA’s stock (NVDA) performance accounted for a third, as it tacked on a cool $1.75 trillion to its market capitalisation[3]. That money is not new money entering the market, that cash is being sucked from other areas. NVIDA’s latest victims would appear to be software stocks judging by current sentiment and price action of the affected such as Salesforce.com.

NVIDIA’s influence and perceived importance to the future direction of the overall market had wags referring to the company’s earnings announcement on May 22nd as the ‘most important macro event of the year’. To everyone’s relief, the company announced a plethora of financial records and a sprinkle of ‘stock-go-up’ dust with a 10-for-1 stock split. Two weeks later, founder CEO Jensen Huang was given the rockstar treatment by delirious ‘investors’ at a tech conference in Taiwan where, in his trademark black leather jacket, he announced the next generation of chips that he hopes will cement their 80%+ market share in AI hardware. Analysts, on average, expect the company to triple revenues over the next three years from YE 2024 $60.9 billion (Act.) to YE 2027 $184.7 billion (est.)[4]. The latter number raised by a mere $57 billion (+45%) in the last six months alone such is the pace of developments and unpredictability of demand.

Call our approach old-fashioned….but…we work on the notion that a company’s stock price should reflect the net present value of all its future cash flows. This, as you would expect, involves making assumptions about what that might look like. It often pays, when guessing about future outcomes to be conservative and build in a margin-of-safety in case things don’t quite go to plan. Being conservative on an industry that is aggressively building out the next best thing has resulted in us remaining on the sidelines. We therefore don’t own NVIDIA but that doesn’t mean we don’t have a dog in this fight. By not owning NVIDIA, we’ve taken an active bet that is only getting bigger (and more painful). For our own sanity, we discuss our concerns below.

A cautionary tale

The parallel between now and the dot.com bubble is eerily similar. My financial career started in the marketing department of a multi-national life assurance company in 1999. One of my main month end jobs was the production of performance stats on their buy list. Technology funds were ripping, I didn’t understand why, but I was intoxicated by it all and I wanted to learn more. In 2001 I started my investment career, the giddiness of what is now referred to as the dot.com bubble had disintegrated into despair and simmering anger as clients, having given up hope on any recovery, cut their losses. High quality businesses such as Cisco Systems and Microsoft - the ‘could do no wrong, rail providers on which the entire internet would be built’ - would lose 89% and 64% respectively before they found a bottom.

Unbeknown to me at the time, but something I picked up by reading the experiences of some of the greatest investors of the time, was the pressure portfolio managers were put under by executive management and investors alike to own these stocks on the way up. Numerous PMs, who resisted the demand because the fundamentals didn’t stack-up, would wind up losing their job between 1998-2000, their crime? Relative underperformance! Bull markets destroy careers, bear markets destroy capital, there is a price to pay, no matter what you do.

When devising Blue Chip, the early memories of angry clients and steep losses shaped the process. We’d own quality and we would be careful about the price we would pay in order to mitigate volatility and the permanent impairment of capital. It’s not to say we’d be mistake-free but hopeful to sidestep the worst of it.

It took Microsoft the best part of a decade for its excessive price-to-earnings multiple of 72x[5] to fade to a level that even the most stalwart of value investors could not resist. By the time such a point was upon us, we had reached peak despair in investor sentiment too. Anti-trust had given Google a foot in the search engine door whilst CEO and Bill Gates successor, Steve Ballmer lurched from one misstep to the other. Despite the challenges, it remained supreme in enterprise software, generating billions in profits and cash flow. When we implemented Blue Chip into client portfolios (circa 2011), Microsoft, trading around 8-9x p/e[6] multiple with >7% free cash flow yield was top of the list. I often had to justify my rationale for holding it, not anymore! Investor sentiment is as cyclical as it is fickle!

Fundamentals

Valuations are not very useful market timing tools, and, as they rely on estimates of what the future may look like, they should be taken with a pinch of salt. Valuations are useful in gauging the potential return of an investment under different scenarios. They can also be reverse engineered to understand what investors are assuming and judgements can then be made as to whether these are realistic or not.

It's fitting that both Microsoft and NVIDIA sit at the top of the market cap spectrum as 1 and 2 respectively, given their commercial relationship. Microsoft is NVIDIA’s biggest client, meaning Microsoft’s AI infrastructure build-out has been a sizable contributor to NVIDIA’s revenue growth. A back-of-a-napkin calculation from one of the team suggests that if the relationship were to stay the same, then Microsoft’s spending cannot slow down anytime soon, to make sense of the valuation:

A simplified way, is to look at it like this:

NVDA is on 40.9x NTM P/E

MSFT is on 32x

Under our standard assumptions, NVDA will need to compound sales (margins are already extreme, but we’ll hold them steady) at >14% p.a. over 10 years and MSFT will have to do ~10.5%, in order to be fair value. Needless to say, if NVDA’s margins compress (which seems highly likely – happy to discuss) sales will have to grow even faster.

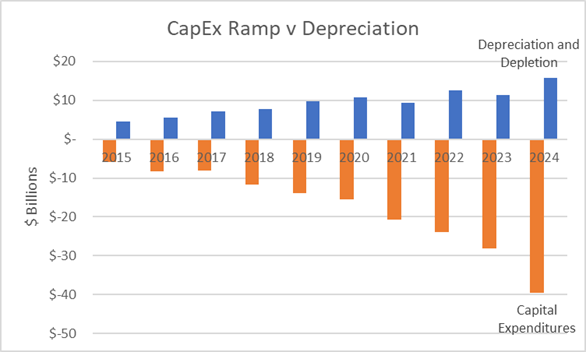

Last year MSFT had a capex ratio of 16% - which, by the way, is extreme by conventional standards. But if they grow capex in line with NVDA sales (being their largest customer) that ratio will grow to 21% in 10 years. And bear in mind MSFT is already at 43x FCF today, so somehow or other they’re going to have to grow their FCF at 15% per year in order to be fair value, while only growing revenue 10.5% and increasing capex by >14% p.a.

The numbers look crazier for META. With a lower P/E the market is implying ~6% growth and a capex ratio of 37% 10 years out!

Something really doesn’t stack up.

We’re happy to admit that the problem here may be our assumptions or grasp of the opportunity at hand, but it seems unlikely to us that NVIDIA’s biggest client will be able to keep its current pace of expenditure without demonstrating to investors that there will be some significant return on this investment. Most of the build-out expense will be capitalised and then expensed as depreciation through the income statement at some point in the future, potentially hitting earnings per share if sufficiently profitable revenues don’t compensate.

In Microsoft’s earnings announcement in April, its Cloud Service product Azure, saw a 31% increase in revenue, 7% of which was directly attributed to AI-related demand. The company was keen to impress that it was early days in its AI monetisation. Demand also outstripped supply resulting in a ‘material’ increase in capex to help meet this demand – more data centre capacity = more chips. For now, the supportive relationship and overall narrative remains intact.

The competition

NVIDIA’s Graphic Processing Units (GPUs) are very powerful processors originally designed for graphics rendering but, when networked together in very large “clusters” (100s or 1000s), have found a use case in training large language models due to their parallel processing strengths and ability to process vast amounts of data quickly. At roughly $40,000 a chip (for the high-end H100 product) they are expensive and very high margin. This would generally attract competitors but designing GPUs from scratch isn’t something you can just do.

AMD’s MI300 is a credible competitor to NVIDIA’s H100, whilst others seek alternative ways to achieve similar outcomes. Alphabet has their own Tensor Processing Units for use in Google Cloud, Amazon has their Trainium chips for use in AWS. There are numerous startups working at the problem too.

Probably the most interesting and promising approach comes from Cerebras Systems – a private company, which has successfully pioneered the first ever “wafer-scale engine” – a “chip” the size of an entire 12-inch silicon wafer, designed specifically for AI tasks. Starting with a much larger chip, rather than dicing up wafers and then stitching them back together with networking equipment (i.e. the GPU cluster approach), comes with important advantages in speed, cost, power efficiency and ease of use. If you can believe it, Cerebras’ business is growing much faster than even Nvidia’s, but starting from a small base.

Not all AI tasks are equal either. Large language model training requires the processing of vast amounts of data which makes GPUs a natural fit. Inferencing the information, generating real-time reasoning from the trained data in response to user commands, does not require their use – it can also be done with CPUs. Estimates vary, but most experts currently believe that inferencing requirements will far outweigh training requirements in future. NVIDIA has a GPU solution of course and it accounts for 40% of its datacentre business but the competitive landscape is already intense and as the market shifts from training to inferencing it’s likely to get even more so. For example, Oracle use ARM-based architecture chips from Ampere Technologies within OCI. Ampere, part owned by Oracle, has teamed up with Qualcomm in a bid to push aggressively into the inference market. The principal advantage of using Ampere’s CPUs rather than GPUs, is much lower capital cost and much lower power consumption – both extremely important considerations in a capital- and energy-conscious world.

As competitors snap at NVIDIA’s heels, Huang promised at his latest rock gig to up the product cycle cadence from every two years to annually, proportionally increasing the firm’s execution risk in the process. A slip may not cede leadership per se but if the stock price is dependent on new product launches at a higher cadence that risk is heightened nonetheless.

The final issue we have to contend with is the cyclicality of the semi-conductor market. Its history is littered with boom-bust cycles, yet today’s investors have been blessed with an usually long cycle that may lead some to believe we’re in a new normal. This may be, chips are everywhere in today’s products and will continue to be so, but that doesn’t stop over ordering and inventory build ups when the flow of goods slow. Intel, the dominant chip producer of the .com boom had real, soaring demand for its chips as the fast-growing home PC market took off. However, during the 2000-2003 recession, the demand dropped and inventory built up. Shares have never regained their 2000 high, even in 2021 when revenues and earnings per share peaked at more than 1.4x and 3x their 2000 levels.

I have no doubt this note will age badly in the short term... but if history were to rhyme once more.... it won’t. I wish all NVIDIA holders an enjoyable trip to the moon, please don’t forget to get off!

Sources:

- [1] NVDIA market capitalisation as at 30/09/2022 $302 Billion. As at close of business 07/06/2024 NVIDIA market capitalisation was $2.973 Trillion. Microsoft is currently the world’s most valuable company with a $3.150Trillion market capitalisation. Data source: FactSet

- [2] Data from MSCI World and FactSet, in USD terms

- [3] NVIDIA market capitalisation as at 29/12/2023 $1.223 Trillion

- [4] Data Source: FactSet

- [5] Microsoft’s P/E peaked on 27/12/1999 at 72.4x according to data from FactSet

- [6] Microsoft’s P/E bottomed on 22/08/2011 at 8.4x according to data from FactSet