30th June 2024 marked 10 years since the launch of the Ravenscroft Global Blue Chip Fund. The reason for launching the fund was to offer clients access to our direct equity strategy, through investment in a flexible and convenient structure. The strategy that the Fund represents had been in development for many years before and was focused on investing thematically in quality businesses at a reasonable price. On the face of it, not much has changed; our energy to work and deliver on Blue Chip’s mandate burns as bright today as it did when we started the fund. The driver behind that energy is the desire to constantly repay the trust our investors have in us to deliver on our promises, and we thought this milestone was as good as any to send you a big thank you.

The last decade

Looking back over the last decade it feels like we have gone through a lot. In the run-up to the fund’s launch, the US had already ‘reset’ its relationship with Russia over a burger and China was happy to supply the world with cheap goods. Policymakers had just navigated the Eurozone debt crisis and the US had finished a period of austerity known as sequestration. Economies hummed, feathered by disinflationary trends driven by a peace dividend fostered through geopolitical cooperation, globalisation, and a financial framework that allowed, to the point that it was expected, central banks to lean in at the first sign of financial stress. The result was a low volatility upward slope to markets that accelerated the popularity of passive investing as investors sought attractive returns in a low interest rate world. This all changed with the arrival of Covid in March 2020; with it came lockdowns, layoffs, and a sharp recession that saw the ultimate reaction from central bankers and their governments in an effort to stave off the worst impact of their actions on the economy. Wild swings in monetary and fiscal policies followed, simultaneously financial market volatility went wild before settling down into a hot bull market driven by zero rates and excess liquidity. Predictably inflation followed and interest rates surged, the peace dividend has started to disintegrate as geopolitical tensions rise, trade wars rage as the West, having ceded leadership in some critical markets, now pushes back on China’s state-sponsored IP theft and anti-competitive practices. East versus West trading blocks are forming as a potential new cold war looms as hot wars rage in Eastern Europe and the Middle East.

Yet, as world events get a lot more ‘interesting’, today’s equity market volatility continues to fall as indices hover at their all-time highs (at the time of writing). The volume of money that has and continues to feed its way into markets is increasingly being funnelled through passive investment vehicles that replicate sectors or indices. This is helping fuel discrepancies within sectors and indices as large companies attract a greater share of this passive liquidity irrespective of the value their shares actually offer investors. We reach our anniversary asking the question of whether valuations matter in this liquidity-fuelled world. We conclude that they do as we remain resolute that price is what you pay, value is what you get, and the value of a share will determine, ultimately, the return you will earn.

Sticking to the plan

But that doesn’t mean navigating these periods is easy. The sirens luring their prey are loudest when it is most obvious, and the temptation to change and ‘do something’ is greatest when investors’ resolve to stick to their process is at their weakest. Learning from the past experiences of others is useful in crafting a process but having the experience in deploying that process through different environments is priceless. Nobody wants to be the fool at the poker table but sometimes the market has a habit of doing just that. Sudden changes made to rejoin the herd inevitably happen at the point of maximum pain and age badly, resulting in poorer performance and loss of integrity.

During the past 10 years, there have been a number of periods that have tested the process. Some have resulted in adaptations to enhance what we already do – please see our Q2 2024 Quarterly Insights for more information. Others have been painful affairs only to see markets reverse and the process exonerated. Experience leads us to believe that we are in a period that will result in the latter but we’re mindful that market distortions can be prolonged affairs as ‘the favourite few’ grind relentlessly higher and the pressure to ‘do something’ builds.

Our process is built upon the simple foundation of understanding what it is you own and why you own it. This knowledge is built initially by learning about the business and the industry it operates in. The findings help build a picture of the quality of the company and the likelihood of it achieving what management say it will do and what the market is pricing in. Where we see anomalies – where the market may have mispriced a business – we see potential dangers (if overpriced) or opportunities (if under-priced). Over time, as we study more companies and monitor developments across industries the knowledge and understanding deepens adding additional insights to our analysis and the assumptions that go into our models.

Valuation, therefore, plays a pivotal role in our investment process (please read our weekly article Silence is Golden on how we go about valuing companies). We’re not momentum investors looking for reasons to join the herd – we let the facts and figures speak for themselves and where we see intrinsic value we see a potential investment candidate. The words of the great value investor Sir John Templeton “if you’re not prepared to hold a stock for ten years, don’t think about holding it for ten minutes” ring in our ears when putting together our valuation models and making decisions. Sir John was, in his pursuit of intrinsic value, prepared to be early on the way in, and was always the first out oftentimes before his decisions attracted the herd. In the asset class we operate in - global large caps – it’s a greater challenge to find attractively priced opportunities. The asset class is awash with investors and traders of all shapes and sizes but through hard work and looking under numerous rocks we occasionally come across the right fit, that diamond in the rough that has been overlooked and offers an appropriate margin of safety the operating business we may end up owning.

Standing out

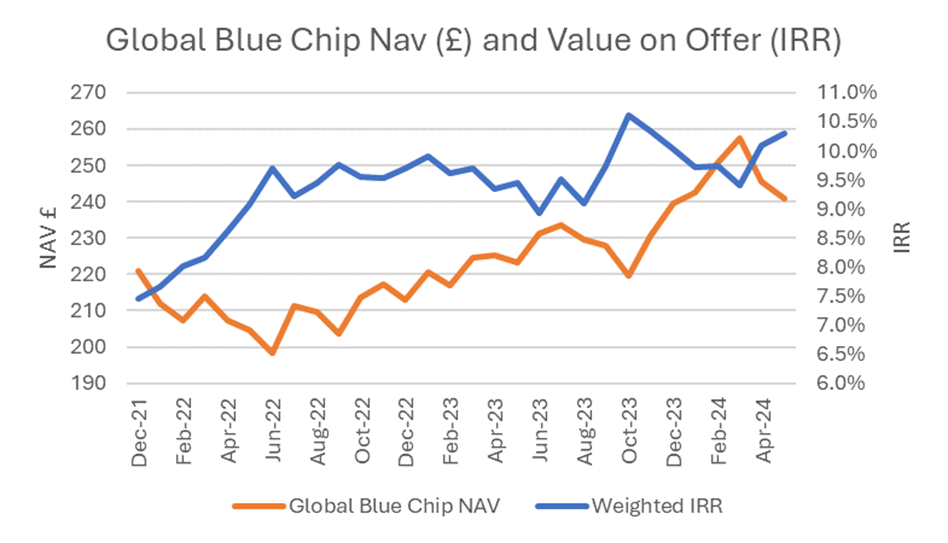

As we reach 10 years of running the Blue Chip Fund, we are mindful of the growing disparity between how we look and perform relative to the market. How long can the market stand on one leg? History has shown it can do so longer than you would like it to. We’re not in the habit of chasing returns at any price and this is reflected in the current portfolio where in aggregate, its valuation is about as compelling as it has ever been. If you’re more concerned about what will happen in the future than what has already passed, Global Blue Chip offers a compelling risk/reward investment proposition, and that is something we are willing to celebrate!

As dispersion within the market continues with the largest stocks attracting more of the available attention and capital, we have been able to gradually increase the overall value proposition.

Cheers to that!