Welcome to our second quarter Global Blue Chip Insights commentary for 2024, the fourth edition.

In this update we will cover the following:

- Performance commentary for Q2

- An explainer on year-to-date performance

- 10 Years Old! – Adaptations to the process

- Stock in Focus – Rockwell Automation

Global Blue Chip Q2 2024 performance commentary

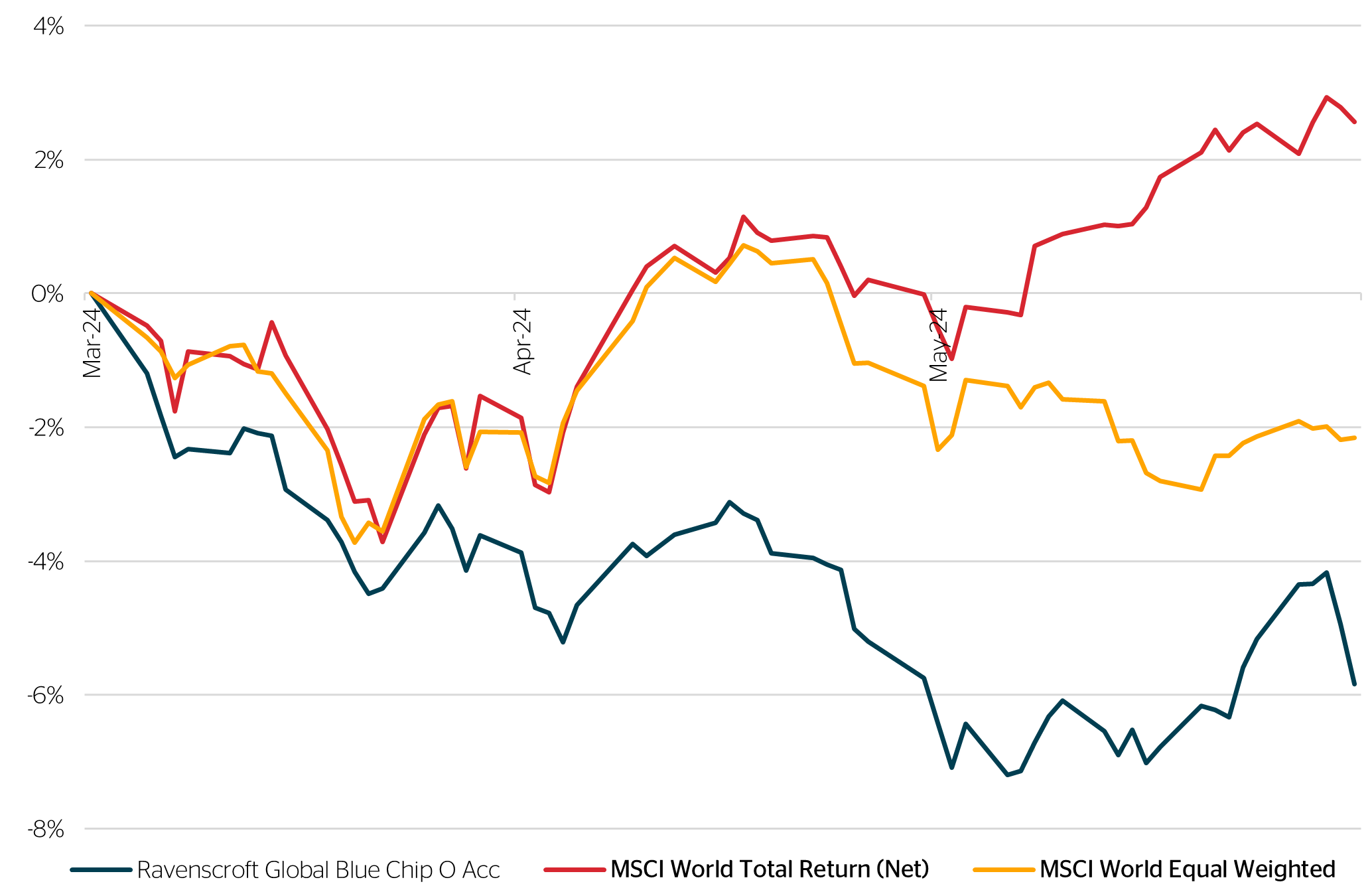

The rally in stocks slowed in Q2 with the MSCI World Total Return (Net) registering a 2.6% return in GBP. In contrast, the Global Blue Chip strategy returned -5.84%[1]. This took year-to-date performances to 12.7% and 1.3% respectively.

Chart 1. Ravenscroft Global Blue Chip Performance Against MSCI World (Net) and the MSCI World Equal Weighted for Q2 2024, in GBP

April and May were particularly disappointing months for the strategy. June was a lacklustre affair driven mainly by the ‘usual’ large cap tech stocks that continue to dominate the investment landscape. Overall, the broader market’s quarterly return was driven more by the Magnificent Seven, who contributed over 3% on their own. When looking at the returns of an equal weighted alternative, that reduces the influence of a company’s market capitalisation, the overall return for the quarter was negative.

Concentration risk is one of a number that can be associated with passive investing. The popularity of index investing has exploded since the great financial crisis but the first ETF to track the S&P500 was the SPDR S&P 500 ETF Trust launched in 1993. It has taken a while, but the ETF industry is huge and they are now the first port of call for most investors wanting stock exposure due to their diversification, ease of use, and low fee structure. More money now flows through passive instruments than any other form of investment, including mutual funds, single stocks/day trading activities etc. This fuels a systematic bid under the biggest stocks, attracting the most capital due to the way ETFs are constructed with the biggest market capitalisation stocks having the highest weightings. Should money flows reverse as savers (Boomers) turn spenders in retirement, will this reverse the net money flow and the largest stocks face the headwind of a prolonged offer of their shares? Time will tell, but given where demographics are, it’s a dynamic that is worth considering sooner rather than later and picking stocks where value is at hand rather than being forced into the biggest may prove to be a better, long-term strategy going forward.

Performance Breakdown

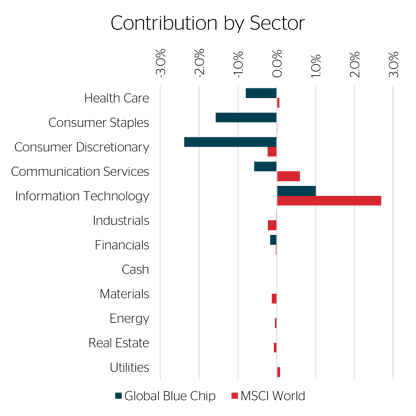

Looking at the performance through the lens of our themes and the most appropriate sectors helps us break down what happened from a relative perspective. It’s clear to see from Chart 2 below that stock performances, on average, were somewhat disappointing, across the board. We fared better within tech positions, which did offer a positive contribution albeit one that lagged the broader market.

Chart 2. Sector Allocation, Sector Performance and Contribution by Sector for Q2 2024

Ageing Demographics – Healthcare Sector (including the life sciences)

Despite a strong recovery in June, our healthcare holdings could not recover the losses incurred during the early part of the quarter. Life science stocks Bruker and Bio-Rad were the worst sinners, whilst Regeneron joined Alnylam amongst the saints.

Bruker’s share price performance was very disappointing in Q2, but not due to any disappointing developments in the business, so far as we are concerned. Up until late March the shares had been performing extremely well, in part due to Bruker’s exceptional underlying performance against a difficult background in the life science tools industry. But Bruker’s shares are not immune to movements in sympathy with its peers, and this is what started to take hold in early Q2. In late April, Bruker announced that it would acquire the assets of NanoString out of bankruptcy, while several weeks later they announced a modest sized share issue to help fund the acquisition – these announcements prompted the next leg-down in Bruker’s shares. Management hosted a “mini Investor Day” during the quarter to explain their strategy. We believe management to be credible and remain very excited about the direction of the business in the years ahead, including a very significant ramp in earnings starting from next year. The shares are now at about their cheapest valuation in 10 years.

As a business in adjacent industries to Bruker, Bio-Rad’s shares suffered a similar fate in Q2. Unlike Bruker however, Bio-Rad has been facing headwinds, most notably in bioprocessing, which is an industry currently in a prolonged slump. Until investors are able to attain more comfort as to when the bioprocess industry will fire on all cylinders again, it seems likely there will be further “false starts” in the shares of the relevant players (Bio-Rad being one). While we have no special insight as to when things will concretely improve, we continue to believe that patience will be rewarded.

The first half of Q2 saw Regeneron’s shares reverse declines from the second half of Q1, before going on to make new highs. Various factors have likely contributed to this result, but most notably the company showed very strong numbers for its recently launched eye drug “Eylea HD”. With increasing likelihood that Regeneron will be able to protect its Eylea franchise, investors once more seem to be coming round to the idea that Regeneron is a growth business – we would agree.

In late June, Alnylam announced the headline results of an important clinical trial – one of the most hotly anticipated events in biopharma this year. The company provided conclusive evidence that its medicine Vutrisiran significantly reduces the risk of death and improves quality of life in patients with ATTR amyloidosis with cardiomyopathy (a progressive heart disease with a large patient population). Anticipating approval by the relevant regulatory authorities, investors began to appreciate the magnitude of the opportunity in front of Alnylam, sending the shares up almost 60% in the last week of Q2.

Global Consumerism – Consumer Staples and Discretionary Sectors

Consumer stocks were the biggest drag on performance for a number of individual reasons, but Estée Lauder and Nike ended the quarter as two of our biggest detractors to performance.

Estée Lauder disappointed the market with its latest earnings update after it revised its revenue sales growth guidance due to the slower-than-anticipated recovery in mainland China. In our view, this is a short-term issue that will have a limited impact on the long-term opportunities for the company. Our thesis is largely playing out with the inventory situation improving and demand from the underlying consumer outstripping the reported sales into the Asia Travel Retail business. As with a number of businesses purchased over the past six months, the company is at an inflection point, having disappointed investors for a number of years now. It will take time to rebuild confidence but when it comes (and we believe it will) the shares will rerate accordingly.

Nike also announced disappointing results. The company expects sales to fall in its next fiscal year as the company battles waning consumer sentiment and increased competition. During covid, Nike leaned too heavily into selling its goods directly to consumers at the expense of its wholesaler partners. With the benefit of hindsight, this was likely a mistake and their actions have allowed some of their rival brands to regain a foothold. This has been compounded by the fact that product innovation also slowed. Management appears to have woken up to these errors and is taking corrective action. Nike’s valuation is as attractive as it has ever been since we have monitored the company. It seems crazy that we are at a price that was last seen during the Covid crisis, despite the continued innovation across products and distribution channels.

Technology & Innovation – Technology and Communication Services Sectors

Technology was a bright spot during a somewhat bleak quarter, carried by some of the biggest technology stocks in the index. Nonetheless, we had our share of success too with Oracle, Adobe, and Netflix entering the top five contributors. Disney, however, remains under scrutiny.

In early June, Oracle reported its full-year results. The size and growth of Oracle’s order book appeared to catch investors unawares and was received very positively. Growth is being driven, in particular, by Oracle’s differentiated cloud infrastructure, with an outsized share coming from AI customers, such as OpenAI.

Adobe’s shares reacted positively to its Q2 update - unwinding a significant portion of the negative movement witnessed in Q1. We believe AI to be complementary to the product and services Adobe offers its customers. Technical know-how is often a barrier that prevents people achieving their desired creative output. AI can help to overcome this and, so far, the evidence suggests this leads to more content creation, expanding the potential customer base of Adobe.

Netflix started the quarter as a major detractor following its Q1 earnings announcement. There was nothing especially concerning from our perspective but management did warn the market that come 2025 it will no longer provide key performance indicators such as net subscriptions and average revenue per user. Their adaptation is in response to how the business model is evolving as advertising becomes an increasing share of the total revenue pie and the old KPI’s become less relevant. Initially the market was suspicious over the move but soon realised that the results were actually pretty good and there wasn’t much to gripe about. Shares have more than recovered and are a whisker away from making all-time highs.

Five-year performance

| 30/06/2023 - 30/06/2024 | 30/06/2022 - 30/06/2023 | 30/06/2021 - 30/06/2022 | 30/06/2020 - 30/06/2021 | 30/06/2019 - 30/06/2020 | Annualised since inception | |

| Global Blue Chip Portfolio | 5.1% | 16.7% | -7.5% | 18.7% | 7.9% | 10.8% |

Source: Ravenscroft, compiled 03/07/2024

It is important to note that past performance is not a reliable indicator of future results.

[1] * Returns for the quarter in GBP unless stated otherwise. Source: RIFO Blue Chip O Accumulation unit data from TISE and MSCI World data from FactSet

An explainer on year-to-date performance

Over the past six months the performance has been a real frustration due to not owning a certain number of very large, tech-based businesses, a cyclical uptick in some sectors where we have minimal exposure and a few self-inflicted wounds due to a mismatch between company announcements made and market expectations. Most of the damage was meted out over April and May, which eroded much of the positive performance we had accrued in the first quarter. In the previous report, we touched on the sector issue and some of our stock-specific headwinds. What we haven’t yet explained is the extent to which not owning the Magnificent Seven has impacted performance and why we haven’t been allocated to such companies despite the obvious strength in price performance.

For completeness, over the six months to the end of June the MSCI World has rallied 12.7%, of which approximately half is attributable to just six stocks (the “Magnificent Seven” excluding Tesla), which have been the preferred momentum play on the potential of AI. NVIDIA has accounted for almost a quarter of the returns, which is pretty staggering when you consider the index is made up of roughly 1,500 underlying businesses. Of those six, we own one – Microsoft. Whilst we have benefited from its inclusion, the company is among the smaller allocations within the portfolio (which is a direct function of it being one of the companies with the lowest expected returns in the portfolio) and thus we haven’t participated in the uplift provided to the same extent as the index.

Given the size of impact this small collection of companies has had on the index we feel it is worth spending some time understanding why an investment in them does not currently meet our approach and what would need to happen for this to change:

Amazon – a business we admire with a results-orientated and consumer-centric culture. The difficulty with Amazon is ascribing a fair value to its stock given the number of industries it spans (cloud services provider, retailer, advertiser, logistics operator, media producer etc). The complexity and the interaction between them make it hard to estimate the free cash flow the business is likely to generate and thus the intrinsic worth of its shares. In such scenarios, we typically look for a wider margin of safety than we would when investing in a highly predictable and largely stable business. At current prices, we do not believe the margin of safety is there. That said, we have owned it briefly in the past and we continue to look for opportunities to own it again.

Alphabet – A business we are very familiar with, having owned from Q3 2018 to Q1 2024. We sold the position on both valuation and cultural concerns. Since then, the share price has continued to rally (+40%) and looks increasingly unattractive based on our fundamental understanding of the business and what the current share price implies about the future growth rate required. We would consider owning Alphabet again at the right price and if management demonstrate they have addressed the cultural issues plaguing the business.

Apple – another business we owned in the past at a time when it was unloved and attractively priced prior to its transition to a more services-focused business. We sold at the end of 2020 on valuation grounds and regulatory concerns over what could significantly reduce the profitability of its services businesses. The complaints about Apple’s anti-competitive practices are growing louder. At the same time, there is increasing evidence that the innovation in the hardware business is waning, and upgrade cycles are lengthening. Over the last three months, the shares are up 40% after Apple announced, at its annual developer conference (WWDC), that it was jumping on the AI bandwagon with Apple Intelligence. We would consider owning it again if the shares retraced to a level where the price was supported by the fundamentals – this seems unlikely in the near term due to the euphoria accompanying any mention of Ai.

Meta – this is a hotly debated company within the team. From a cash flow perspective, the company looked very compelling at times in 2022 but we were unable to overcome our concerns about some of the ethical issues surrounding social media and its detrimental impact on society – especially on young users – which has led to the US Surgeon General wanting to impose smoking style warning labels on social media platforms over mental health impacts. We aren’t enamoured with management either on their desire to drive the narrative on what users should be doing in the future (rather than reacting to what consumers want to do) through their capex spending on obsessions such as the metaverse, Oculus Rift/Quest, and now AI. We also have some concerns about the sustainability of its advertising business – namely the risk presented by its major customers questioning incrementally and reaching the same conclusion as companies like Airbnb – who stopped doing performance advertising and saw no reduction in traffic to their website. The shares have re-rated significantly since, yet the concerns remain. If we weren’t able to get comfortable with the issues when the share price offered a margin of safety we certainly can’t when they are fully priced.

NVIDIA – There is no doubt that this stock has sparked market excitement but we believe there are reasons to doubt the sustainability of NVIDIA’s recent surge. This is a transactional industry where you are only as good as your last chip. The company may dominate the AI chip market currently but it’s only able to achieve these sky-high margins due to the imbalance between supply and demand. High margins eventually attract competition, as manufacturers clamour for their share, and these temporarily high margins are eroded. On top of this, NVIDIA’s expensive chips become a significant drain on their largest customers’ (the cloud hyperscale’s) resources, incentivising them to develop their own silicon. These are formidable companies with deep pockets and a clear incentive to drive down costs – they are not companies you want to have to compete against. To justify its current share price, the company would have to execute their growth plans perfectly over a sustained period; we feel that despite the obvious momentum, the range of potential outcomes is so wide for NVIDIA and the share price provides no margin of safety considering the very real risks to its dominance.

Outside of technology, approximately a further 2% can be attributed to our conscious (and structural) decision to avoid investing in sectors made up of businesses with high levels of cyclicality and low-quality earnings. We maintain no exposure to the energy, utilities, materials and real estate sectors and the only business we own in the financial sector is Visa (and this was only recently reclassified from a technology business). Over the period these sectors have contributed positively to market returns and as such have caused a differential.

Whilst the above accounts for the vast majority of the difference in relative performance (8%), the remainder is due to a few stock specifics detailed below:

Estée Lauder – In May, the company revised down its guidance due to the timing of the recovery in China prompting an immediate 20% fall and a slow drift back down to the levels we initiated at in November 2023 (after being up 60% in quick succession). The thesis for investment is playing out largely as anticipated with the inventory situation continuing to improve and we expect growth rates to start accelerating again shortly once the reset is complete. We believe this to be a timing issue and we do not expect this to have any implication on the business (or the desirability of its products among its consumers) in a few years’ time. We used the opportunity to increase the position size as a result.

Nike – The company lowered its FY25 guidance due to challenges highlighted in the latest quarter prompting an immediate 20% sell-off – the biggest one-day move since the company IPO’d in 1980. The issues stem from a strategic error management made whereby they leaned too heavily into their direct-to-consumer distribution channel at the expense of Nike’s wholesale partners. This left a gap on its shelves which its competitors willingly filled, enabling them to regain a foothold in various categories Nike competes in. Whilst the company has recognised its error and is taking corrective action, this will take some time and the growth rate is likely to slow whilst Nike navigates the multichannel world we now live in (and the challenges this presents).

Etsy – Etsy continues to come under scrutiny from investors who are unlikely to let up until management can demonstrate their ability to resume GMS growth following the buoyant Covid period. Etsy recently announced changes to its listing policy to remove low-quality, commoditised goods available on other e-commerce platforms. The more Etsy does to differentiate itself from these low-quality platforms (Temu/Shein) the more obvious it becomes that its marketplace is not at risk from these businesses.

Bio-Rad - Bio-Rad has been facing headwinds, most notably in bioprocessing, which is an industry currently in a prolonged slump. Until investors are able to attain more comfort as to when the bioprocess industry will fire on all cylinders again, it seems likely there will be further “false starts” in the shares of the relevant players (Bio-Rad being one). While we have no special insight as to when things will concretely improve, we continue to believe that patience will be rewarded over time.

Bruker - In late April, Bruker announced that it would acquire the assets of NanoString out of bankruptcy, while several weeks later they announced a modest-sized share issue to help fund the acquisition – these announcements prompted the next leg-down in Bruker’s shares. Management hosted a “mini-investor day” during the quarter to explain their strategy. We believe management to be credible and remain very excited about the direction of the business in the years ahead, including a very significant ramp in earnings starting from next year. The shares are now at about their cheapest valuation in 10 years.

As ever, we continue to monitor and scrutinise our positioning and stock-by-stock holdings. While the share price moves experienced are frustrating, we have no concerns with the long-term growth potential of these businesses and remain holders. If this ever changes, of course, we will take action.

We are also mindful of the disparity between how our strategy is holding up in this momentum-driven market and the relative performance. However, we strongly believe that the current portfolio offers a very attractive value proposition.

For example, the average earnings growth expectation across the portfolio is currently 12% based on analyst forecasts, which is higher than the broader market’s 8-9% expectation, according to data from FactSet. In addition, because of our preference, at this point in time, for out-of-favour stocks you are not paying a premium for this additional growth. The aggregate value across the portfolio on a price-to-earnings ratio is roughly 17.7x based off one year forward earnings expectations whilst the broader market is trading on a 19.6x multiple.

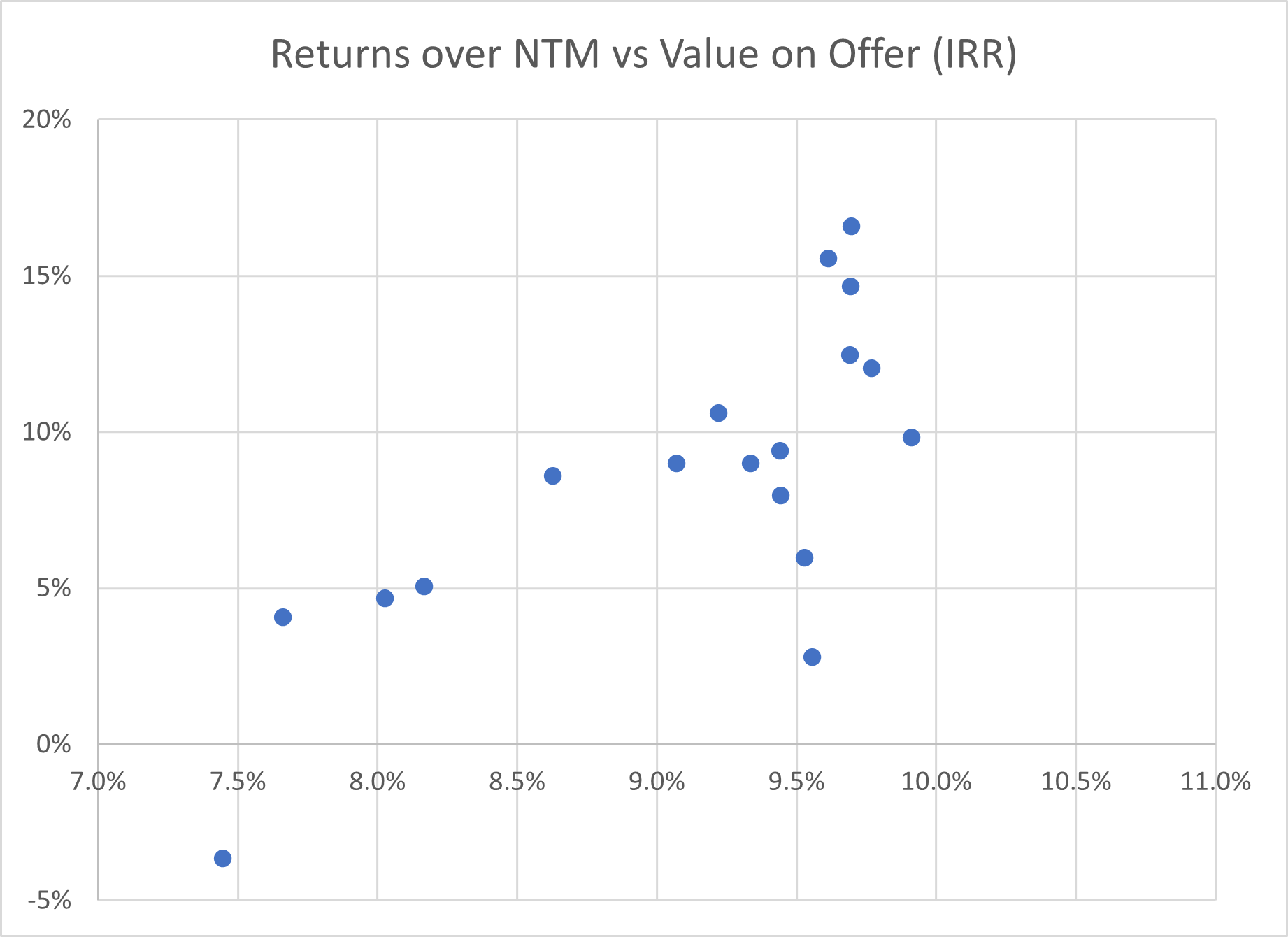

Our valuation-focused approach ensures those companies with the highest expected future returns are held within the portfolio at a higher weighting. When the individual internal-rate-of-return (“IRR”) is low, we trim (or exit) the company in question and rotate into businesses showing higher value on offer. We can derive the aggregate expected return of the overall strategy from the returns expected from the individual holdings – what we refer to as the strategy’s IRR. With the usual caveat that past performance is not necessarily a guarantee of future returns, we are comforted by the fact that the portfolio’s IRR today is the highest it has been in the 10 years we have been running the strategy.

This is confirmed by a number of other commonly used valuation metrics (such as the PEG ratio) which reveals that investors in our collection of companies are getting significantly more growth per unit of value compared with the index, reflecting an attractive risk-reward opportunity.

The chart below plots the historical IRR of the strategy against the performance achieved over the following 12 months. Historically, there has been a clear correlation between the aggregate portfolio IRR and the returns subsequently achieved. We view this as evidence that our valuation approach works, in that it alerts us to businesses that are mispriced and prompting us into action.

10 Years Old!

Despite the torrid quarter, Blue Chip reached an historic milestone – its 10-year anniversary – at the quarter’s end. We marked this event with a short note (which can be read here) accompanied by a quiz based on some of the businesses we have invested in. Entrants have the chance to win a series of prizes and we would encourage you to enter – please see our website for details. We would like to take this opportunity to thank all our investors for your support over the years and our desire to serve you burns just as bright today as it did when we launched the strategy.

As we look into the future, we hold a collection of stocks that are aligned with our themes, steeped in quality and offer, as a cohort, a value proposition that has rarely been better. The philosophy remains the same but we have refined the process over the past 10 years as we continue to learn and build on successes. The following points highlight some of the most notable improvements we have implemented over the past decade:

- Valuation: Valuation has always been at the heart of our process but in late 2017 and early 2018 we developed and implemented an entirely new valuation process, tailored to the challenge of valuing the types of businesses we’re interested in. It’s a system based around what is known as the internal rate of return (“IRR”) which determines the discount rate you’d need to apply to a future series of cash flows in order to get a net present value equal to zero., We believe this system works quite well for dependable businesses with relatively steady growth and staying power and has positively contributed to our buying and selling decisions. Today, we triangulate our IRR with a series of valuation multiples to get the best gauge of value that we can.

- Review cards: In 2021 it became clear to us that we weren’t always able to move as quickly as we needed to on new ideas. Until then, our long-form research process typically meant it took several months to take a new idea from concept through to implementation. In that time, there was the risk the opportunity initially identified could have passed. To combat this, we introduced a short-form process that allows us to initiate smaller position sizes much more quickly, before ultimately exposing them to the rigour of the longer form process prior to taking the stock up to a full weighting.

- Substitute bench: As time has gone by, we have greatly expanded our “subs bench”, building depth of knowledge on a greater number of stocks. As markets, industries and individual names continue to cycle in and out of favour, it helps ensure that we are always able to own a whole portfolio of great businesses at attractive prices, without compromise.

- Management and culture: Over time, we have found ourselves paying ever-greater attention to the quality of a business’ management and culture. Notwithstanding that investing is inherently about the future, many investors seem most concerned with what has happened in the past (the “rear view mirror”). The people who know a business best is its management, and so if they can prove themselves to be worthy of trust, then their statements about the future become extremely valuable. We spend more time on this than we used to.

- Quality: We challenged our own assumptions on where quality is to be found, and we’ll continue to do so. For example, in the earlier days we used to “screen” our universe of potential holdings on the basis of various pre-defined quality-based criteria and thresholds. We later learnt that quality comes in many guises and you must be open-minded about where you find it. One example is BMW, which we consider to be a high-quality business (and one that has delivered fantastic returns for our investors), but is a company you would not have seen in the portfolio 10 years ago.

There’s still plenty of work to be done, no one day passes where we think we’ve cracked the code. Investing in today’s landscape is as noisy and as challenging as any other and we believe long-term success will be underpinned by a strategy and process that delivers results in a sustainable fashion. We won’t get everything right, but we can be expected to offer clients a reasonable risk-adjusted return and that’s what we aim to do.

Through each quarter we write a number of articles on stocks that we own (or do not), often tying in aspects of our process to offer more context to interested clients. During the quarter we have discussed the following:

- The impact of noise and how we can reduce it to make better judgement calls – Silence is Golden

- Netflix’s Quarterly Earnings, an illustration of the Precision Fallacy – Ta’dum(b)

- Why are socks experiencing heightened volatility when broader index volatility declining? – What’s with the volatility?

- The risk/reward around owning NVIDIA – I want to talk about NVIDIA

Stock in Focus – Rockwell Automation

Introduction

Rockwell Automation is the world’s leading pure-play automation company and has been on our radar for several years due to its alignment with several of our favoured themes. These include its role as a ‘picks and shovels’ play, mission-critical products and services, a growing software and recurring revenue stream and multiple secular growth drivers. However, until recently the valuation has been a sticking point for us, but with the shares currently under pressure as the company grapples with short-term headwinds, we have taken the opportunity to buy into this attractive multi-year growth story.

Rockwell’s shares have underperformed the market this year due to falling revenue expectations, with management currently guiding for a 6-8% drop in revenue for fiscal year 2024. While the decline is material, it is mainly due to short-term timing issues rather than weakening end-market demand. Following the Covid pandemic, many of Rockwell’s customers over-ordered from the company to compensate for severe supply chain disruption. However, now that supply chains have normalised, they have too much inventory on hand and, despite healthy demand from their own customers, they are temporarily reducing orders from Rockwell to manage their inventory backlog. Nevertheless, it is important to put this year’s revenue drop into perspective. Rockwell’s revenue growth averaged 12.7% per annum over the three years following the pandemic, and revenues are still expected to be over 25% higher this year than they were in 2019.

Opportunity Set

Over the long term, Rockwell is ideally positioned to capitalise on a number of major secular growth trends. The reshoring of manufacturing in the US and Europe, coupled with a shrinking and ageing workforce and the digitisation of the global economy, are all driving increased demand for industrial automation.

The digitisation of industrial manufacturing through connected devices, cloud computing and AI is leading to significant opportunities to create more efficient software-defined automation processes and higher-value lifecycle services.

In terms of reshoring, the US is leading the way with over $1 trillion in mega projects announced since January 2021 and, given that only 16% of these projects have started construction, this represents a substantial multi-year growth opportunity for Rockwell. As a US company and with by far the largest market share in North America (~60% of group revenue), Rockwell is in a much stronger position than its European and Asian competitors to capitalise on these trends. This is a reversal of the pre-pandemic landscape, when China was the fastest growing market for automation, a market where Rockwell has relatively low exposure, representing only ~6% of sales.

Background

Rockwell Automation’s history dates back to 1901 when Lynde Bradley and Dr. Stanton Allen formed a company to produce speed controllers for electric motors. The company, which became known as Allen-Bradley in 1909, remained a private company until it was acquired by Rockwell International in 1985. Following the acquisition, Allen-Bradley effectively became Rockwell's automation division and it remains a key brand of the now renamed and more focused Rockwell Automation. Rockwell International demerged its legacy non-automation businesses in 2001.

A pivotal development in the company’s history was the invention of the programmable logic controller (PLC) which Allen-Bradley pioneered in 1970. These PLCs are rugged industrial computers that play an essential role in the control and monitoring of the manufacturing processes from assembly lines to robotic devices. Rockwell’s PLCs work in conjunction with their proprietary Logix control platform (a software language used to program and control the PLCs).

Recent Evolution

Over the last five to six years, Rockwell has focused on expanding its software and services business. The expansion was in response to both the threat of potential new competitors (particularly cloud hyperscalers like Amazon, Google and Microsoft) and the significant opportunities of a rapidly digitising global economy. By enhancing its software and services offerings, Rockwell has been able to improve the value proposition of its products and services whilst expanding into new areas such as cybersecurity. This shift towards software and services, often resulting in recurring revenue, has increased the overall resilience of Rockwell’s business, with annual recurring revenue expected to account for about 9% of total revenues this year, double the rate of 2019.

Under the FactoryTalk brand, Rockwell offers a market-leading portfolio of software solutions both on-premises and in the cloud, leveraging AI for automated manufacturing, energy efficiency and materials handling. Rockwell’s software also supports its lifecycle services business, from system design to operations management, predictive maintenance and cybersecurity.

Rockwell Today

The company operates through three segments:

- Intelligent devices, offering smart products, including drives for power and motion control and safety and sensing devices.

- Software and control, providing the software and hardware critical for automating and managing production processes

- Lifecycle services, encompassing digital consulting, remote monitoring, asset maintenance and cybersecurity

Not only is Rockwell the world’s leading pure-play automation company, but it is also the only company that can support many different types of industrial processes, from discrete (automotive, semiconductor, and warehousing), to hybrid (food & beverage, household & personal care and life sciences), to process (oil & gas, mining and chemicals). This industry-wide capability along with its integrated control and information architecture helps increase the deployment speed of new systems whilst reducing the total ownership costs for customers.

Having built a leading-edge suite of hardware, software and services, management’s focus over the next few years will be on integrating its capabilities into one seamless offering, whilst focusing on revenue and cost synergies to drive growth and margin expansion. That said, the company will continue making bolt-on acquisitions to increase recurring revenue and expand its market outside North America. Putting it all together, Rockwell is targeting through the cycle annual revenue growth of 6-9% with EPS and free cash flow growing faster than revenue due to improving margins.

Conclusion

Over the last few years Rockwell’s management has successfully repurposed the company’s automation business for the 21st century. Today, the company is well placed to capitalise on the global mega-trends driving the demand for intelligent software-driven automation, whilst the increasing level of recurring revenue is leading to a more resilient business. Nevertheless, it is important to remember that the company will remain susceptible to downturns in the business cycle and the rate of industrial production, particularly in North America.