Decisions, decisions

As we approach year end, the world continues to be an uncertain place. Just in the last fortnight, we have seen regime change in Syria and chaos in South Korea. Whilst neither events have a direct impact upon monetary policy, they do highlight that volatility remains high and will be one of the considerations around Central Bank decision making.

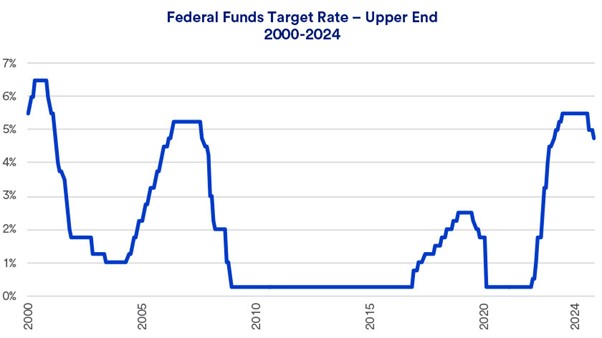

Of more immediate interest to our markets, the US Federal Reserve meet next week and markets are expecting another 25 basis point rate cut. If this forecast is correct, then this will mean that US rates end the year at a range of 4.25% to 4.50% and will have been cut by 100 basis points since September.

Alongside the usual economic indicators to be considered, the Federal Reserve will also have to think about how the new incoming Administration may impact their decision-making process. It is still too soon to be able to predict specifics but one broad theme we would expect to see will be that the Trump Presidency will result in tax cuts. This should be supportive for US growth as economic momentum is maintained by domestic participation. Of course, the threats of tariffs could be a negative for the economy. But how much of President elect Trump’s current rhetoric is his opening position ahead of negotiation is unknown?

The outlook for US monetary policy next year has probably evolved a little over the last three months based on the change of Government and updated economic figures. The pace and range of rate cuts next year is now expected be slower than was predicted three months ago. The majority of economists expect the Fed to cut rates by a total of 75 basis points in 2025. The overall ‘neutral’ level of US interest rates (the level of official rates which neither stimulates nor suppresses economic activity) has also been revised up. Overall then, increased global volatility coupled with a less aggressive easing cycle should benefit USD cash investments next year.

Source: US Federal Reserve, 7th November 2024

Turning to the UK, the MPC next meet on 19th December and markets are currently ascribing an 87% of a no change decision. This is even after last Friday’s GDP data, which showed a second monthly contraction. The tight UK Labour market is likely to keep upward pressure on average earnings which will in turn add to the inflation numbers. The quarterly inflation expectations survey will probably also reinforce this point. UK households expect the pace of price rises to accelerate next year with inflation expected to reach 3.00%. This is the first expected increase in inflation since August 2023 and ingrained inflation expectations are a key indicator for the MPC. Forward looking expectations of inflation will naturally feed into increased wage demands.

Source: Bank of England

With service inflation still at about 5.00% and inflation to remain above the 2.00% in 2025, the MPC is in a similar position to the Federal Reserve with limited room for manoeuvre. Unsurprisingly the outlook for UK monetary policy next year is therefore similar to the US. UK base rates are currently 4.75% and it is reasonable to expect the MPC to cut three times during the course of the next year so that official rates are 4.00% this time next year. Again, an expected slower pace in UK interest rate cuts will benefit cash investors.

So current thinking is for interest rates to decline gradually in 2025 and that the outlook for both the US and UK is very similar, albeit for slightly different reasons. This is in contrast to the outlook this time last year when, particularly in the US, markets were expecting a sharp series of rate cuts.

Either next year will turn out to be slightly more predictable than 2024, or events will once again prove the forecasters wrong!