Waking up last Monday to Japan’s Nikkei’s worst day since the 1987 Black Monday crash served as a stark reminder that snapbacks in markets can happen in the blink of an eye. The 12.4% loss on the Nikkei on Sunday night was the worst day for the index since the global crash and the Nikkei erased all its gains year-to-date – eight months of hard work undone in a day. This volatility wasn’t focused on the Nikkei alone; the Nasdaq is 14% below its all-time high and the darling of the AI boom Nvidia is down 27% from its highest point.

So, what happened?

Multiple factors have contributed to the pullback. Starting with the US – the economy appears to be slowing due to increased living costs, depleted savings and higher interest rates. In China, the widely expected stimulus measures didn’t occur in July and as such there has been a lack of traction in the Chinese economy. The Yen carry trade imploded – many short-term investors were borrowing Japanese Yen (“JPY”) at low interest rates, converting the JPY to USD and buying US stocks. The Bank of Japan (“BoJ”) raised interest rates for the second time this year (having previously not increased rates in 17 years), leading to the JPY strengthening considerably. This meant that traders had to pay higher interest for the borrowed JPY and now faced significant currency losses. The US stocks they bought may not be enough to repay the JPY they had borrowed and as such this caused a huge unwind of trade positions which were then exacerbated by margin calls which negatively impacted US stocks as investors became forced sellers. Moreover, fears of a broader war in the Middle East are escalating. There is uncertainty in the US political system following Biden’s withdrawal and the failed assassination attempt of Trump.

Moreover, two significant announcements on Friday highlighted the market's fragility:

- Berkshire Hathaway: Despite holding a record cash pile, Berkshire Hathaway halved its Apple shareholdings, increasing the free float of one of the world's largest companies and raising concerns about a potential full liquidation of its remaining 2.6% stake.

- Intel: Intel announced it would lay off 15,000 workers, 20% of its workforce.

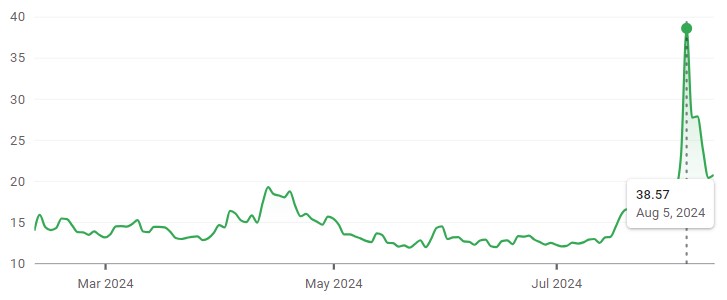

The CBOE Volatility Index measures volatility by tracking trading in S&P 500 options. Large institutional investors tend to hedge their portfolios using S&P 500 options to position themselves as winners whether the market goes up or down and the VIX index follows these trades to gauge market volatility. Broadly speaking, if the VIX index is at 12 or lower, the market is considered to be in a period of low volatility. 12-20 tends to be normal, whereas anything above 20 is seen as high volatility. When you see the VIX above 30, that’s sometimes viewed as an indication that markets are very unsettled. That is what happened last week. Whilst the VIX traded at 65.73 intraday, the end-of-day index settled at 38.57. Either way you look at it, markets have been unsettled by what has happened over the last week.

CBOE Volatility Index (last six months)

Whilst absolute negative performance is never nice, a shake-out in the large-cap tech names has meant that our client portfolios will have largely fared better and as such on a relative basis, outperformed.

As we enter the new world and a new economic cycle, we are expecting higher levels of volatility than post the global financial crisis as we enter a world with greater inflation and interest rate volatility. In this higher volatility environment, we will still see numerous opportunities to make money in both bonds and equities and it is our job as investment professionals to navigate these periods successfully. We tend to focus on three key pillars to gauge the attractiveness of equity markets – liquidity, economic growth and valuations. Starting with valuations, outside of the Magnificent Seven, valuations look cheap. If we are correct and interest rates start to fall, this should increase liquidity within markets. Finally, economic growth, whilst job figures have started to show signs of stress, we still believe we will avoid a recession, largely helped by central banks cutting rates to support economic activity. As such we remain constructive over the next 12 months.