"With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future." — Carlos Slim Helu

Billionaire and former world’s richest man Carlos Slim’s quote is a pertinent reminder of not letting longer-term judgement be clouded by recent market trends. From an historical perspective, over time, global small-cap stocks have been proven to outperform their large-cap peers, as shown in the celebrated study conducted by Professors Eugene Fama and Ken French. The study, which goes back to 1926 (the earliest reliable data can be examined), found that small-cap stocks in the US have outperformed by 285 basis points annually.

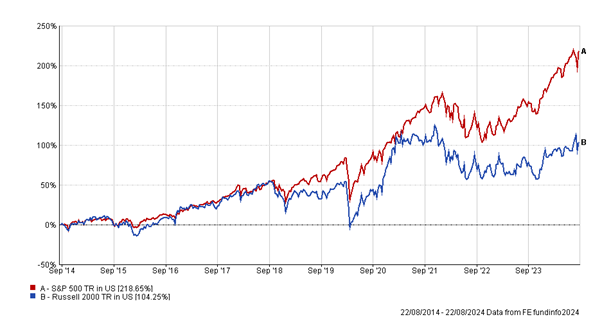

This trend hasn’t held true over the last decade, however, with large-caps (represented by the S&P 500) decidedly outperforming the Russell 2000 over this period. This recent phase has been exemplified by large-caps principally driving the market. Initially big tech was at the forefront, but the baton has more recently been taken over by the ‘Magnificent 7’. Investors would be forgiven for forecasting these industry trees will keep growing to the sky.

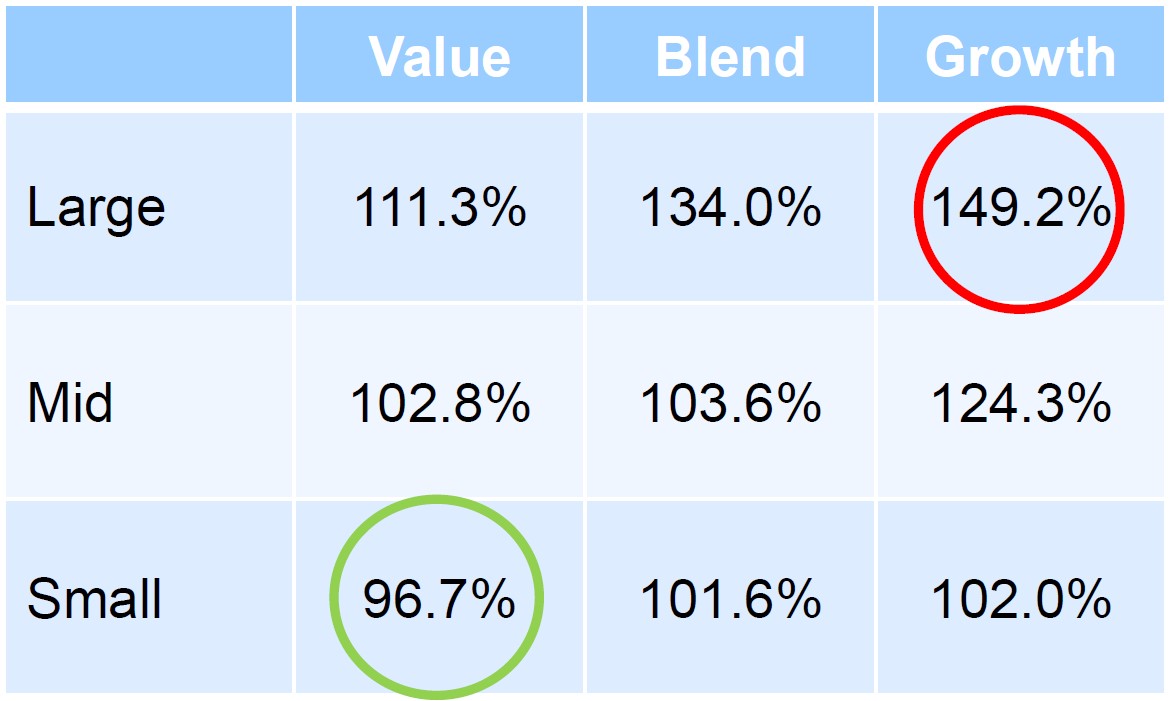

Advocates of mean reversion would stress these conditions can’t endure and that we will inevitably return to the long-term trend and an outperformance of small-caps. Current valuations would certainly support this scenario, as shown in the table below, which shows P/E as a percentage of 20-year average).

There are various justifications as to why small-caps have been underperforming. Most notably, small-caps tend to underperform in a rate-rising environment due to their higher reliance on leverage and floating rate debt. With policymakers commencing interest rate-cutting cycles one of small-caps’ primary headwinds is being removed, while the discount to large-cap stocks looks increasingly compelling.

Additionally, sentiment has favoured mega-caps, where the hype around the AI boom has seen investors funnel ever more funds into a narrow set of stocks in the expectation that these companies will fuel productivity efficiencies within the economy leading to ever more demand for their products.

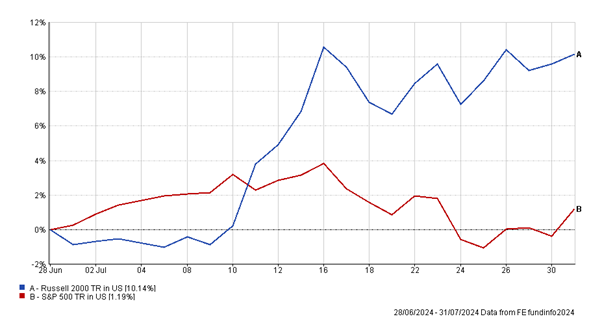

Earlier last month, however, investors saw how quickly the market can rotate. Doubts surrounding the sustainability of earnings of AI-exposed mega-caps led to a selling of tech stocks at the same time as investors digested the expectation that the Federal Reserve would begin lowering interest rates as soon as September on moderating economic data. The combination provided the impetus for small-caps to outperform in July by their widest monthly margin in decades.

Whilst Ravenscroft portfolios are still predominantly invested in large-cap quality growth companies within our equity exposure, due to their more defensive characteristics, we are cognisant of the opportunity set materialising in the smaller-cap areas of the equity market. Moreover, our Balanced strategy is in the process of adding the Abrdn GEM Smaller Companies Fund to portfolios, not only to benefit from valuations but also increase our diversification across our emerging market exposure.

To conclude, volatility is a feature of small-cap investing, as is the nature of the asset class, this volatility nonetheless is invariably accompanied by potentially higher returns. Whilst it is worth bearing in mind that the growth of a company is predominantly greatest in the early stages of their development, these characteristics would suggest taking a long-term approach in smaller cap investing. Although now may not be the inflection point at which small-caps begin outperforming, today’s fundamentals do provide a compelling entry point to long-term investors.