We write this note following a week that included interest rate decisions by both the US and the UK central banks.

First to go was the US Federal Reserve (“Fed”), which held US rates steady in the range of 5.25% to 5.50%. This was not a great surprise to markets given that the Fed had been, and continues to be, at pains to avoid signalling a rate cut.

However, the latest set of minutes are a bit more dovish, removing obstacles to a September easing provided the next two CPI reports are positive. The minutes of the 31st July Fed meeting emphasise that economic activity has continued to expand at a solid pace but that job gains have moderated, commenting that the unemployment rate “has moved up but remains low”. The minutes also note that “some further progress” has been made towards the 2% inflation objective, reminding us of the Fed’s mandate to achieve maximum employment and inflation at the rate of 2% over the longer run.

The minutes further note that the committee judges the risks to achieving its employment and inflation goals continue to move into better balance, adding that the economic outlook is uncertain therefore the committee remains attentive to the risks to both sides of its dual mandate of maximum employment and 2% inflation. This includes monitoring incoming data on the economic outlook, which would lead the committee to adjust its monetary policy stance if risks emerge that could impede the attainment of those goals.

Some investors seemed disappointed by the absence of a signal of policy easing in September but having said they were going to monitor incoming data and knowing that there are two more CPI and labour market reports still to come before the next meeting the committee was never going to take the step of committing to future policy moves at this meeting

Our view is that the Fed needs to ease policy soon and more than expected to prevent a US recession/hard landing and prevent a significant stock market correction.

Turning to the UK, the news was far more exciting with the Bank of England cutting base rate by 0.25% to 5% in a 5:4 split vote on Thursday.

UK headline inflation remained at 2% in May and June – bang in line with the Monetary Policy Committee’s (MPC) target and therefore created a perfect window of opportunity to cut rates despite the fact that many think services inflation is still too strong to allow the MPC the luxury of a rate cut. We deliberately use the phrase “window of opportunity”; the reason for this is that headline UK inflation will strengthen again towards the end of the year as various base effects fall out of the data. Further, it is expected that the energy price cap will rise again in the autumn. Added to this, the recent conjecture that the new government is considering above-inflation pay rises for some public sector workers could stoke market concerns over the outlook for inflation. Finally, the UK economy is now forecast to perform better than expected earlier this year. So, taking all of this into consideration, it could be that enough members of the MPC felt that not cutting base rate now would risk seeing the window of opportunity closing later in the year.

We’ve just mentioned the new government and even though it is now four weeks old it’s worth considering how the cash team views Rachel Reeves, the new Chancellor.

First, the new occupant of 11 Downing Street, Reeves worked for the Bank of England for a number of years, which is positive. Because of this and the fact that the election result was not a surprise means that the financial market’s reaction was muted. Another positive was the size of the Labour majority, which will have pleased markets who like certainty. By comparison, the political situation in France at the moment, where there is a hung parliament, contrasts starkly with that of the UK. It is easy to see what could have happened had the UK result been much closer.

Looking at policy, during their general election campaign Labour effectively ruled out large-scale tax increases to fund their spending plans but having had a chance to scrutinise the books Labour have found an alleged £22 billion “black hole” left by the Conservatives. It is therefore little surprise that the Chancellor is now considering some tax increases to reduce the amount needed to be raised by debt issuance. That said, it’s early days and the first few steps have been reasonably reassuring from our perspective.

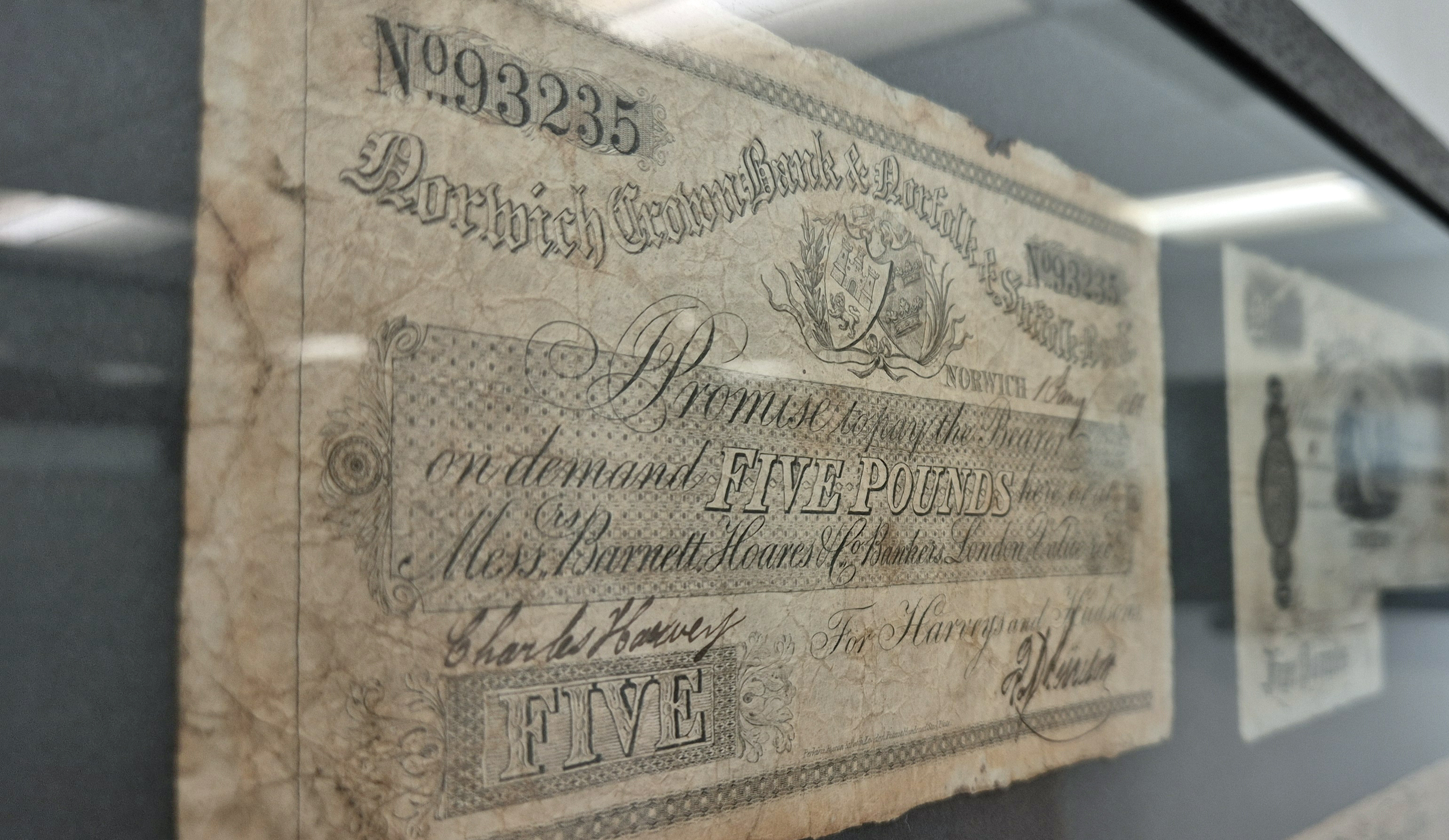

To end on a lighter note, we recently spotted a BBC report headlined “Rare £100 banknote fetches £32,000 at auction”, which piqued our interest. The report read: “A rare £100 banknote from 1855, which was worth such an enormous sum at the time it had to be cut in half for safe delivery, has fetched £32,000 at auction. The note, issued by the Liverpool branch of the Bank of England 169 years ago, was worth approximately £15,000 in today's money on the date it was issued.”

We have our own collection of old framed banknotes in our Guernsey office which, if you’re passing by, we’d love to show you. While they may not be worth £32,000 at auction, they are nevertheless quite interesting.