As of 31st August, gold was $1,942 per troy ounce – up 5.5% since the start of the year1. Anyone keeping an eye on the gold price will know that it hasn’t all been smooth sailing, with prices recently dipping under $1900 for the first time since March. Silver has been a little more lacklustre during 2023 and has been unable to maintain the higher prices seen in April and May, currently sitting at $23.50 per ounce.

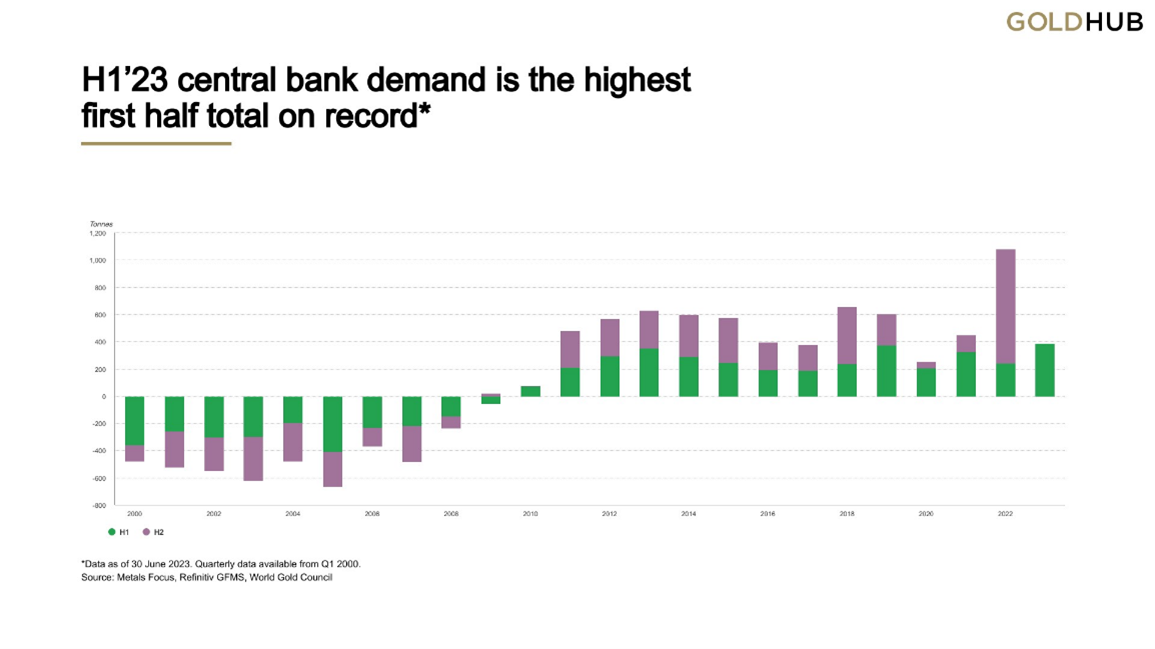

Central bank gold purchases slowed during Q2 but have been a solid support for prices during the first half of 2023, with The People’s Bank of China being the standout buyer, adding over 100 tonnes to its gold reserves.

The positive outlook from China’s Central Bank was also shared in their jewellery sector as a 28% increase was seen relative to Q2 20222. This increase offsets the slightly lower figures coming out of India, which were caused by record-high local prices. Fluctuations in jewellery demand are expected, particularly in India, as it relies heavily on wedding season and the Diwali Festival. October to February is the most popular time for gold buying so a strong end to the year is likely.

Bar and coin demand has fallen in Europe, particularly in Germany, following the introduction of 19%3 VAT on all silver bullion coins. Up until the start of 2023, non-EU silver coins had received favourable tax treatment, meaning they were highly sought after in the German market. The Ministry of Finance has now closed this door and it’s no surprise that the outcome has been a complete collapse of the market there.

The impact of taxes should be a consideration when investing in any product, and precious metals are no different. Fortunately, if you are a tax resident in Guernsey there’s a lot less to concern yourself with, but what are the implications outside of our (sometimes!) sunny little island?

This is an open-ended question with a huge number of ever-changing answers but there are certainly a few important areas to highlight. In the UK, investment-grade gold bullion is VAT-free4. However, when you decide to cash in there’s the small matter of capital gains tax to think about. Investors can be charged up to 28%4 for all taxable gains over the annual exempt amount – which has also recently been reduced for 2023-24 to £6,000 for individuals5. It is set for further reductions in the coming years so choosing assets which are exempt could prove to be a smart move for many. Britannia and Sovereign coins carry higher premiums on the initial purchase but are excluded from CGT on sale. This is due to certain coins carrying a legal tender status in the UK. So, although in the short term it may feel like larger bars are cheaper, CGT-free coins might have a better net payoff when sold. This also applies to silver and platinum coins produced by The Royal Mint.

Although fine gold is generally VAT-free in most countries, silver, platinum, and palladium, are not. There are varying rates throughout Europe, with Switzerland being recognised as one of the lowest at 7.7%6. The UK levies the standard 20%4, which means that any investors purchasing silver in the UK, or having assets delivered, will pay roughly £120 per kilo in VAT. There are ways of storing silver in the UK VAT-free, such as bonded warehouses. This may avoid an initial tax on purchase, however, ongoing storage fees will likely include a VAT fee as the service is still provided in the UK.

These are all things to bear in mind, whether they are relevant today or in 10 years’ time.

Sources:

- 1 LMBA

- 2 World Gold Council

- 3 Kitco

- 4 Royal Mint

- 5 Gov.uk

- 6 PwC

FINANCIAL PROMOTION: The value of investments and the income derived from them may go down as well as up and you may not receive back all the money which you invested. Any information relating to past performance of an investment service is not a guide to future performance and may not be repeated.

This article is for informational purposes only. Ravenscroft does not provide tax advice to its clients and all investors are strongly advised to consult with their tax advisors regarding any potential investment. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future.