Welcome to our third quarter Global Blue Chip Insights commentary, the inaugural edition!

In this update, we will cover the following:

- Performance commentary for Q3 and year-to-date

- Stock in focus – Stellantis

- Deep dive – Has Disney’s castle been breached?

- Stock selection and portfolio construction insights – Explaining optionality

Global Blue Chip Q3 2023 performance commentary by Ben Byrom

Global equities effectively tracked sideways to finish the quarter up 0.7% in GBP terms (Source: FactSet MSCI World (Net Return) in GBP). The benign return masked considerable volatility as investors grappled with rising bond yields amidst deteriorating economic data. From a seasonal perspective, August through to September are traditionally weak periods for equity returns and this year proved no exception to this.

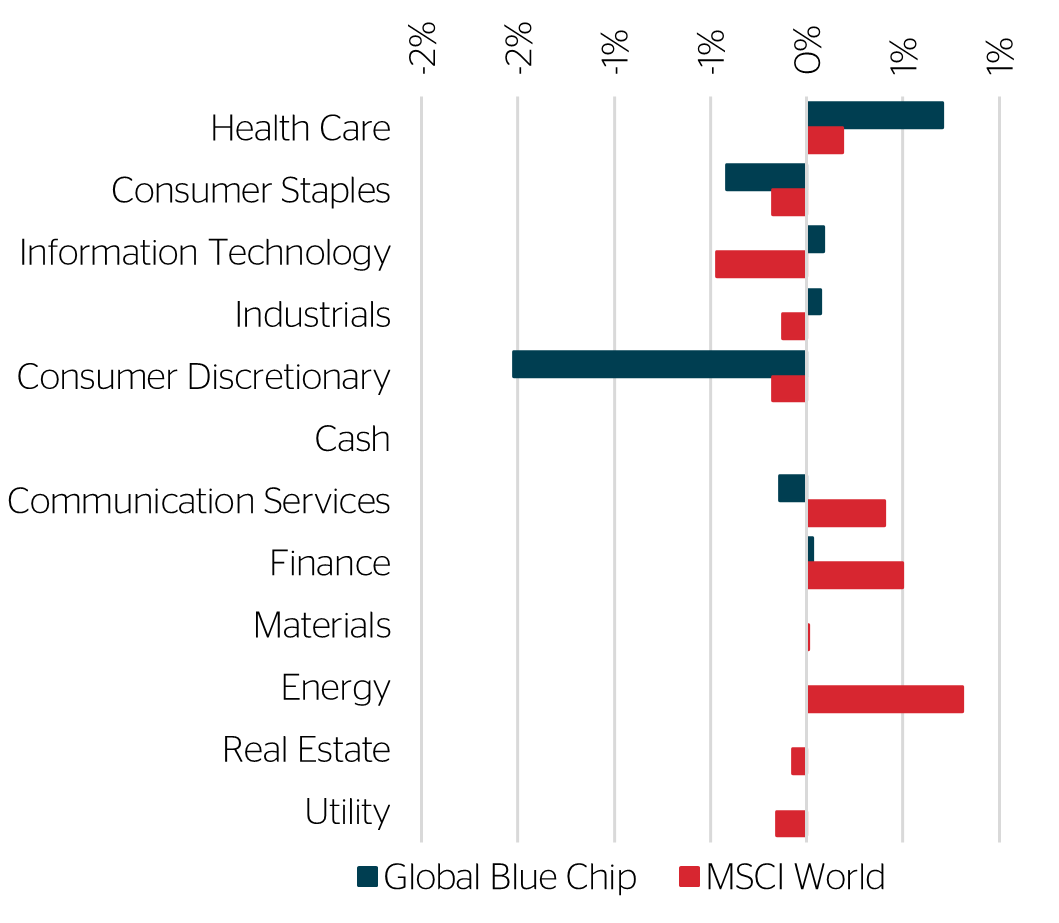

Chart 1. Ravenscroft Global Blue Chip Performance Against MSCI World (Net) for Q3 2023, in GBP

The Global Blue Chip Strategy underperformed the MSCI World during the quarter, falling 1.5%. The biggest detractors were our consumer discretionary stocks, which fell collectively 9% and contributed -1.5% to performance. Our consumer staples positions also had an uncertain quarter, falling 5% collectively, contributing -0.4% to our overall return. Healthcare was our biggest contributor to performance generating a 0.7% return. Small, positive returns in Technology and Industrials amidst negative sector backdrops were largely offset by the collective negative return of our streaming investments. Energy and Financials, areas of the market where we have very little exposure, had a good quarter as oil rose to over $90 a barrel and bond yields continued to rise, despite the deterioration seen in the broader economic data.

Chart 2. Contribution by Sector for Q3 2023 (returns in GBP)

|

Top 5 Contributors (GBP) |

GBP Contribution |

Weight |

GBP TR |

|

|

1 |

Regeneron Pharmaceuticals, Inc. |

0.78% |

4.03% |

19.30% |

|

2 |

GSK plc |

0.43% |

5.04% |

8.44% |

|

3 |

Alphabet Inc. Class C |

0.27% |

1.97% |

13.53% |

|

4 |

Sanofi |

0.22% |

4.94% |

4.46% |

|

5 |

Dropbox, Inc. Class A |

0.20% |

3.19% |

6.35% |

|

Top 5 Detractors (GBP) |

||||

|

1 |

Bayerische Motoren Werke AG Pref |

-0.69% |

4.81% |

-14.34% |

|

2 |

Edwards Lifesciences Corporation |

-0.58% |

2.48% |

-23.50% |

|

3 |

Etsy, Inc. |

-0.58% |

2.84% |

-20.50% |

|

4 |

Oracle Corporation |

-0.35% |

5.01% |

-7.01% |

|

5 |

LVMH Moet Hennessy Louis Vuitton SE |

-0.31% |

1.92% |

-16.09% |

Source: FactSet and Ravenscroft, Compiled 03/10/2023

Our biggest contributor to performance was Regeneron Pharmaceuticals after the FDA approved its higher dose, lower frequency regimen of Eylea, a drug to treat a number of degenerative eye diseases. Despite recent successes, we believe the underlying business’s long-term potential is under-appreciated by investors, which is why it continues to command a high weighting in the portfolio. However, we caution clients that Regeneron’s stock is also very skittish, especially around clinical trial developments and subsequent drug approvals as it continues to build out its portfolio.

Shares in GSK were buoyed by strong early launch data on its RSV vaccine, which was approved back in May. Whether or not this marks a long-overdue change in sentiment, we do not know, but we remain happy with the direction of the business and the value of the shares.

BMW was the strategy’s biggest individual detractor, falling 14% in sterling terms and contributing -0.7%. The stock hit an all-time high at the very start of the quarter following a positive Q2 earnings announcement, where it raised guidance for the year. We suspect the weakness is off the back of prevailing negative sentiment towards the auto sector, particularly the European auto industry, due to competition concerns from cheaper Chinese imports and potential backlash from China over European investigations into uncompetitive practices adopted by Chinese auto companies. The concerns come at a time of deteriorating economic data and back-peddling by a number of European governments on their renewable energy agendas, throwing doubt over the pace of electric vehicle adoption – an important area of growth for many automakers.

Stock in Edwards Lifesciences was weak through much of the back end of the quarter after it announced positive Q2 earnings, which allowed it to post a beat-and-raise on the top and bottom line. We suspect the weakness was due to the company not being able to meet elevated expectations on US Transcatheter Aortic Valve Replacements. Sentiment was subdued further towards the end of the quarter when it was revealed the company was the subject of an EU anti-trust investigation for potentially violating rules designed to “prohibit abuses of a dominant market position”. We suspect the weakness is overdone and instead could offer investors an attractive entry point as the long-term outlook for heart replacement valves looks robust.

In terms of changes to the portfolio, we introduced car manufacturer Stellantis in July, this despite the concerns surrounding the industry. Possibly, it is these very concerns that offered us the opportunity to invest in a car manufacturer with industry-leading margins at a very attractive multiple. We discuss Stellantis further in the Stock in Focus section later in this update.

During August we completed our exit from Amazon. The decision was based on valuation grounds. We acknowledge that, due to Amazon’s reinvestment policy, earnings will be depressed and the stock will look expensive using a traditional price-to-earnings ratio most of the time, however, the amount of money the company expects to funnel into the development of their next ‘big thing’ with no guarantee of success is eye-watering. At the price we exited, the margin of safety that would compensate us for such reinvestment risk had been firmly eroded. It is worth noting that should intrinsic value (by our estimates) materialise in the shares of Amazon once again we would be willing to buy the stock back.

We also sold Illumina, the maker of genome sequencing machines, after a period of uncertainty and underperformance at the company that resulted in a reshuffle of the board and a change of chief executive officer and other high-level executive positions. The ongoing anti-trust trials over its GRAIL acquisition, the involvement of an activist investor, and the emergence of several competitors in a market that was largely seen as Illumina’s monopoly has placed great uncertainty and doubt over its competitive positioning. To continue our holding would require prophetic judgements that lie well beyond our humble abilities.

We replaced Illumina with another life science business called Bruker Corporation. Bruker started life around 1960 in Germany’s Mittelstand, where businesses are renowned for ingenuity and engineering excellence, before moving its headquarters to, and listing in, the US at the turn of the century. Bruker manufactures and supplies scientific instruments and analytical solutions for use across various fields such as life sciences, materials research, and pharmaceuticals, to name a few. The Covid-related revenue growth and associated inventory stocking enjoyed by the life science sector has gone into sharp reversal and valuations have become much more reasonable after a somewhat savage sell-off. Sentiment remains depressed but we are very excited at the new opportunities that face us in this sector.

Year-to-date commentary

On a year-to-date basis, global equities have largely shrugged off a US regional banking crisis, central bank monetary tightening, higher rates regimen and deteriorating economic data.

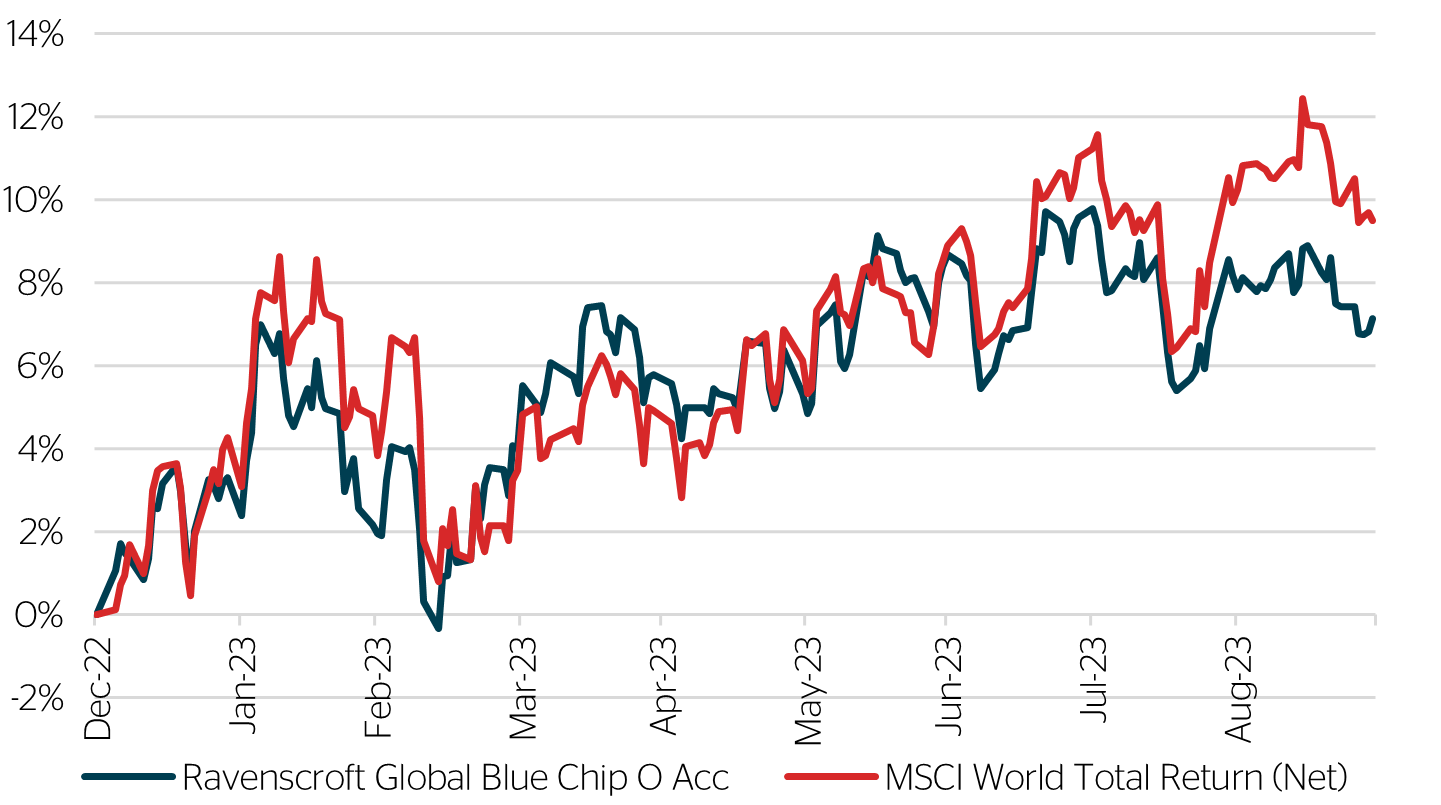

Chart 3. Ravenscroft Global Blue Chip Performance Against MSCI World (Net) for Q3 2023, in GBP

This ‘mini bull market’, however, has been driven by only a handful of technology-related stocks heavily associated with the AI narrative and referred to as the ‘Magnificent Seven’. Being under-exposed to this exclusive cohort has proved problematic for a number of stock pickers.

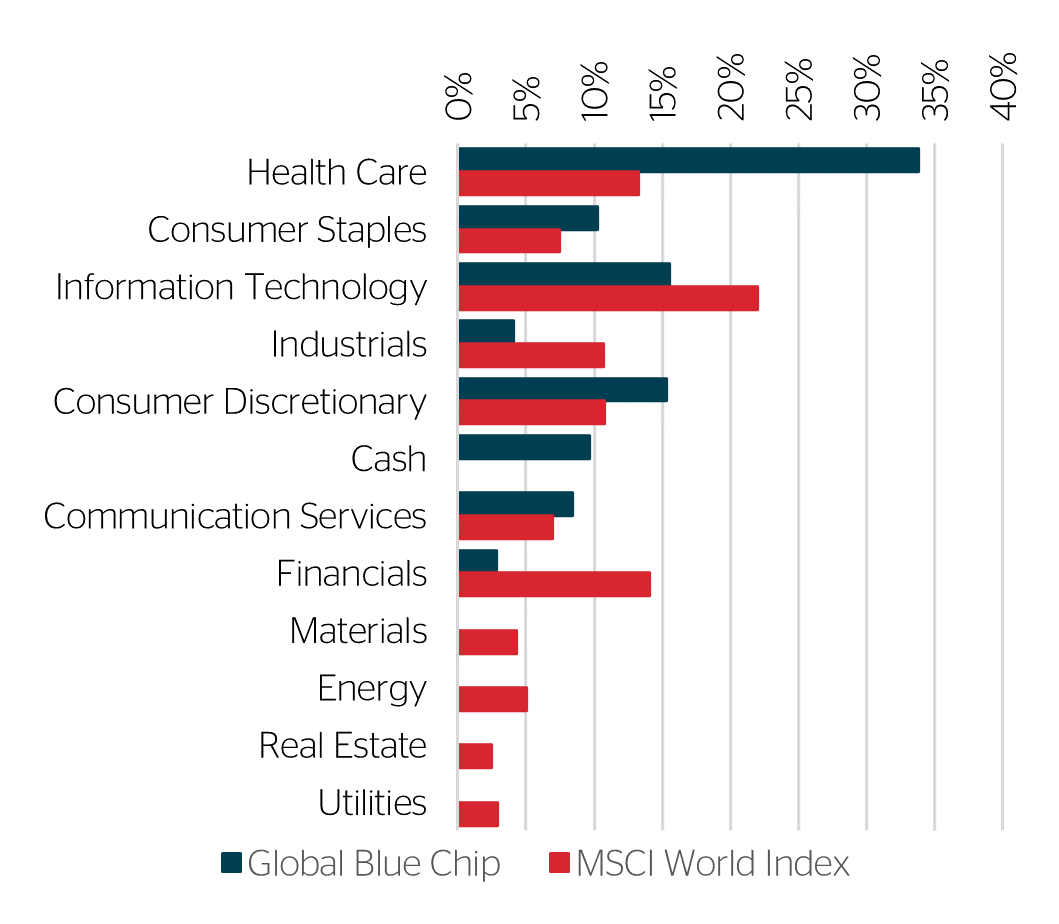

Chart 4. Ravenscroft Global Blue Chip Average Positioning Relative to the MSCI World (Net)

Nonetheless, we are relatively pleased that our defensive positioning, as evidenced above, with our weight to healthcare and consumer staples, hasn’t detracted too much. For most of the year, we traded leadership with the broader market only to cede ground this quarter for the aforementioned reasons.

|

Top 5 Contributors (GBP) |

GBP Contribution |

Weight |

GBP TR |

|

|

1 |

Oracle Corporation |

1.47% |

5.05% |

29.06% |

|

2 |

Alphabet Inc. Class C |

1.19% |

2.57% |

46.45% |

|

3 |

Amazon.com, Inc. |

1.14% |

1.98% |

57.53% |

|

4 |

Microsoft Corporation |

0.94% |

3.08% |

30.60% |

|

5 |

Bayerische Motoren Werke AG Pref |

0.93% |

4.89% |

18.99% |

|

Top 5 Detractors (GBP) |

||||

|

1 |

Etsy, Inc. |

-0.92% |

1.96% |

-46.86% |

|

2 |

Alnylam Pharmaceuticals, Inc |

-0.63% |

2.39% |

-26.56% |

|

3 |

Diageo plc |

-0.43% |

2.90% |

-14.68% |

|

4 |

NIKE, Inc. Class B |

-0.42% |

2.27% |

-18.60% |

|

5 |

Bio-Rad Laboratories, Inc. Class A |

-0.40% |

2.47% |

-15.99% |

Source: FactSet and Ravenscroft, Compiled 03/10/2023

With that said, the technology stocks we do own performed relatively well. We had exposure to three of the Magnificent 7, which has been helpful, although, as mentioned previously, we did let Amazon go on valuation grounds. Oracle, whilst not in the magnificent seven, is now viewed as the fourth hyper-scaler in cloud computing after revealing a series of new AI-related tools. Consumer and life science stocks dominated on the detractors. The market is clearly weighing the impact of a potential recession on stocks such as Etsy and Diageo whilst Nike is heavily discounting excess inventory, temporarily suppressing margins in the process. We view the activity in the latter as a temporary issue and see the weakness as an opportunity to pick some stock up. Life science stocks are currently being shunned by investors as inventory de-stocking hits revenues and causes uncertainty. With valuations at a much more reasonable level, we are beginning to see and pick up attractive risk-reward opportunities.

Five-year performance

|

|

30/09/2022 - 30/09/2023 |

30/09/2021 - 30/09/2022 |

30/09/2020 - 30/09/2021 |

30/09/2019 - 30/09/2020 |

30/09/2018 - 30/09/2019 |

Annualised Since Inception 31/12/11 |

|

Global Blue Chip Portfolio |

12.0% |

-4.5% |

16.9% |

4.8% |

15.5% |

10.9% |

Source: Ravenscroft, compiled 05/10/2023

Stock in focus: Stellantis by Oliver Tostevin

We, in this business, have continued to do the same things for a long period of time without ever having the courage, the audacity to look at a change in paradigm to make things better.

Sergio Marchionne

In 2015, FCA CEO Sergio Marchionne delivered an impassioned presentation entitled Confessions of a Capital Junkie: An insider perspective on the cure for the industry’s value-destroying addiction to capital. The audience was a meeting of sceptical automotive analysts. Marchionne’s message was that for too long the industry had been squandering vast sums without commensurate returns. Moreover, capital requirements were only going to increase due to new regulations and technology-related demands. Without change, the industry would see its demise. Marchionne’s prescription was consolidation: by combining and fully integrating, automotive companies could see vast eliminations in duplicative costs, all while maintaining the necessary investments. But mergers are difficult and carry risk. Moreover, they require strong leadership. Nevertheless, the cost savings were too large to ignore: We need to do something. Something needs to give. It cannot continue like this.

The late Marchionne is, in spirit, the founding father of Stellantis – one of the most recent additions to the Global Blue Chip (“GBC”) portfolio. Stellantis was consummated in January 2021 through the merger of FCA and PSA – bringing together the eighth and ninth largest automotive businesses in the world to create the fourth largest by unit sales, spread across the industry’s single largest brand portfolio (see diagram). The sort of scale Marchionne had in.

The deal has the support of both the Agnelli (FCA) and Peugeot (PSA) families, who remain the largest shareholders and have board representation. Furthermore, the company is led by Carlos Tavares, a rare leader no less capable than Marchionne himself. Indeed, Tavares was the only industry leader to take Marchionne to heart – as CEO of PSA Tavares orchestrated the 2017 acquisition of the Opel and Vauxhall brands.

The results of the FCA-PSA merger are sensational. When the deal was announced in late 2019, they foresaw €3.7bn of annual synergies, 80% of which were to be achieved by the fourth year; in reality they achieved €7bn within two years.

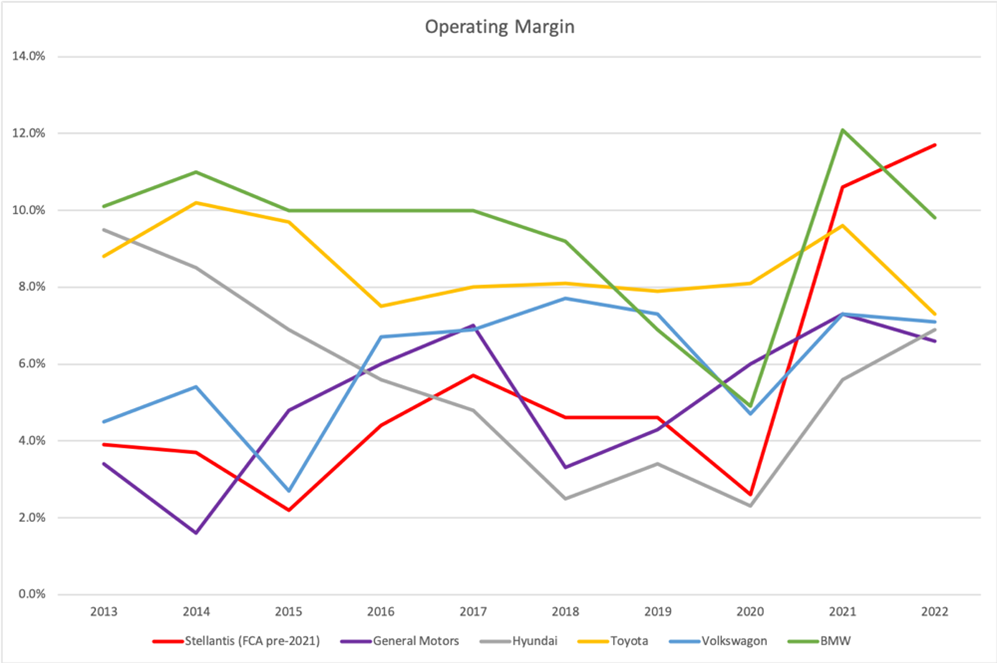

You can see these results in the operating margin, presented here. Of all its mass-market peers, Stellantis is now comfortably the most profitable. We include BMW, another GBC holding, for context – Stellantis now makes the sort of margin that used to be the preserve of premium producers. Stellantis’ peers haven’t tried to do the same, but as Marchionne said, it’s difficult, risky and requires leadership. Moreover, the door to future mergers may now be shut given shifts in regulatory winds.

Despite Stellantis’ exceptional situation, the shares trade on a P/E ratio of around 3x – and this does not account for the fact that more than 40% of its market capitalisation is represented by net cash alone. While it’s true that most Stellantis peers also trade at depressed levels, Stellantis’ discount is steeper – given its qualities and ambitions, we believe it should carry a premium.

So, why the doom and gloom? It’s common for automotive valuations to appear low before a recession as the market anticipates peak earnings before a dive. But even still, a 3x P/E seems low – for context, BMW’s was more than 6x on the eve of the great financial crisis, a particularly severe automotive recession. As investment managers, we don’t predict recessions, merely prepare for them instead – Stellantis has a breakeven point of 40%, meaning a 60% drop in net revenue would still result in a profit. This is the best breakeven in the industry, and along with a fortress balance sheet, we remain confident.

Something else is going on. Two words: Tesla and China. Markets are worried that legacy automotives are being disrupted by electric vehicle upstarts, and in particular that European producers cannot compete against cheap imported Chinese EVs. And, presumably, amidst all of this, Stellantis is bound to lose its superior margins. Our view is that the market does not fully understand and appreciate Stellantis’ model and its unique strengths. Not only do we believe Stellantis will avoid disruption, it stands to thrive in this brave new world.

Stellantis has by far the best brand portfolio, with strong positions in all regional markets, providing opportunity for revenue diversification as well as the ability to tailor brands as needed. One should never underestimate the importance of brand as a fundamental underpinning of the consumer decision – and Stellantis understands this well, applying it across all design elements. A good case in point is the redesign and repositioning of the Peugeot brand. Peugeot cars used to look very ordinary but newer models are quite striking, and you’ll find this type of thinking has spread company-wide - highly important in a world where other brands seem to be converging on styling.

Stellantis is moving all of its brands onto just four dedicated fully electric platforms, each with the capacity to produce two million vehicles a year. Not only will this bring scale economies, but best-in-class performance too. The first of these platforms goes live imminently with the launch of the Peugeot e-3008.

Concerning cheap Chinese imports, in so far as there is a risk, it comes down to price competition in Europe where trade barriers are low. First of all, the Chinese are an extremely long way from being able to compete with Stellantis on brand power and we believe consumers will continue to be prepared to pay higher prices for established brands they know and trust – especially on big-ticket and often ‘emotional’ or ‘identity’ driven purchases. Second, the lower end of the market is the most price-sensitive and Stellantis understands the importance of keeping manufacturing costs low here by producing these vehicles in low-cost jurisdictions such as Slovakia. Most recently, the EU has launched an anti-subsidy investigation into Chinese imports to determine whether they benefit from illegal subsidies. While one result could be much higher tariffs, the success of our investment does not hinge on this.

Stellantis has a bold plan to generate more than €20 billion in annual free cash flow by 2030, which would represent a mid- to high-single-digit compound annual growth rate. They also intend to maintain double-digit operating margins. While we think management has proven to be generally credible in their claims, at current prices we believe we are likely to make a good return even with no growth at all.

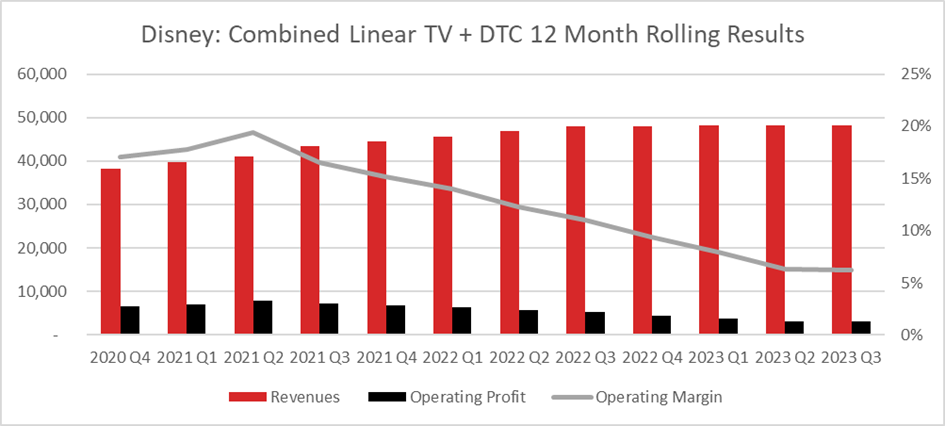

Deep dive - Has Disney’s castle been breached? by Samuel Corbet

Being a Disney shareholder has been a wild ride over the past few years. The volatility stems from the significant challenges the business faces as it transitions away from a linear TV distribution model to a fully-fledged direct-to-consumer (“DTC”) one. A recent hiatus with one of America’s largest cable providers highlighted how delicate the situation is between Disney and its TV network partners and how fractious paving the new way may prove. With any disruption, there are positives and negatives and in this deep dive we aim to explain these and what it means for us as shareholders.

Historically, cable companies competed with each other by offering consumers access to the largest cache of content. The importance of the “bundle” in selling their cable package and retaining subscribers enabled content providers such as Disney to demand ever-increasing affiliate fees from their partners who had little choice but to grin and bear it or risk their own customers defecting to another provider. This proved to be a lucrative model for Disney, who were only too happy to capture an increasingly greater portion of the value created at the expense of the cable companies’ margins. Unfortunately, you can only have so much of a good thing and Disney’s greed ultimately made the economics of cable TV unattractive for cable companies who turned their attention to other, more profitable, businesses – reducing the power Disney held over them in the process. Consequently, Disney is quickly learning that cable companies these days, they just don’t get scared like they used to.

This all came to a head this quarter when Charter Communications, which, under its Spectrum Brand, operates the second largest US cable network (with over 14 million pay-TV subscribers) refused to bow to Disney’s latest price hikes - prompting Disney to (temporarily) remove its channels from Charter’s service whilst negotiations resumed. After a week of stalemate, Disney proved that some people are worth melting for and announced a “transformative agreement” with Charter for the distribution of its linear TV and DTC services. The major change is that Charter subscribers will now be granted access to the ad-supported tier of Disney+ (Disney’s DTC platform) as part of their cable subscription and they will also be granted the same privilege when Disney launches the hotly anticipated dedicated ESPN service.

Whilst Disney’s willingness to yield is a clear indication of a disturbance in the force, the agreement is not as one-sided as the common narrative would have you believe. If anything, until now, Disney has been playing an underhanded game – increasing the fees it charges its cable partners for access to its linear TV channels whilst simultaneously removing content and placing this behind a paywall for the consumption of its paying Disney+ subscribers only. One can make a fairly compelling argument that cable TV subscribers should have had access to Disney+ all along and that the recent action is merely levelling the playing field (or as Yoda would put it “balance, they have sought”).

Given the ultimate direction of travel, there are clear benefits to Disney in allowing its cable partners to promote its DTC platforms to their subscribers. Initially, Disney will gain immediate access to millions of new subscribers, allowing it to deepen its engagement with them. Anytime there is a platform shift there is a need to re-educate the consumer in how they should now be viewing your content. By allowing Charter subscribers to use its DTC offerings, Disney is sharing some of the marketing and education burden with its cable partners. This provides time for customers to familiarise themselves with the Disney+ platform and for all parties to work towards an orderly migration ahead of the inevitable decision to call time on the provision of cable services.

On top of this, one shouldn’t underestimate the importance of bundling when it comes to reducing subscriber attrition rates (more commonly referred to as “churn”). The beauty of Disney+ is that it is accessible to anyone with an internet connection and a credit card – no lock-in periods or arduous setup required. However, whilst the ease of adoption is an attractive attribute for gaining subscribers, the easy-to-use, consumer-centric, nature of the platform makes the Disney+ platform more susceptible to churn as consumers periodically pick and choose when they want to access (and pay) for Disney’s content. Whilst it’s likely these customers will ultimately subscribe again in the future (when a new show or season piques their interest), consumers are less likely to cancel at all if it is included as part of their cable subscription bundle and they perceive they are getting access for free. This helps Disney smooth and maximise the revenues it receives.

Of course, the Holy Grail for reducing churn is creating a product (or service) customers love to such an extent that they are willing to part with their hard-earned funds without having to resort to the psychological trickery bundling makes use of. Part of the reason Disney’s linear TV business has been so profitable for the company is that bundling encourages subscriptions (and the associated fees) from consumers who wouldn’t otherwise be willing to pay for access to the same services independently – in the eyes of the consumer, the sum is very much worth more than the parts. By extending the appeal, the broader subscriber base essentially subsidises the consumption habits of the most devout. The market remains sceptical that Disney will be able to monetise its content as effectively under the new DTC model. We do not share this pessimism and suspect this could be a case of if you focus on what you left behind you will never see what lies ahead.

The key issue comes back to the value stick framework we introduced during the last quarterly as part of our discussion on Airbnb. For too long Disney has focused on capturing value when the company would be better served by creating value. Disney needs to pivot and reprioritise its efforts in pursuing initiatives that increase the consumers’ willingness to pay. With partnerships like the Penn Entertainment deal announced this quarter, we think we are beginning to see green shoots in this regard and see little reason why Disney can’t, ultimately, command a higher share of their consumers’ wallets once it has demonstrated the ability to increase the value it offers.

To infinity and beyond?

So, what does this mean for our investment in Disney? The reality we are faced with is that Disney’s Media and Entertainment Distribution division (“DMED”) is undergoing a period of significant change and questions remain over where profitability will ultimately settle, which makes valuing this portion of the business trickier.

On the other hand, Disney’s Parks, Experiences and Products division, (“DPEP”), continues to perform well. Focusing on this segment in isolation, and assuming that Disney will be able to grow revenues in alignment with long-term inflation targets (but no further), the price we ascribe to this portion of the business accounts for 96% of today’s share price. Essentially, the market is ascribing no value to Disney’s media assets which doesn’t seem reasonable to us, despite the uncertainty surrounding the new distribution model.

Such differences in opinion are often the source of our most compelling investment opportunities. Undoubtedly, Disney’s management has made mistakes, but the extent to which the company’s shares are being punished seems incommensurate with the ‘crimes’ committed. Ultimately, the allure of Disney’s brands and characters has value irrespective of the success of its streaming efforts. Whilst we firmly believe the DTC strategy is the right approach for long-term consumer engagement, it would be remiss not to mention that Disney reserves the option to pivot should a more fruitful model materialise – given the price of shares we believe no value is being attributed to the alternative options Disney has to increase its cash flows.

At the current price, we believe the risk/reward proposition to be attractive. Shares would appear to be underpinned by its DPEP division with no value being ascribed to the existing catalogue of content produced (or any future releases) no matter the monetisation model that prevails. We therefore feel we are getting the optionality inherent within a successful transformation of its DMED division – with all the benefits that an engaged customer will bring to the broader Disney flywheel – for free.

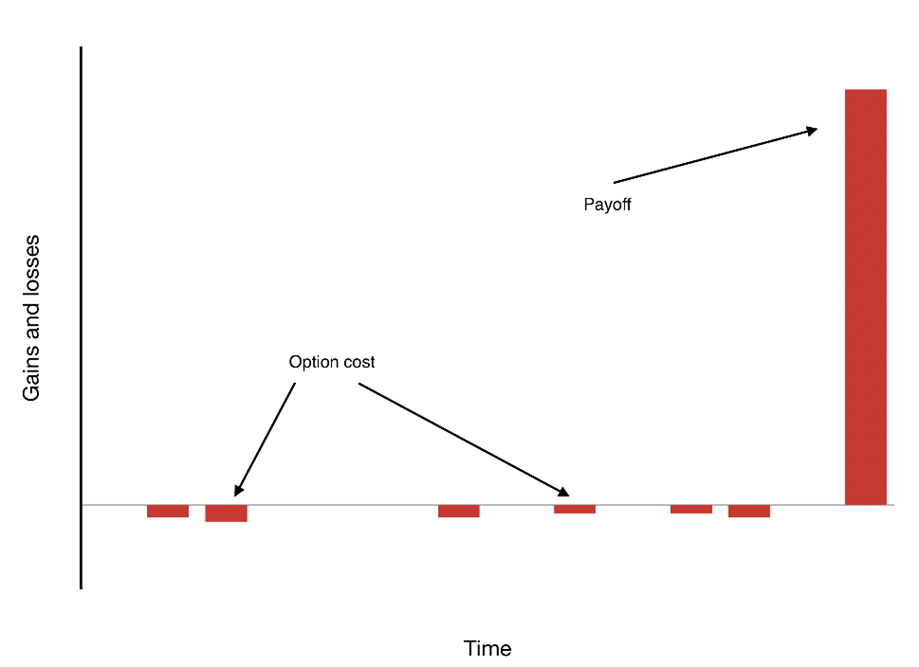

Stock selection and portfolio construction insights – Explaining optionality by Oliver Tostevin

Optionality – The upper half of luck

“Optionality is about getting the upper half of luck.”

“The edge from optionality is in the larger payoff when you are right, which makes it unnecessary to be right too often.”

Nassim Taleb, Antifragile: Things That Gain from Disorder

At Global Blue Chip, one concept we employ in our stock selection and position sizing is “optionality”. While it comes up routinely as a topic of internal discussion, it occurred to us that we rarely discuss it with you, so this note seeks to put that right.

You may have heard of financial “options” – generally the right, but not the obligation, to enter into some specified transaction in the future. We’re not talking about these. As Nassim Taleb notes in his iconic book Antifragile, explicit options are often expensive to buy; but due to the siloed way in which people contemplate the world, they tend not to recognise options when they occur in other domains – where they frequently remain cheap, or indeed, free.

“To have options” should be clear in its everyday meaning – and that’s what we’re getting at here. If someone has options, they have “optionality”. And with optionality, comes the eventual prospect of an outsized payoff – so long as you don’t overpay for the options in the first place. Accordingly, we love businesses with “cheap optionality” and such businesses tend to get a higher portfolio weight. There are a number of case studies within GBC that we could use to demonstrate optionality, two of which are Oracle and Regeneron.

When we initiated our investment in Oracle around four years ago, our thesis was that the company would succeed in transitioning the majority of legacy on-premise software customers to the cloud, and achieve a significant revenue uplift. We thought this would roughly double revenue over 10 years – an aggressive non-consensus position at the time. Barely featuring in our analysis, but present in our minds, was the prospect of Oracle emerging as a “hyperscaler” in cloud infrastructure with massive revenue opportunities, among the likes of Amazon and Microsoft. We considered this optionality – great if it happens, but we’re not relying on it or paying anything for it. 2023 newsflash: it’s happening. We’ve had to materially increase our forecast growth rate and will probably need to again. What we did not envisage, however, was the prospect of Oracle becoming a major player in healthcare IT, but this became a possibility with the acquisition of Cerner in 2022. Cerner is a top two player in electronic healthcare records – it’s an excellent business with high barriers to entry but with moderating growth. If nothing else happens, we think Oracle paid a fair price and we’re no better or worse off. But Oracle’s vision is to disrupt the entire space with AI and deep data integration, from clinical trials through to primary care. The ambition is better healthcare at a lower cost, with Cerner a central piece of the strategy. While we cannot be certain whether they will achieve their vision, if they do it could become a gigantic revenue stream. Great companies pick up cheap options along the way.

Regeneron Pharmaceuticals is a business positively steeped in optionality. Back in early 2018, when we started studying the company, analysts forecasted peak Dupixent sales of $3-4 billion. It is now clear that Dupixent is a rare wonder drug that is disrupting the treatment of allergic disease – and this is indeed what management was saying five years ago. We didn’t (and still don’t) know how big this drug could be – $3-4 billion just felt too low and given the lack of enthusiasm in the share price we saw it as a cheap option. In 2023 Dupixent is likely to achieve revenue of more than $11 billion and it’s still growing more than 30% a year. Peak sales are now forecast to be around $20 billion – perhaps not high enough. One of the reasons for Regeneron’s success is that they have the best technology in the industry for discovering antibodies, backed by an entrenched culture of science and innovation – an optionality generator if you like. This became apparent early in the Covid pandemic when they rapidly produced a combination of antibodies that could neutralise the virus – in doing so they saved thousands of lives and generated more than $7 billion in revenue at very healthy profit margins. A further example is the Regeneron Genetics Center (“RGC”), set up 10 years ago to make medical breakthroughs through industrial-scale genome sequencing. They have the largest database in the world of genomes linked to healthcare records. So far, RGC has discovered 30 novel drug targets, and counting – the odds that Regeneron will hit pay dirt with some of these “options” are very high.

In essence, what we mean by an “option” is the prospect of a very large payoff; and to have “optionality” is when you can acquire such options at a low cost – so there are really two elements to it, often arising in different ways. For example, we might see “cheap optionality” when we initially buy a share such as Oracle or Regeneron – the possibility of very positive outcomes but without incremental risk. Other times, additional optionality can arise along the way due to developments within the business. Sometimes those developments relate to actions taken by the company in the past, and sometimes to actions yet to be taken. Such actions could originate at the top with management, or from the bottom up (say, with a researcher in the company’s laboratories). Well-run companies with constructive cultures tend to generate optionality and they’re worth hanging onto.

We see optionality as an important tool in our kit – the more, the better. As we’ve already mentioned, in order for the tool to be truly effective, it’s essential not to overpay for it or to rely on any spurious assumptions about it in one’s financial forecasts. If we do this well, then there’s potentially significant additional upside for new investments and continuing upside for existing ones. For this reason, most of our holdings carry some optionality in one way or another.