“Bills rise higher every day

We receive much lower pay

I’d rather stay young, go out and play

It’s like that, and that’s the way it is!”

Run-D.M.C, 1984

Please click here to view/download the PDF version of this update.

Despite Liz Truss’ disastrous mini-budget at the end of 2022, most investors entered 2023 with a fairly positive mindset.

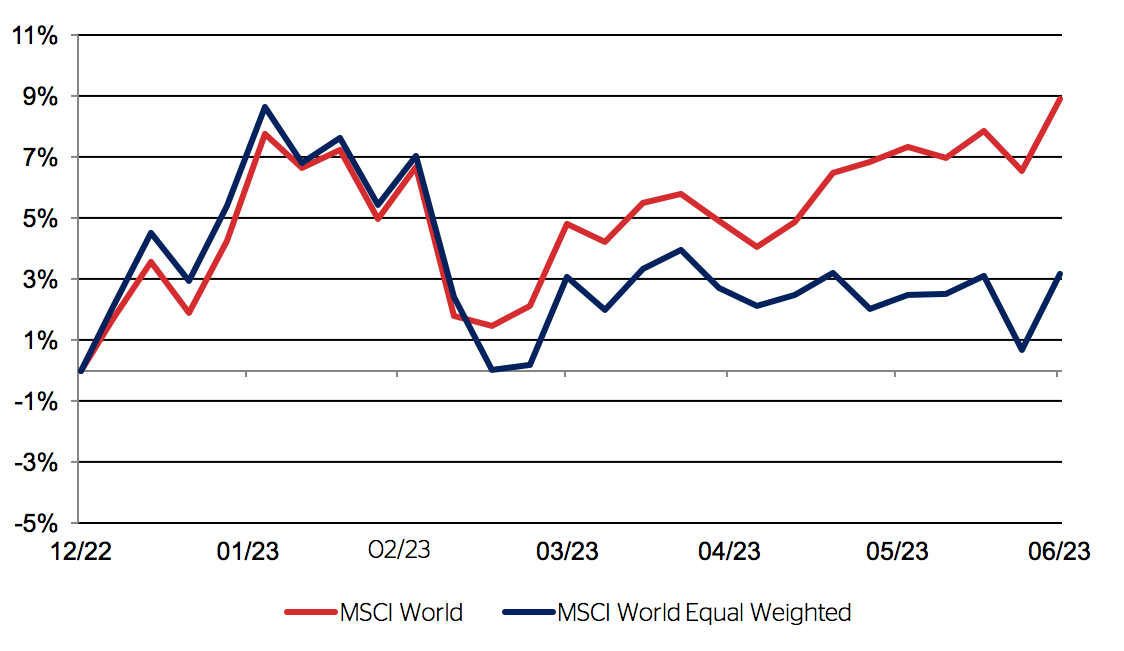

There was a general sense that inflation (globally) was beginning to peak and that, at some point, the Fed would pivot on interest rates and we would then be back to what many perceive as business as usual: lower and/or falling interest rates and inflation, leading to the market rallying strongly. And so it was for a few weeks, as markets rose strongly across the board. The MSCI World (GBP) rose some 8.6% (1) in the first 5 weeks of the year.

Note: The MSCI World Index is made up of approximately 3,000 companies. Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta and Tesla account for 18% of it.

Although the broader market began to stall at this point (confidence diminished in the wake of a run-on banks, triggered by Silicon Valley Bank), US indices continued to move higher. This was largely driven by a thinner segment of the market – essentially, AI stocks or those associated with AI, such as MSFT (Microsoft). At the point of writing, MSFT is up some 42% year-to-date (2).

I mention this because, in many respects, markets have had a bit of a false start. Inflation is still strong – particularly in the UK – interest rates also remain high and, just recently, Federal Reserve Chair, Jerome Powell, indicated that US interest rates could move higher again.

From the start of the year sentiment seems to have shifted – consensus now leaning towards higher and stickier-than-expected inflation, which is mirrored in interest rates. Whilst we don’t know the exact direction of travel, we do know that neither the Bank of England nor the Federal Reserve knows any better. In fact, neither central bank boasts any sort of track record when it comes to forecasting inflation. Indeed, quite the opposite!

Thus our inclination is one of pragmatism: we remain cognisant that “bills rise higher every day – it’s like that and that’s the way it is”, but that things can also change quickly. To navigate this environment, we have chosen to invest with a foot in both camps. Essentially, portfolios will have a foot exposed to value-orientated investments and higher-yielding corporate bonds whilst also having the other foot firmly planted in the growth camp with exposure to themes such as healthcare, technology and AI.

Whilst current popular belief seems to reside in the higher-for-longer inflation camp, what if that doesn’t happen? What if inflation falls faster than expectations? Arguably, we have seen the future – or at least the roadmap for such an environment – in the first six weeks of this year.

As interest rates, particularly in sterling, have continued to rise, so has the attractiveness of cash. As things stand, many retail banks will now offer approximately 5% (annualised) for a 6-month fixed deposit. It is therefore unsurprising that investors are asking themselves, given the volatile backdrop of today’s markets, whether they should simply hold cash rather than invest. It’s a perfectly sensible question! And, yes, as you would expect, we have a cash team as part of our discretionary investment service. There isn’t a one-size-fits-all answer to this, since it really depends on an individual’s circumstances, risk profile and – most importantly – time horizon. In very simple terms, and taking history as a guide, equities and bonds typically outperform cash over a period of 3-5 years and beyond. However, with that outperformance comes the trade-off of additional volatility. Put simply, if investors have shorter-term liabilities, then cash – or cash-like assets – may well be most suitable. For longer time horizons, we advocate investing into equities and bonds via what we consider irrefutable investment themes. Themes that we believe could outperform the broader market for many years to come ……. “it’s like that and that’s the way it is”!

Cautious Portfolios

Lower Risk

by Robert (Bob) Tannahill

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue-chip equities with strong cashflows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split and the maximum equity-weighting of approximately 35%. The cash generated can be re-invested to provide capital or taken as an income stream.

Over the quarter the cautious/income strategy returned -0.4% (3) including both income received and capital gains/losses. While negative, this represented an outperformance of the average manager in the sector who returned -1.0% over the period (4).

Outlook – Time and Value is on Our Side

Say we bought a bond today issued by a solid company that matures in five years’ time. Given market prices as we write, this bond could well have an interest rate of 4% but be priced at £90 for each £100 bond you bought. In jargon, you would say that this gave the bond a 6% yield to maturity once you combine the income and the expected capital gain. With this in mind, we can ask two questions: first, what will my return be at the end of the current year; and, second, what will it be at the end of the bond’s life in five years’ time? Over the next six months our return is uncertain. We will receive half a years’ interest of £2 but the market price of the bond could easily rise or fall by £4 over that time meaning a profit or a loss is possible over this period – albeit a profit is more likely thanks to the interest payment received. Over the five-year life of the bond, however, that uncertainty falls away. Absent of any issue with the company, we will receive £20 in interest and make a £10 capital gain as the bond matures with a face value of £100. This return of £30 on £90 invested gives a healthy profit of 33.3%, before costs, with a low level of uncertainty. This looks very attractive!

This combination of short-term uncertainty shifting to much more certainty in the medium term is the same situation we have in the overall cautious/income portfolio today. It is hard to say what the return over the next six months will be since there are so many short-term factors that could cause markets to rise or fall over that time. On the other hand, given the prices of our assets today we have a much higher degree of confidence that when we are looking back on the next few years, we should be doing so with a healthy return in our pockets.

Underlying Investments – A Mixed Bag

Most of our equity funds, high-yield bond funds and near-cash assets performed as expected, with positive returns between +0.6% (5) (Muzinich) and +2.5% (6) (Fidelity). On the positive side, we had a solid return from new addition GAM Star Cat Bond which posted +3.5% (7) over the quarter, in line with its income yield. We also had a nice surprise from Sanlam Hybrid Capital Bond which, after being out of favour with markets for most of last year, posted a solid +2.6% (8) in the second quarter. The weaker area was sterling bonds (where worrying UK inflation data caused them to drop in price as markets started to assume that the Bank of England will have to go further in order to bring inflation back under control). The TwentyFour Corporate Bond Fund returned -2.8% (9) over the period. Another new entrant, Lazard Thematic Inflation Opportunities Fund, had a tough period (-1.2%) (10) due to a holding in First Republic Bank, which became a victim of the US banking issues. We met with the manager of the Fund over the period and, while the situation is clearly undesirable, we are comfortable that the manager was unlucky – as opposed to having made an error of judgement that would cause us longer-term concerns over the Fund. The key detractors were the two defensive positions in the portfolio: Ruffer Total Return Fund and Allianz Strategic Bond Fund. Our aim for these positions is that they rise in value during the toughest times and aren’t an excessive drag when markets are rising. Since we began building these positions in September last year, they have largely performed. However, the May/June market environment was very tough: multiple positions have gone against them in the range-bound markets over the quarter. We have spoken to both teams and, while we have no immediate concerns with how they are managing the funds, we will keep both under review.

Portfolio Changes – Themes

Changes over the quarter followed two themes. First, we continued to shift our bond allocations towards funds with more flexible mandates. This saw the introduction of Candriam’s Global High Yield Fund and Jupiter’s Dynamic Bond Fund. Second, we moved to take advantage of the higher interest-rate environment by trimming some of our volatile assets (equities) in favour of near-cash assets (iShares £ Ultrashort Bond ETF) – a competitive return of over 5% at current interest rates but with much lower volatility.

Balanced Portfolios:

Medium Risk

by David Le Cornu

Objective: The Balanced portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

When I was a young man (many years ago) I often spent my weekend on a boat fishing off the coast of Jersey.

When fishing, if visibility was poor, we wouldn’t venture far from shore. When currents were unfavourable, we might adjust speed, but we persevered knowing the discomfort would be temporary and the journey, ultimately, worthwhile.

In investment markets, today, visibility is poor and we are suffering cross currents: inflation remains stubbornly high, leading to some central bankers (Bank of England, in particular) becoming more aggressive. This spurred on by better-than-expected economic performance and tight labour markets. Lagging indicators tell us that the global economy has performed better than expected, whereas a number of leading indicators are flashing warning signals that economic performance could deteriorate from here.

In this foggy investment environment, over Q2, the Balanced strategy returned -0.5% (11) which compares to a return of -0.4% (12) from the IA 20-60 index.

My inner skipper is telling me to keep the good ship HMS Balanced close to shore. By this I mean it’s not the right time meaningfully to increase portfolio sensitivity to falling interest rates/inflation or the prospect of improving or deteriorating economic performance.

Whilst I am confident that interest rates and inflation will ultimately fall and help to unlock embedded value in our bond holdings, it is presently impossible to be highly confident about when exactly this will happen. We hold a mixture of cash, short-dated credit, longer-dated sovereign debt and some tactical bond funds, each of which we expect to perform strongly when a more positive inflation and interest-rate environment prevails. The value will be received in two waves that may or may not arrive concurrently. Wave 1: our bond holdings are now paying attractive rates of interest – typically in excess of 5% per annum. Unlike the beginning of 2022, investors are now being paid to wait. Wave 2: as inflation and interest-rate expectations soften, the capital value of bond holdings will appreciate – thereby delivering capital gains in this part of the portfolio.

The poor visibility and choppy waters we have been sailing in has limited changes to the fixed-interest content over the quarter to: (1) introducing cash (ultrashort Bond ETF effective duration of 0.26 years and a weighted average yield to maturity of 5.13% (13)); (2) returning Schroder Strategic Credit fund back to a 5% weight (effective duration 2.5 years and yield to maturity of 9.2%) (14); plus (3), waving au revoir to Vontobel Global Corporate Bond fund and greeting Jupiter Dynamic Bond fund. The latter was a switch to a tactical bond fund manager with a more flexible mandate who should be better able to navigate and take advantage of challenging market environments.

There have been no changes within the equity content this quarter, but there has been a lot of hard work and healthy debate amongst the team – work is ongoing, but early conclusions are that we should stick to our knitting since allocating equity, globally and thematically, as we feel it has clearly added value over the long term.

Another similarity between fishing and investment is that sometimes it delivers instant gratification and sometimes not, thus requiring patience. Fishing for mackerel is easy, while sea bass are elusive. On many occasions I was very close to giving up; but, instead, persevered and was handsomely rewarded.

The mackerel of today’s investment markets appear to be the large technology businesses – especially where there is an AI link. Much has been written about the lack of market breadth where two technology businesses now account for 25% of the Nasdaq and seven technology businesses account for 50% of the Nasdaq. We have exposure to both Microsoft and Nvidia who feature amongst the Magnificent Seven. They are at the sweet spot and delivered instant gratification, rising 19% (15) and 51% over the quarter (16). We invested in diversified AI exposure at the beginning of the year, through Sanlam AI, and are being handsomely rewarded. I remain convinced that over the next 5 to 10 years this theme will deliver the strongest returns from amongst our thematic investments, leaving me inclined to look for opportunities to add to the position.

On the other hand, the sea bass of today’s investment markets are bonds. We know there is significant money to be made. But whilst central banks are aggressive, inflation is sticky and the short-term direction of interest rates seems more likely up than down, capturing the return will not be easy. Like a good fisherman, I understand that patience will ultimately be rewarded.

Growth Portfolios:

Higher Risk

by Samantha Dovey

Objective: The Growth portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

Many will know that we have been talking about the changing investment environment and that the coming decade will more than likely be very different to the last – at least those years from 2008 to the beginning of 2020. Ultimately, new financial cycles typically look different to the last.

The Global Financial Crisis of 2008 prompted developed-market central banks to maintain exceptionally easy monetary policies (low interest rates and lots of money in the system) causing material appreciation in asset prices. Investors were willing to pay up for growth in equities, while revising down discount rates (bond yields) due to declining inflation expectations. This pushed equity multiples higher and bond yields lower over the decade, creating a perfect environment for the rise of passive ‘buy and hold’ investing.

All has been turned upside down: heightened inflation, monetary tightening, rising geopolitical concerns and deglobalisation demand reworking supply chains – which comes at a cost. This is a very different backdrop to that of 2008/09 and requires a slightly different portfolio, hence the changes of late.

We have implemented two changes this quarter: the first was a 3% investment into Pacific North of South Emerging Income Opportunities. Our Growth strategy currently has 12% allocated to emerging markets spread over three funds: one focused on Asia, another on Frontier Markets and, finally, one with a growth tilt in the broader emerging markets. The introduction of this Fund gives the portfolio a different dynamic in terms of exposure since it is more “value” centric, ensuring that we have a good blend of companies able to navigate the different investment opportunities that these volatile markets present.

The investment objective of Pacific North of South is to provide investors with a dividend yield that exceeds inflation – a real-yield. This is achieved by investing in a relatively concentrated portfolio of 50-60 emerging market stocks that are attractively valued and able to compound returns on a sustainable basis. This objective is part of the broader theme we have seen across our strategies of “bringing the cash flows forward”; essentially receiving an ongoing return as opposed to waiting for growth.

The Pacific investment team has built its approach around three major investment principles:

- Value investing outperforms other styles over time: by buying equities whose income streams are priced below those of the market and their peers, we expect to receive more income over time.

- Value needs to be assessed relative to the riskiness of the stock: establishing the equity risk premium is essential in this process.

- Both value and dividends need to be seen in the context of domestic risk-free rate: equities need be attractive relative to their domestic fixed income markets in order to perform over the long term.

In the middle of the quarter we said hello to an old friend in the form of Schroder Strategic Credit.

As the Fund continued to be held across both the Income and Balanced strategies, we were in consistent correspondence with fund manager, Peter Harvey. During our latest meeting in May, we spoke to him regarding the investment opportunities he is seeing in the short-dated high-yield investment-grade space. In his words they are excellent. And whilst fund managers often talk up their own book, the metrics don’t lie.

The Fund is currently running with a yield-to-maturity of 9.2% and effective duration of 2.5 years (17). In March 2022, when we sold the holding, these metrics were a yield to maturity of 5.9% with an effective duration of 2.8 years (18). Now we are getting more bang for our buck allied to an attractive risk/return.

As we continue to transition from one financial cycle to the next, we think it’s important to think about the changing world – and how to structure portfolios for what’s to come – as opposed to looking in the rear-view mirror. This is why you have seen changes in the portfolio and why there will be a few more to come. You will see a renewed focus on our long-term irrefutable themes as an integral part of these changes.

Global Blue Chip Portfolios:

Higher Risk

by Ben Byrom

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

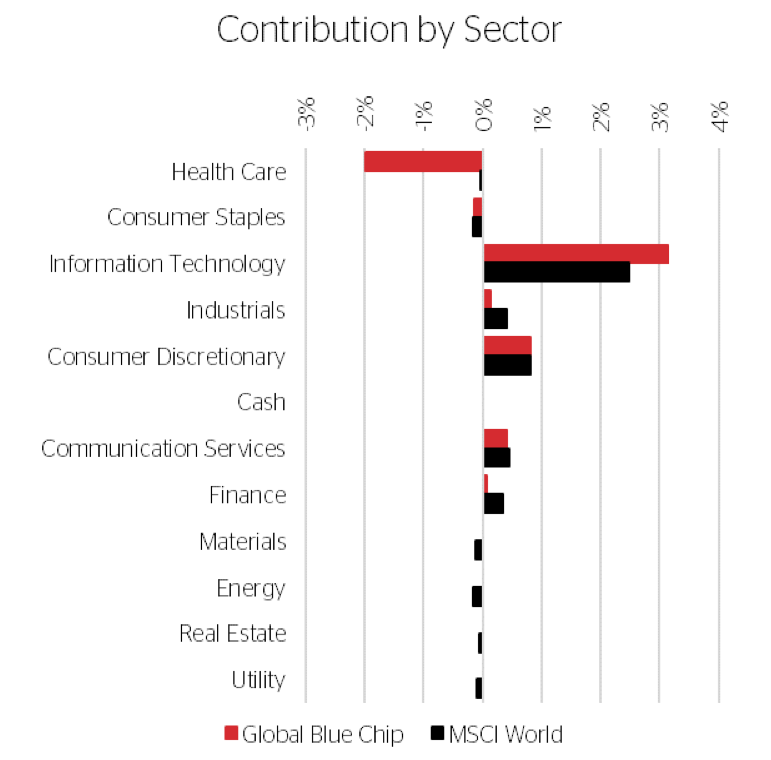

Equity markets continued their rally through much of the second quarter with the MSCI World recording gains of just over 3.9% (19) in GBP terms even with a sterling/dollar headwind of some 2.8% (when adjusted for the exposure in US-denominated investments) (20). The Global Blue Chip Strategy returned 3% (21). The main contributor to the underperformance was our overweight to healthcare where a number of underlying holdings had a somewhat disappointing quarter.

Performance Breakdown

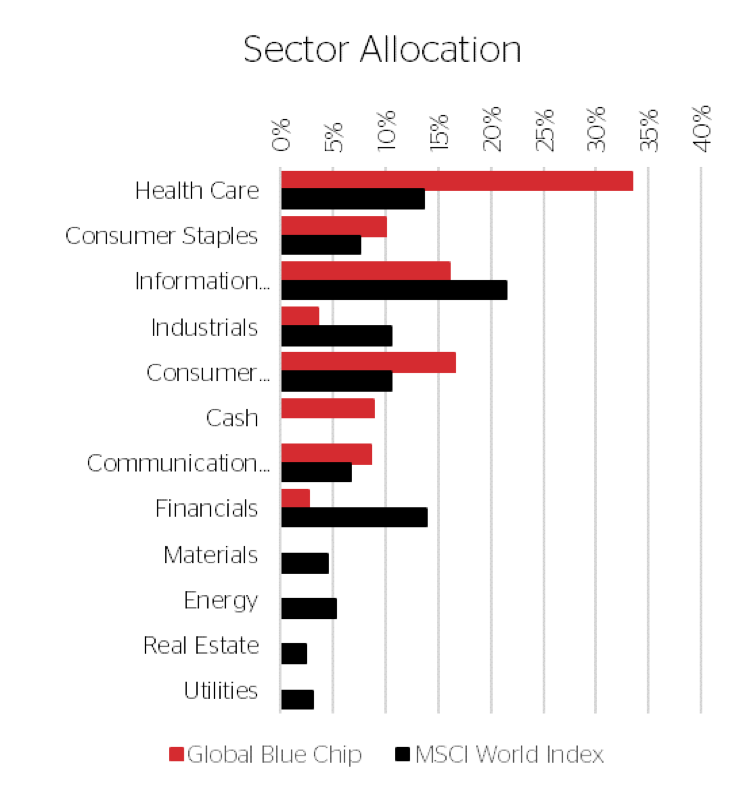

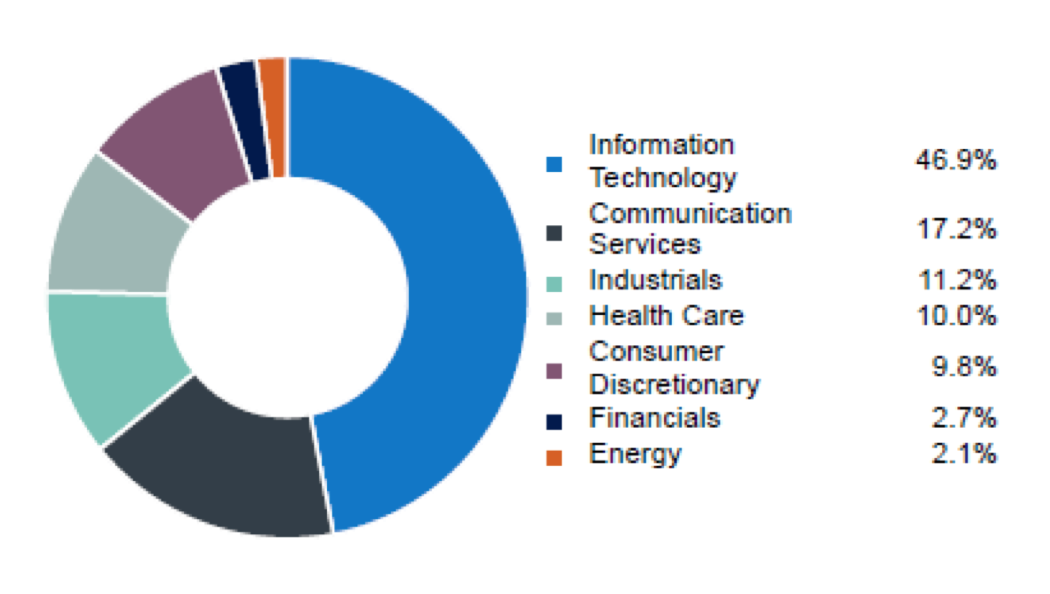

The chart above shows how the strategy was positioned by sector weight on average through the quarter, relative to the broader market.

Our preference for healthcare is due to a mix of steady growth characteristics and attractive valuations. A recent increase to the sector comes off the back of a growing opportunity within life sciences.

We have zero weight to the deeper cyclical area of the market since companies within this sector are either overly leveraged or have no pricing control – or both.

Our allocation to financials is due to a reclassification of Visa by MSCI.

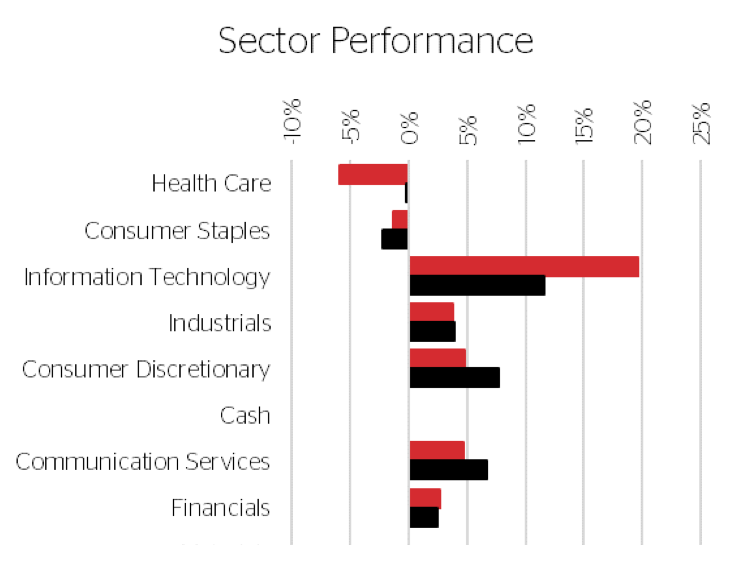

By grossing-up the performance of our holdings in each sector, we can compare how our stock-picks fared against their sector peers.

Our technology stocks were the biggest outperformer.

We also outperformed in both consumer staples (albeit with a negative outcome overall) and financials, despite owning only one stock!

Not having exposure to the deeper cyclical areas of the market was a net positive to the performance this quarter.

The product of a sector’s weight and its performance is the contribution our asset allocation and stock-picking had on final performance.

Healthcare is where we gave up the most ground.

Despite good stock-picks in financials and industrials, our underweight reduced their overall impact. We typically shy away from banks due to the very high levels of leverage employed within their business models. Our underweight to Industrials is driven by lack of attractively priced opportunities at present.

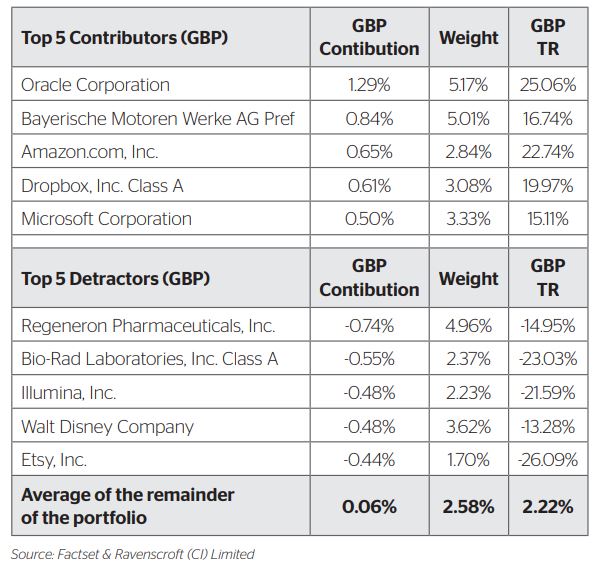

Top Contributors and Detractors

The table below shows the top 5 contributors and detractors.

AI has been the buzzword for much of this year, exemplified by NVIDIA. Their chips are used in generative AI applications that are proliferating the knowledge economy at what seems to be an exponential rate. Nevertheless, the theme is showing signs of maturing as investors seek opportunities away from the obvious into second and third-tier stocks that have the ability to demonstrate some point-of-differentiation with their products through the implementation of AI.

Shares in Microsoft, whose most obvious connection with AI is their collaboration with ChatGPT owner OpenAI, continued to surf the AI wave. The Company has been on a streak recently, outperforming expectations over the past three reporting quarters. Q3 2023 was no different – beating on both the top and bottom line and offering-up future revenue and earnings guidance that beat expectations. During the investor call, CFO Amy Hood continued to captivate investors by sprinkling more AI pixie-dust:

“As with any significant platform shift, it starts with innovation, and we’re excited about the early feedback and demand signals from the AI capabilities we’ve announced to date.

We will continue to invest in our cloud infrastructure, particularly AI-related spend, as we scale to the growing demand driven by customer transformation. And we expect the resulting revenue to grow over time.”

Dropbox is also pivoting towards AI within its product range and is firing 500 employees (16% of the global workforce) in order to fund the change in direction.

CEO Drew Houston, announced the very tough decision via his Twitter account attaching the email he had sent to his employees informing them of the change of direction and subsequent consequences. In it he wrote:

“The AI era of computing has finally arrived. We’ve believed for many years that AI will give us new superpowers and completely transform knowledge work. And we’ve been building towards this future for a long time, as this year’s product pipeline will demonstrate.”

On 21 June the Company introduced new AI products: Dropbox Dash, AI-powered universal search, and Dropbox AI, products designed to improve customer efficiencies and user experiences by utilising cutting-edge technologies. This is exactly what we would expect from an owner/ founder CEO who is highly incentivised to win with remorseless focus on both customer needs and the continuing relevance of their products.

Oracle is another that has been covertly beavering away at its product offerings to meet growing AI needs. In her pre-prepared remarks on Oracle’s Q4 earnings, CEO, Safra Catz, commented:

“Oracle’s revenue reached an all-time high of $50 billion in FY23. Annual revenue-growth was led by our cloud applications and infrastructure businesses, which grew at a combined rate of 50% in constant currency. Our infrastructure growth rate has been accelerating—with 63% growth for the full year, and 77% growth in the fourth quarter. Our cloud applications growth rate also accelerated in FY23. So, both of our two strategic cloud businesses are getting bigger—and growing faster. That bodes well for another strong year in FY24.”

The earnings release set a touchpaper under the shares, which rocketed a good 16% to a high of $127.54 over just 4 trading days. Shares have since retraced some of that move, finishing the quarter at $119.09 – a 32% (in USD terms) uplift.

The top three detractors are found within healthcare, more specifically biotechnology and life sciences. Regeneron Pharmaceuticals had some rather unexpected news that spooked investors when its filing for its high-dose Aflibercept formulation was not approved due to problems found at a third-party filling facility. No issues were raised about clinical safety or efficacy; we assume that once the wrinkles with the third-party partner have been resolved, the higher-dose regimen will be approved.

Shares in Bio-Rad, a recent addition to the portfolio, took a steep tumble after it moderately revised down its medium-term growth outlook due to a tougher funding environment within the emerging biotechnology sector and the margin impacts from stubborn inflation. We continue to believe the company is well-positioned for future growth and that the shares are attractively priced.

Activity

During the quarter we introduced vacation rental company, Airbnb, to the portfolio. The combination of falling tech-related stock prices and rising cash flows culminated in a valuation opportunity. Sentiment at the time was also rock-bottom, adding credence to the notion we were counter positioned to the market – a place where we find comfort more often than not. Airbnb is the subject of our Stock in Focus should you wish to learn more about the latest investment.

We pride ourselves on keeping portfolio activity to a minimum and what activity there is we try to keep to small tweaks in weightings in order to manage our overall risk profile (i.e., not be too weighted to any one stock or group of stocks). Due to the bifurcated nature of the market this year, many of our technology holdings outperformed the majority of the portfolio, distorting, to a degree, the portfolio’s structure – time to act!

One way we try and keep name turnover to a minimum is to weight our holdings according to the risk/reward on offer. This way we get to keep great businesses but in smaller quantities. By adjusting our preferred weighting down in the lower risk/reward situations we free-up space to take advantage of the more compelling risk/reward opportunities or open new prospects.

Towards the end of the month, we reviewed all our holdings, their valuations and preferred weightings, rebalancing the portfolio accordingly. There are too many trades to dissect individually, but, in general, we reduced some ‘hot’ tech positions and reallocated the proceeds across the portfolio with an emphasis to some of our worst performing.

As we look towards the second half of the year, many of the concerns we had in January still apply. The portfolio remains in ‘defensive mode’ with preference given to the more defensive sectors and cheaper stocks within the portfolio. We also have a healthy cash balance which we can deploy when opportunities present themselves.

Global Solutions:

Higher Risk

by Shannon Lancaster

Strategy not available to UK investors.

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

Much has changed over the past quarter and, as we look forward to the second half of the year, the market feels notably different to where we were at the end of March. The quarter since has seen the continued rally of the ‘Magnificent Seven’ and the technology sector dominated once again. In what some are dubbing ‘the most hated rally ever’, sentiment indicators have swung to extreme greed and there is a distinct undertone of uncertainty over what is to come.

Uncertainty has long been a defining characteristic of financial markets and, thankfully, we do not make investment decisions based on what may or may not unfold over the short term. Across the Ravenscroft strategies we invest in long-term irrefutable trends that can withstand turbulence. More specifically within Global Solutions, we invest in themes that have a long runway for growth. For example, energy transition investments give us exposure to progress towards to a low carbon economy. Nevertheless, this will likely take decades – and our path will certainly not be a straight line.

In terms of performance this quarter, the fund returned -1.2% (22) for Q2 2023 bringing YTD performance to 1.2% (23). The combination of not owning the super seven stocks that have driven the market rally, weakness in our key sector exposures (like utilities) and stock-specific contagion in the wind turbine space has resulted in relative underperformance versus the index.

Excluding the top index exposures like Microsoft and Alphabet was not an intentional decision when we built the Global Solutions portfolio but rather a result of our fund selection. We look for highly thematic funds usually run by specialist teams within niche spaces and, generally, they will have low crossover with the big indices and most popular ETFs. They invest in businesses that have a specific measurable purpose working towards solving the many and various challenges we face globally. While Microsoft and crew are great businesses, they are usually not ’pure’ enough, in terms of how they generate revenues, to sit within the thematic funds.

One of the top performing funds this year is Polar Smart Energy. The underlying portfolio is full of innovative businesses providing technological solutions and services targeting the decarbonisation of the entire global energy sector. The fund is founded on the belief that; with the world facing an urgent need to decarbonise, demand for smart energy solutions will rise exponentially. The result is a predominantly tech-focused portfolio and more small and mid-cap exposure, which has helped performance this year.

On the other side of the performance table is Schroder Global Energy Transition, which has detracted this quarter. This fund invests all along the energy value chain, including materials, producers and distributors. This fund has a number of stocks that were impacted by contagion in the wind turbine sector, including its top position in Vestas.

Despite not having any exposure to Siemens Energy, some underlying stock exposure was impacted by negative news from the company. They announced that their wind-subsidiary, Siemens Gamesa, had seen a substantial increase in failure rates of turbine components, resulting in an initial estimated bill of over €1bn. This caused the share price to fall 37% and had a ripple-effect on peers like Vestas, Orsted and Nordex.

Over the last two decades, the wind turbine industry has grown rapidly, boosted by decreasing technology costs, relatively cheap renewable energy prices and increased efficiency through bigger and better turbines. Despite all of these positive tailwinds, wind turbine stocks have had a bumpy journey. The pandemic in 2020 led to lockdowns, decreased industrial activity and reduced global energy demand. It caused supply-chain issues and disruptions to project construction. The war in Ukraine has also created logistics and supply chain issues, aggravated in some cases by the impact of sanctions. Pleasingly, many of our fund managers have reported these supply-chain issues have now been resolved.

The issues at Siemens, while painful, are restricted to its own turbines and although it caused peer share prices to move, it will not likely have a longer-term material impact on the sector. The worst is hopefully behind the stocks at this point, and it has likely given our underlying fund managers opportunities to add to their positions. With the need for clean energy going nowhere, and renewable energy prices still looking attractive, we believe the outlook for the energy transition is positive.

Elsewhere in the portfolio, two funds within Basic Needs have been strong contributors. Regnan Waste and Water has been very resilient despite a weak utilities sector backdrop. Although there are many standalone water funds, the two funds we have in this space blend their exposure to food and waste to broaden the investment universe. The fund invests across the water and waste value chains, including into companies developing new technologies to meet ever-growing demand. Waste is expected to double over the next decade, and we have to think of innovative ways to reduce or reuse materials. Regnan’s exposure to waste management companies was beneficial this quarter, as top positions in Veolia, Waste Management and Republic Services contributed positively to returns.

We have also been very pleased with Polar Healthcare Discovery this quarter. It is invested in small and mid-cap healthcare businesses finding innovative cures and solutions to various illnesses. There has been a lot of M&A activity in the portfolio and the fund has benefitted from a handful of takeovers over the past few months.

Given the long-term nature of all of the themes in Global Solutions, the portfolio has been built with the expectation of turbulence. We continue to believe that, although the journey may be bumpy, the destination is worth the wait.

Fund in Focus:

Sanlam Global Artificial Intelligence

by Tom Yarwood

At Ravenscroft, we have long been long-term global thematic investors. One fast-growing, long-duration theme that we’ve identified is the adoption of Artificial Intelligence (AI). AI has consistently been making headlines this year following the launch of OpenAI’s ChatGPT in late 2022 – the first consumer-facing AI application – which has drawn attention from investor and industry alike.

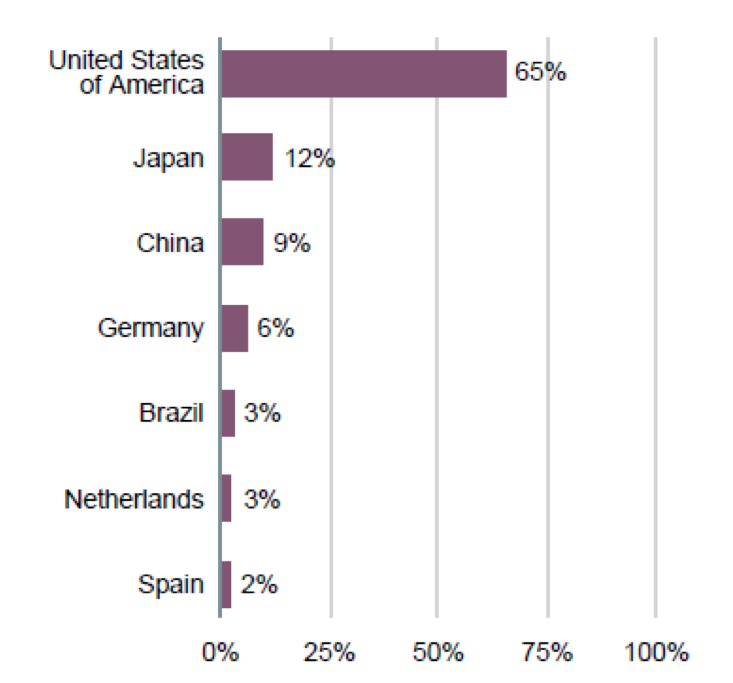

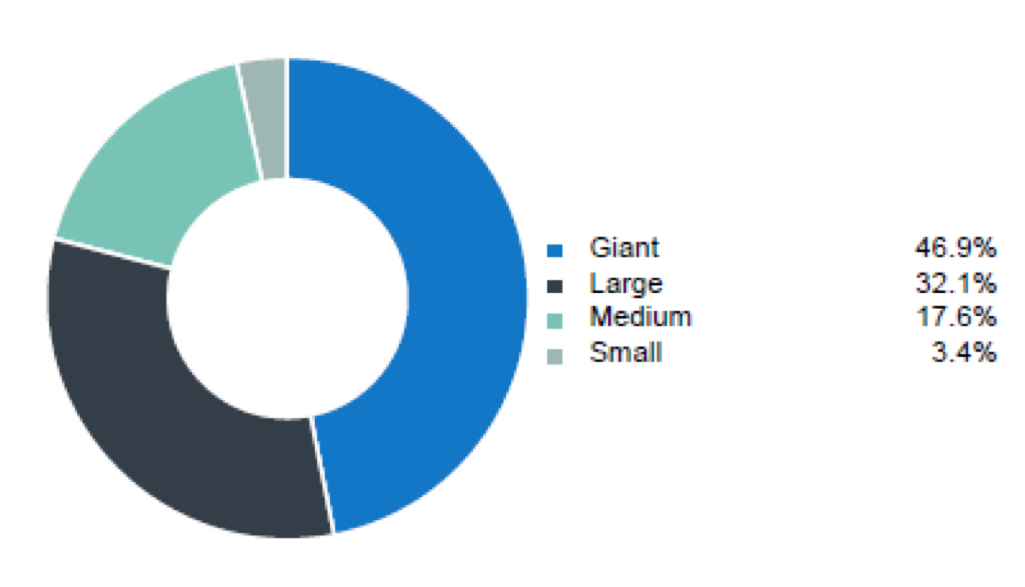

Whilst the hype surrounding AI has been particularly excitable in recent months, the subject has been a direct area of focus for the Sanlam Global Artificial Intelligence Fund since launch in 2017. It argues that the adoption of AI has the potential to solve some of the world’s largest economic and social problems and that companies able to capture this opportunity will benefit from significant competitive advantages. We believe AI has the ability to transform business and create compelling investment opportunities for shareholder returns on a global scale. The Sanlam Global AI Fund is an excellent source to gain exposure to this theme whilst being diversified by sector and region.

The Sanlam Global AI Fund is a long-only, global thematic equity fund that sits as a satellite position in our Balanced and Growth mandates. The portfolio is actively managed by Chris Ford, Head of Growth Equities at Sanlam, who boasts over 20 years of industry experience.

The Sanlam team argues that we’re at the start of the widespread adoption of AI and that those companies who can capture this opportunity will see considerable competitive advantages; they’d go as far as to suggest that the AI transformation taking place is the ‘4th industrial revolution.’

At a portfolio level, the Fund invests into businesses whose engagement with AI is likely to make a material difference to their long-term economic value. The initial investment universe is made up from around 20,000 names, before being reduced down to a more palatable 600 stocks that are worthy of portfolio inclusion through the use of their proprietary thematic AI-screening platform, Orbit. This custom-built tool helps to identify any possible companies whose future economic value might be directly influenced by AI, through the use of AI. This technology is embedded within the investment process and a tool that has been successfully utilised for over five years. Sanlam is a pioneer in the active investment AI space and it’s partly the strength of the platform that gives the process an edge, enabling the trawl through the investment universe in an objective way – even in countries where they don’t speak the language, like Japan or China. As more companies harness AI technology, the opportunity set will continue to grow on a globally unconstrained basis and enable the team to consistently build a portfolio with a great depth of exposure to AI beneficiaries. The managers’ freedom to back best ideas on an unconstrained basis results in a high-conviction portfolio of around 35-40 stocks, well-diversified by sector, region and market capitalisation.

The breadth of its exposure should help the Fund exhibit greater resilience during volatile market periods, given that it doesn’t take a binary outcome on a specific sector, like Technology, or a specific region, like the US.

So how has this looked in terms of performance? AI has dominated markets this year as investors and companies alike recognise the potential surrounding its adoption. As such, the excitement surrounding the technology has been a great tailwind to performance, with the Fund returning 22.0% in GBP terms YTD (24). It’s pleasing to see the strategy is performing as expected and proving to be a great source of diversification in our Balanced and Growth strategies.

In May, Nvidia, delivered its largest month of outperformance vs the S&P 500 Index and added the largest single-day market-cap gain in US stock market history. At the time of writing, it’s up an extraordinary 175.4%, in GBP terms, to the end of June (25). As one of Sanlam’s top positions this has certainly been accretive to performance, alongside other notable positions in stocks like Alphabet and Microsoft.

We recently spoke to Chris Ford about valuations; these still look compelling since a large amount of the AI-driven portfolio has barely moved and the risk-reward continues to remain attractive. We are convinced of AI’s potential as a strong secular tailwind for long-term growth and for Sanlam AI to be best placed to capture this growth potential for investor returns.

Stock in Focus:

Airbnb

by Sam Corbet

Airbnb, originally AirBed and Breakfast, was born out of the necessity to cover a rent shortfall when co-founder, Brian Chesky, a recent graduate in industrial design, arrived in San Francisco in 2007. Brian and his roommate, fellow designer Joe Gebbia, took the opportunity, that a popular design conference provided, to capitalise on the mismatch between the demand for hotel rooms and the supply available in their local vicinity.

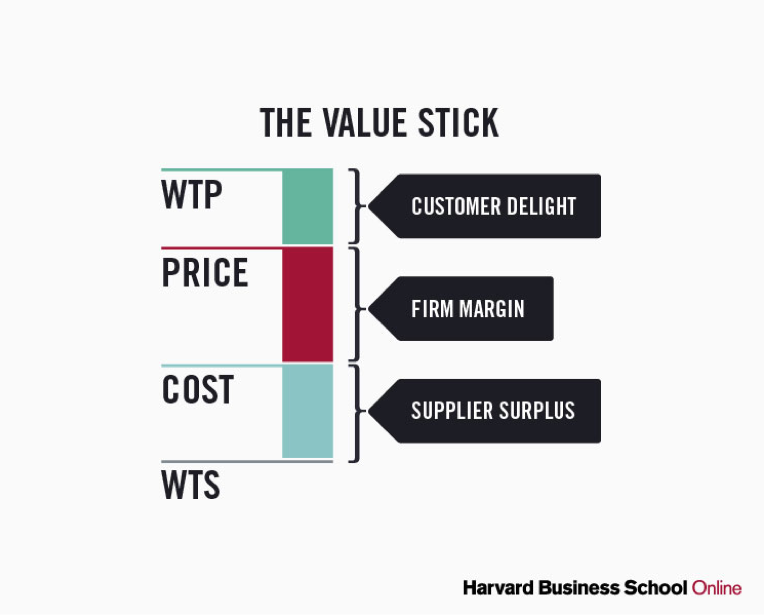

They inflated three airbeds in their home and hosted conference attendees – simultaneously solving their own rent problems and sowing the seeds for what has, today, evolved into one of the largest platforms for alternative accommodation listings. Earlier this year, at the recommendation of another highly-regarded global equity team, we read Better, Simpler Strategy (Felix Oberholzer-Gee) at which introduced us to the Value Stick framework. The framework is made up of four components: willingness to pay (herein referred to as “WTP”), price, cost and willingness to sell (“WTS”). WTP is separate (but connected) to price and, equally, WTS is separate (but connected) to cost. Establishing WTP and WTS creates value, setting prices and compensation captures value. The value created is split three ways: the difference between WTP and price is the value to the consumer (customer delight), the difference between cost and WTS is the satisfaction derived from the work (the supplier surplus). The difference between price and cost is the value that accrues to and is captured by the firm.

Firms create value by extending the distance between WTP and WTS and this is what the most forward-thinking firms focus their efforts on. Profit targeting companies, on the other hand, increase prices or reduce costs potentially to the detriment of either their customers or suppliers. This is an important distinction to grasp because profit-targeting firms can seem like good investments in the short-term and it is easy to lose sight of the fact that customers or suppliers will only tolerate this reallocation of value for so long. Companies who create value can increase customer delight, supplier surplus and the value their firm captures in tandem (a win, win, win).

With that in mind, Airbnb is a company that undeniably falls into the latter camp. Under Chesky’s thoughtful leadership, the Company is laser focused on better serving its customers (both hosts and guests) by solving the issues most pressing to them. On the host side, innovations like AirCover (Airbnb’s comprehensive protection policy, included for free with each rental, and covering damages up to $3 million) and Airbnb Setup (its new host onboarding program) reduce the price at which hosts are willing to list their properties. For guests, initiatives like pay-by-instalments or categorised search (which better showcase Airbnb’s impressive collections of unique properties) increase the consumers’ willingness to pay. We suspect there are many more avenues the company will explore as it continues to find new ways of increasing customers’ delight (or supplier surplus) in the years ahead and we expect the list of ancillary services it offers the users of its platform (and the revenues associated with these) to increase significantly over time.

In key cities, the company is currently supply constrained, and its recent focus has been on increasing new listings as well as improving utilisation rates among its existing properties. As part of this initiative, the company launched Airbnb Rooms during its 2023 Summer Release in May. Airbnb Rooms is an all-new take on the original Airbnb private room. This should increase the availability of listings at a lower price point (80% of rooms below $100 per night) and extend the appeal of the Airbnb platform to a younger cohort of users who have the same desire to travel but are potentially more financially constrained (particularly in the current economic environment) than older travellers. We like this strategy which not only serves as a funnel for acquiring new, life-long users but is also a clear example of Airbnb doubling down on the principal factor which sets it apart from other travel platforms - the uniqueness of its inventory.

Airbnb had been on our watchlist since its initial public offering in December 2020. At the time the euphoria surrounding the company elevated the share price to a level we deemed unattractive. A refocus in response to Covid-19 (which saw the company lose 80% of its business in quick succession) has seen a leaner business emerge; the the fundamentals have improved significantly as a result of the decisive actions taken. This has seen the company quickly converge on the 30% free cash flow margin we anticipated it would eventually reach. This development, combined with a retracement in the share price resulted in an entry point we deemed attractive enough to initiate a position during the quarter. The shares have recovered somewhat since but we remain ready to act should we get an opportunity to increase the stake at our desired price.

Boscher's Big Picture:

Surprising Developments

by Kevin Boscher

There have been several surprising developments from an investment perspective over recent months.

Firstly, the widely anticipated recession in the US and Europe has not yet materialised thanks largely to strong employment markets and resilient consumers. Secondly, although inflation has clearly peaked in the developed markets, it is not falling as quickly as many had hoped or anticipated with a resultant move higher in interest rate expectations and a hardening of central bank rhetoric. Thirdly, optimism around the re-opening of China after three years of Covid lockdowns has faded as the economic data, especially consumer demand, has disappointed. Given this, it is not too difficult to understand why bond yields have moved higher over the past quarter, especially in the UK, where inflation is proving to be much stickier than expected. Perhaps more surprising is the fact that equity markets have generally held up quite well, although headline numbers are being flattered by the strong outperformance from an increasingly narrow range of US FAANG plus stocks, on the back of AI excitement and the prospect of a less hawkish Fed.

I have often maintained that equities need three main pillars to deliver stellar returns: reasonable economic and earnings growth; valuations which do not appear stretched relative to the long-term history and macro backdrop; and enough liquidity to meet the needs of both the economy and investors. Starting with the growth outlook, although there are clear signs that US and European economic activity is softening and a recession looks likely, there are sound reasons why growth has so far held up better than expected and despite a significant tightening of monetary conditions. One of the key reasons is that the US, UK and European consumers, which account for roughly two thirds of economic activity, have been able to continue spending through a period of rising prices thanks to a strong employment market, some wage growth and unusually high pent-up savings as a result of the huge pandemic-related monetary and fiscal easing. Growth has also been supported by lower energy prices and reasonably strong housing and stock markets.

Another important consideration is that the full impact of monetary tightening is yet to come through, since it usually takes effect with a considerable lag. Not only has this has been one of the fastest and steepest increase in rates on record, but the full impact of Quantitative Tightening is also largely unknown. As the various tailwinds fade and interest rate hikes bite, the resilience of global activity in early 2023 is unlikely to last. Despite this, central banks remain in a hawkish mood and are indicating that rates are yet to peak with no cuts on the cards for some time. At their recent forum, central bankers also confirmed that some economic hardship is inevitable but moderate weakness in activity will not change their tightening bias, since their priority is to bring inflation much closer to the 2% target. However, it is also evident that central banks are very unsure about how much tightening is needed and they could change their tone relatively quickly if inflation shows clear signs of falling or should growth materially disappoint.

Given the various offsetting props to growth – including low unemployment, relatively strong private sector balance sheets and lower energy prices – it is likely that any recessions in developed markets will be modest. However, if the Fed makes a mistake and keeps policy too restrictive, which is a distinct possibility, then the recession will be deeper and longer than markets are currently anticipating. It is also important to remember that in periods of high inflation, nominal growth tends to stay positive in a recession as was the case in the 1970s and early 80s. This is very significant for earnings and corporate profitability since revenues and profits tend to hold up much better when companies have pricing power, such as now. Earnings so far this year have largely surprised to the upside, although this is partly due to a prior and significant markdown in expectations. There is widespread concern that forward earnings forecasts are too optimistic given the prospect of an imminent recession. However, assuming any slowdown is mild and given the more optimistic revenue picture, it is possible that forward profits have already bottomed, and earnings will continue to surprise on the upside.

The combination of recession, a tighter credit environment, lower savings rates and the lagged impact from higher rates should enable core inflation (and services inflation in particular) to recede further over the coming months. Although the market, and indeed the Fed, expect rates to move higher before the end of this year, widening disinflation should eventually allow the Fed to ease policy without inducing an economic or financial crisis. The BoE and ECB, on the other hand, have more work to do to reduce demand and bring core inflation under control, hence rates will peak and start falling later than in the US. As a note of caution, however, some commentators are putting forward a credible case why developed economy inflation will settle in a 3-4% range for this cycle due to some of the afore-mentioned trends. If this is the case, then central banks would face a dilemma, since they would have to choose between taking rates to a level which resulted in a much more severe recession or tolerating a higher base level of inflation. Given the high and rising global debt backdrop, my hunch is that they would choose the latter and continue to pursue financial repression, since a highly indebted economy is very sensitive to higher rates.

Falling global and Dollar liquidity has been problematic for markets, Dollar debtors and global growth over the past couple of years. A shortage of Dollars outside of the US, together with aggressive rate rises and a stronger Dollar have led to a significant tightening of financing conditions for many emerging markets and global trade related companies. China is a good example of this at present since part of the explanation for why the re-opening is not going as expected is that Chinese consumers and companies are busy paying down their Dollar debts rather than embarking on a huge consumption and investment boom. Historically, financial or economic crises have often started with such an event, such as the Asian financial crisis in the mid-1990s. A weaker liquidity environment also negatively impacts economic activity and means less money is available to support financial markets. Conditions are likely to remain tight for a while longer and until the Fed either ends QT, starts reducing rates or a combination of both. Beyond the next few months, however, a less hawkish Fed, lower energy prices, falling inflation and the end of central bank QT should lead to an improvement in global liquidity.

From a valuation perspective, equities look attractive in both absolute and relative terms after a difficult couple of years. This is especially true outside of the US and in the UK and Emerging markets. Even in the US, valuations ook much more reasonable if the more expensive FAANG and other mega-cap growth stocks are excluded. Equities look less attractive relative to bonds, but this is partly because bonds themselves are cheap after one of the biggest sell-off in decades. Some sectors and stocks remain relatively expensive, such as large cap technology companies but even here, much of the excess valuation has eased materially over the past two years. Also, if earnings have bottomed and expectations start to improve for 2024 onwards, then this will help bring down valuations further on a forward-looking basis. It’s also important to remember that part of any equity derating during a recession comes from a decline in the multiples that investors are prepared to pay for stocks. Provided that rates and bond yields start to decline over the next year or so, this will enable multiples to expand and valuations to improve further.

Assuming the macro environment evolves as expected over the next year or so, this should be bullish for bonds thanks to weaker growth, falling inflation, more dovish central banks, and an end to QT. In addition, and very importantly, yields across most government, corporate and emerging market sub-sectors stand at multi-decade highs and look very appealing, even relative to cash. Care is required in some areas of credit, such as lower quality high yield issues since a worse-than-expected recession could see debt defaults and spreads (over equivalent government issues) spike higher. Bonds remain unloved and many investors are underweight the asset class, hence prices could correct sharply higher once sentiment and fundamentals turn. Government bonds will also provide some protection should growth disappoint. After a very difficult period, bond investors can look forward to better times ahead and current yields seem to present a significant opportunity on a longer-term view.

It is also true that cash is once again an attractive asset class offering decent yields together with a safe shelter and a source of liquidity for investors during periods of market volatility. It is probable that equities and bonds deliver returns in excess of cash over the longer-term, especially when measured in real (after inflation) terms, but cash is certainly an attractive and high yielding asset class in its own right. Commodities have struggled over recent months, mainly due to a disappointingly weak China. However, we remain bullish longer-term given supply shortages, growing global demand, an improving growth outlook beyond the near term and the prospect of a weaker Dollar once the Fed pivots. Given the expected macro backdrop, we expect the Dollar to gradually decline over the next few years, which will be beneficial for global growth and markets.

The global economic and political outlook is very uncertain, and nobody (including central banks) can be certain where we are headed. We have not been through a pandemic, followed by a war, energy crisis and inflation shock before and economic models are unlikely to accurately predict the future. In addition, the world economy is going through a period of de-synchronised activity with recessions likely in many developed economies whilst China and other emerging economies are in recovery mode. Similarly, inflation has peaked in the US and is falling quite rapidly whereas it remains sticky and slow to ease in the UK and Europe whilst China and other parts of Asia are closer to deflation. In such an environment, policy making is extremely difficult, and we are likely to see a diverging approach here as well with the Fed expected to cut rates and China ease policy at the same time as the BoE and ECB continue to move rates higher.

In my view, the most probable base case is that the next year or so will feel quite disinflationary as recession kicks in and this will enable rates to gradually start falling either later this year or early next. Hence, we are likely in a cyclical bull market for equites. A meaningful rally in bonds should also take place once inflation falls further and the Fed capitulates. Investors should continue to maintain an equity bias in balanced portfolios for the time being but bonds and, indeed, cash, also add sensible diversification and opportunity. A combination of a mild recession, accelerating disinflation and a turn in the interest rate cycle will be bullish for risk assets and investors.

Longer-term, we are more likely returning to a period of elevated economic and inflation volatility (Fire) as outlined above, although even here there is some doubt as the strong secular trends, which have put downward pressure on inflation and interest rates since the late 1980s are still dominating, as recently highlighted by the IMF (Ice). We are confident that our long-term themes have the ability to continue to generate attractive returns in whatever environment lies ahead. In addition, our changing world theme is very much intact, as the global economic and geo-political order and framework evolves. We remain optimistic that we are in the early stages of a recovery period for risk assets but are ready to adapt our investment strategy and approach as events unfold and as required, in order to ensure that we continue to generate strong returns for our clients.

Please click here to view/download the PDF version of this update.