“But if you close your eyes

Does it almost feel like nothing changed at all?

And if you close your eyes

Does it almost feel like you’ve been here before

How am I gonna be an optimist about this?”

Pompeii – Bastille, 2013

Please click here to view/download the PDF of this update.

The last few weeks have been peculiarly reminiscent of 2008. In the words of Yogi Berra, the famous baseball player and manager: “it’s déjà vu all over again.”

We were incorporated in September 2008, a week or two before Lehman Brothers went bust – hot on the heels of the collapse of Bear Stearns, presaging the colossal global bail-out of the banking system that included JP Morgan, Goldman Sachs and Morgan Stanley. A fun time to launch an investment management business!

So, here we are in April 2023 having witnessed another run on banks, resulting, so far, in four failures: Silvergate, Silicon Valley Bank and Signature Bank in the US – and Credit Suisse in Europe. Unlike 2008, (both Kevin Boscher and Tom Craske will cover this in more detail later in the quarterly), we don’t think there is a widespread issue with banks globally, but it does highlight the impact of higher interest rates and the speed with which they have been raised. Things are already breaking so it will be interesting to see how central banks react over the coming months, particularly in terms of their determination to manage inflation.

Sticking with the theme of 2008, the key to our stance then was how we adapted and evolved our investment strategy to ensure that portfolios were fit for purpose in a changing world; that ethos and process remains at the heart of everything we do.

In very simple terms, we seek to appreciate our clients’ needs, understand the environment in which we live and identify long-term investment themes.

It is clear to us that change is afoot and that investors need to recognise the tidings. At our recent investment presentation, we highlighted what we call Four Forces of Change that we believe will impact the investment environment for years to come.

Geopolitics

Geopolitical angst has been bubbling below the surface for many years but this has now come to the simmer. We have recently seen the US knocking alleged Chinese spy balloons (and a few innocent homemade weather versions) out of the sky. This was followed by the Russians downing a US drone over the Black Sea. China continues to expand its military ambitions, recently announcing another year-on-year increase of 7.2% in defence spending ($225 billion). More concerning, and according to the CIA, President (for life) Xi has instructed the People’s Liberation Army to be ready to invade Taiwan by 2027. Moreover, the most obvious reflection of heightened geopolitical tensions are Russia’s (further) invasion of Ukraine and how the West has chosen to react. Compare it to the way the EU cravenly ignored Russia’s invasion of Crimea in 2014. We are experiencing a new cold war and can expect hostility to continue to rise over the coming years.

This backdrop is likely to increase market volatility whilst supporting a period of elevated inflation.

Demographics

We have highlighted an ageing global demographic for many years and it is a key driver behind our long-term healthcare allocation. Over time, this also means that the percentage of the population in the workforce shrinks – there are fewer people working but they are still required to maintain a similar, if not higher, level of productivity. Of course, this is aided enormously by technological advancements; but, overall, this will clearly be an inflationary trend over the long term.

Inequality

Inequality is a well-documented global phenomenon and one of the drivers behind the rise in populist politics. Whilst the recent cost-of-living increases in the UK have triggered strikes across the public sector, it is fair to say that this is the culmination of years of growing inequality.

This wealth gap will need to be addressed over time and, again, this is likely to have an inflationary outcome as wages rise.

Climate Change

This is another force that is already embedded in our portfolios, specifically our Global Solutions strategy. If we are truly going to address climate change globally, we will need to change our behaviour, the way we live, work, travel, communicate and how we provide and consume energy. Such an approach is very unlikely to be a cost-saving exercise and so, again, we find ourselves looking at another inflationary force.

In short, we are expecting the coming years to be peppered with more bursts of volatility driven by any combination of the above alongside higher inflation.

In light of our four forces, we have taken steps to ensure that our investment strategy evolves to cope. Our long-term irrefutable themes, such as healthcare, technology, consumption and global brands, all remain at the core of our portfolios. However, we have adapted some of the ways we play these themes to reflect the more inflationary environment. An example in the technology space would be our investment directly into Artificial Intelligence (or machine learning, if you prefer), which is increasingly used by companies to push efficiencies, combat inflation and maintain margins. It is this constant re-examination of our themes, combined with an understanding of the world into which we invest, that will be the key to meeting our clients’ investment objectives, both now and in the future. To return to Yogi: “the future ain’t what it used to be” – but we’re alive to it!

Cautious Portfolios:

Lower Risk

By Thomas Craske

Objective: The Cautious portfolio’s objective is to increase its value by predominantly allocating capital to fixed income investments. The portfolio can also invest into global blue chip equities with strong cashflows and progressive dividend policies. A neutral position would be a 75% bond/25% equity split with the maximum equity-weighting of approximately 35%. The cash generated can be re invested to provide capital or taken as an income stream.

The mini banking crisis – Are interest rates peaking at last?

Events over the quarter have certainly increased the chances that we are approaching this turning point. If central banks have found the pain point, i.e., where economies are starting to creak under the pressure of higher interest rates and inflation continues to fall, then we may well be moving from the tightening phase of this cycle to the easing phase. That, in time, leads to interest rate cuts and stimulative polices to encourage growth. Indeed, the market discourse over the last few months has gradually changed from being largely dominated by all things inflation, to focusing on rate cuts or “pauses”, a growth slowdown and job layoffs.

The collapse of Silicon Valley Bank (SVB) and Credit Suisse is indicative of the pressure that rapidly rising interest rates has applied to sectors like banking and property - and has made for a startling couple of weeks.

What is confidence-inducing is the speed with which authorities reacted to the issues, making it clear that lessons have been learned from 2008, and, more importantly, calming market fears of further contagion.

We appreciate that some of the headlines over the quarter, namely those surrounding the failure of Credit Suisse and SVB, have left investors with questions. Technical terms like “AT1”, and “CoCos” may be unfamiliar to many, so, given that the Cautious Strategy invests predominantly in debt securities (which includes these now-notorious instruments), we thought it prudent to explain what they are, why all the hullabaloo and how we responded.

What is an AT1, why did markets react, and how did we respond?

In the wake of the 2008 global financial crisis, banking authorities resolved to ensure that nothing similar could happen again. One major regulatory change required banks to hold more capital to provide support in times of stress. The AT1 bond, or Additional Tier One bond – otherwise known as Contingent Convertible bond – was one of the tools created to help. The bonds act as a cushion for banks should things turn sour and can be converted to equity or be written-off entirely. This conversation triggered in times of stress, supports a bank’s financial position and thus helps it to stay afloat. By design, they transfer risk away from the taxpayer and towards investors.

During the emergency take-over of Credit Suisse by UBS, the former’s AT1 bonds were triggered and written off. While that in itself was not unexpected in this type of situation (this is where it paid investors to have read the small print) it caused a strong reaction in markets. This was partly because it has been some time since AT1 bonds have been triggered – a sharp reminder to investors of the risks they carry – and partly because of a technical issue around how the Swiss handled the situation.

Traditionally, AT1s, or any bond for that matter, rank above equity holders in the event of a default, meaning that if a business fails shareholders lose 100% of their investment before lenders (bond investors) take any losses. This ‘golden rule’ was broken in the case of Credit Suisse. In the forced $3.2bn merger with UBS, AT1 holders were completely wiped out while shareholders got something (small, but symbolic) back. This perceived changing of the rules called the legitimacy of the whole AT1 market into question and, always quick to assume the worst, a loss of confidence spread amongst market participants, which then developed into a broad-based sell-off in all bank-related, and even insurance-related, securities. Speaking to experts in the space, however, the Swiss versions of AT1 bonds were based on slightly different contracts. This made the actions of the Swiss authorities entirely legitimate, even if they surprised markets. UK and European regulators were very quick to point this out, which brought some calm to markets.

During the turmoil, and as with any situation like this, we contacted our fund managers to confirm our exposure to Credit Suisse and to further understand their thoughts on the broader impact on markets.

We are pleased to report that the Cautious Income strategy had no exposure to the affected Credit Suisse AT1 bonds.

We do hold exposure to other AT1 bonds, mainly via the Sanlam Hybrid Capital Bond Fund although this translates into less than 2% of our overall portfolio and is focused on the highest quality names in the space. We are comfortable in Sanlam’s management and stress-testing of these positions and positive about the fund’s future return prospects (while being conscious of the risks in the asset class). On this basis we chose not to change our positioning.

How did the strategy and fund perform?

All things considered, we are pleased to be able to say that the Cautious strategy delivered a positive return of +1.5% (1) over the quarter. This was

slightly behind the sector which returned +1.6% (2), although when we analysis this small gap it looks to be based on factors that should wash out given time. The fact that markets delivered a small positive return in a quarter that contained a mini banking crisis is testament to the value on offer in parts of the market following the turmoil we saw last year.

Unsurprisingly, it was the funds most exposed to the financial sector that underperformed this quarter. Sanlam Hybrid Capital Bond, Prusik Asian

Equity Income and, recent addition, Lazard Global Thematic Inflation Opportunities returned -0.2% (3), -1.8% (4) and -0.1% (5) respectively. The bulk of the underperformance in these funds took place following the Credit Suisse collapse.

As regular readers will know, we are concentrating our efforts on building a strategy that can navigate the changeable environment that Mark describes in this newsletter’s opening piece. And it is great to see that one of the star performers over the quarter has been a recent addition to the strategy, GAM Star Cat Bond. Implemented precisely due to its differentiated return profile, the fund returned +3.5% (6), without even a wobble during the banking episode. Another new addition, Allianz Strategic Bond, which for all intents and purposes acts as the portfolio’s recession protection, returned +1.4% (7) over the quarter and +4.5% (8) through March. That these funds have performed admirably over a testing period gives us confidence that the changes made to the Cautious strategy will provide a strong ballast for the foreseeable future – and help it to deliver on its objective to investors over the long term.

Balanced Portfolios:

Medium Risk

By David Le Cornu

Objective: The Balanced portfolio’s objective is to provide capital appreciation through a balance of fixed income and global equities. A neutral position is a 50% bond/50% equity split and the maximum equity weighting is 60%. The cash generated can be re-invested to provide capital or taken as an income stream.

Hunting Alpha

The first quarter of 2023 has shown that global investment markets remain a precarious place to go hunting for investment returns.

We began the quarter with six glorious weeks where investment markets sensed that inflation was heading lower and central banks would soon pivot and moderate the pain that they were inflicting through their interest-rate policies. How quickly things change! In mid-February, on the back of an unfavourable inflation print, the Federal Reserve flexed its muscles, promising even higher interest rates for longer and quickly killed off the prevailing optimism; nevertheless, the extent of the pain that central banks are inflicting on the financial system became clear in March.

This, combined with lacklustre banking regulation and the law of unanticipated consequences, dented depositor confidence and threatened a run on the global banking system. In the space of one week the Federal Reserve provided an additional $303 billion in funding to the US Banking System, guaranteed all US depositors’ funds, offered unlimited loans to US banks, and, with accounting chicanery, provided a methodology for US banks to ignore the mark-to-market losses on their treasury holdings for at least a year. The big six central banks huddled together and promised bountiful liquidity for the financial system. We also said goodbye to SVB, Signature Bank and Credit Suisse.

Despite all the above, the Balanced strategy rose +1.5% (9) over the quarter, broadly in line with the IA Mixed (20-60%) Sector which returned +1.6% (10).

As investment managers, our aim is to deliver attractive long-term returns in excess of those generated by broad investment markets. The excess return gained over and above the return of the broader market is labelled “alpha”.

Achieving alpha is more art than science. To achieve alpha, we need a combination of hard work (thorough research), skill (ability to think differently to the herd), time, courage (preparedness to hold a position when it is not performing), humility (preparedness to admit your thesis was wrong and exit a position), as well as the right weapon.

Sometimes when hunting alpha, we choose to use a shotgun, sometimes we choose to use a rifle, and sometimes we choose to use a heat-seeking missile!

In the Balanced strategy, we changed weapons within part of our thematic equity allocation, switching out our shotgun for a rifle. We sold a long-term favourite, Polar Capital Global Technology and purchased a 4% position in Sanlam Artificial Intelligence. For a decade we had been using the shotgun, embracing the very broad growth opportunity that we saw within technology-related equity investments. The decision to sell was far from easy. Polar has delivered attractive long-term returns, their knowledge in the technology space is undoubted, and, to be candid, the investment team is a favourite of ours; every meeting with them over the years has been enjoyable and incredibly insightful.

You may reasonably ask why would Ravenscroft sell Polar Capital Global Technology?

In our search for alpha we have reached the conclusion that we will better serve our investors by focusing part of your portfolio upon a specific area of technology (AI) rather than embracing the broader opportunity set. The reason for focussing upon AI is multi-faceted; we believe we are at an inflection point where the adoption of AI within businesses will see exponential growth to where its use becomes the norm rather than the exception. This is driven by advances in AI over many years, whereby, rather than appearing to be a science fiction-based concept, every day, practical applications are now clear for all to see. This will provide significant opportunities for the businesses that develop and deliver AI, as well as for those businesses that intelligently use it to improve productivity and profitability. Additionally, if the decade ahead has higher interest rates than we have typically known since 2009, this speaks to a higher cost of capital and a more discerning spend upon technology by individuals and companies. This, in turn, should result in a broader gap.

The Sanlam AI fund was launched in June 2017 and has delivered a return of more than +16% per annum. We are oft reminded by our regulator that past performance is not a guarantee of future returns, and any investment may fall or rise in value. If our thesis on the opportunities presented by and broadening usage of AI are anywhere near correct, however, and Sanlam continues to show the skill it has in the past, we expect this to be amongst the most rewarding investments Ravenscroft will make for its investors over the next decade.

During the quarter a weapon change also took place within the fixed income content of the Balanced strategy. In this instance, we switched out a rifle for a heat seeking missile.

Motivated by the increasing value within global fixed income markets, it seemed appropriate to add to the bond exposure. We believe that inflation will abate as the year progresses and expect the aggressive tone of central banks to moderate, so we also wanted to extend duration to increase the portfolio’s sensitivity to falling interest rates.

At the same time, we are conscious that the decade ahead could be more volatile for bond investors than the one proceeding it, so we thought it was time to change tack and appoint a bond fund manager with a wider mandate than most we have utilised in the past.

This led to the sale of the iShares 7-10 year Treasury, a reduction of cash and the introduction of a 7% position in Allianz Strategic Bond fund.

Historically, most of our investments in bond markets have been rifle shots, such as the investment into the iShares 7-10 year US Treasury, which targeted a very specific part of the bond universe. Going forward, we will continue to deploy a number of rifle shots but will complement these with a number of investments in strategic bond funds, which have a much wider investment mandate.

These are more akin to heat-seeking missiles than rifles. Whilst the manager (Allianz) has to operate within the terms of its investment mandate, there is more latitude in where to invest in the hunt for alpha (i.e., like a heat-seeking missile it can change direction mid-journey in order to hit the target). In this case, whilst the Fund is restricted to focusing investments on sovereign debt, it can choose which blend of Governments’ debt it wishes to invest in. It is also empowered to choose the duration of the Fund. Since 2016 Mike Riddell (the Manager of Allianz Global Strategic) has actively managed duration within the Fund; in 2019 it was 3.3 years whereas today it stands at 10.4 years. The Fund can also have up to 20% currency exposure.

I hope that you have found this commentary interesting and would like to assure you of our absolute commitment to communicating clearly with you. If you have any questions about this commentary, please feel free to contact me or any member of the Ravenscroft team.

Growth Portfolio:

Higher Risk

By Samantha Dovey

Objective: The Growth portfolio’s objective is to provide long-term capital appreciation by investing predominantly into global equities. A neutral position is a 25% bond/75% equity split and the maximum equity weighting is approximately 85%.

What a difference a year makes

As my thoughts turned to the first quarterly of the year, the song going around in my head was “What a Difference a Day Makes” by Dinah Washington, only to realise the reference to a year rather than a day is more relevant! It’s still a great tune though.

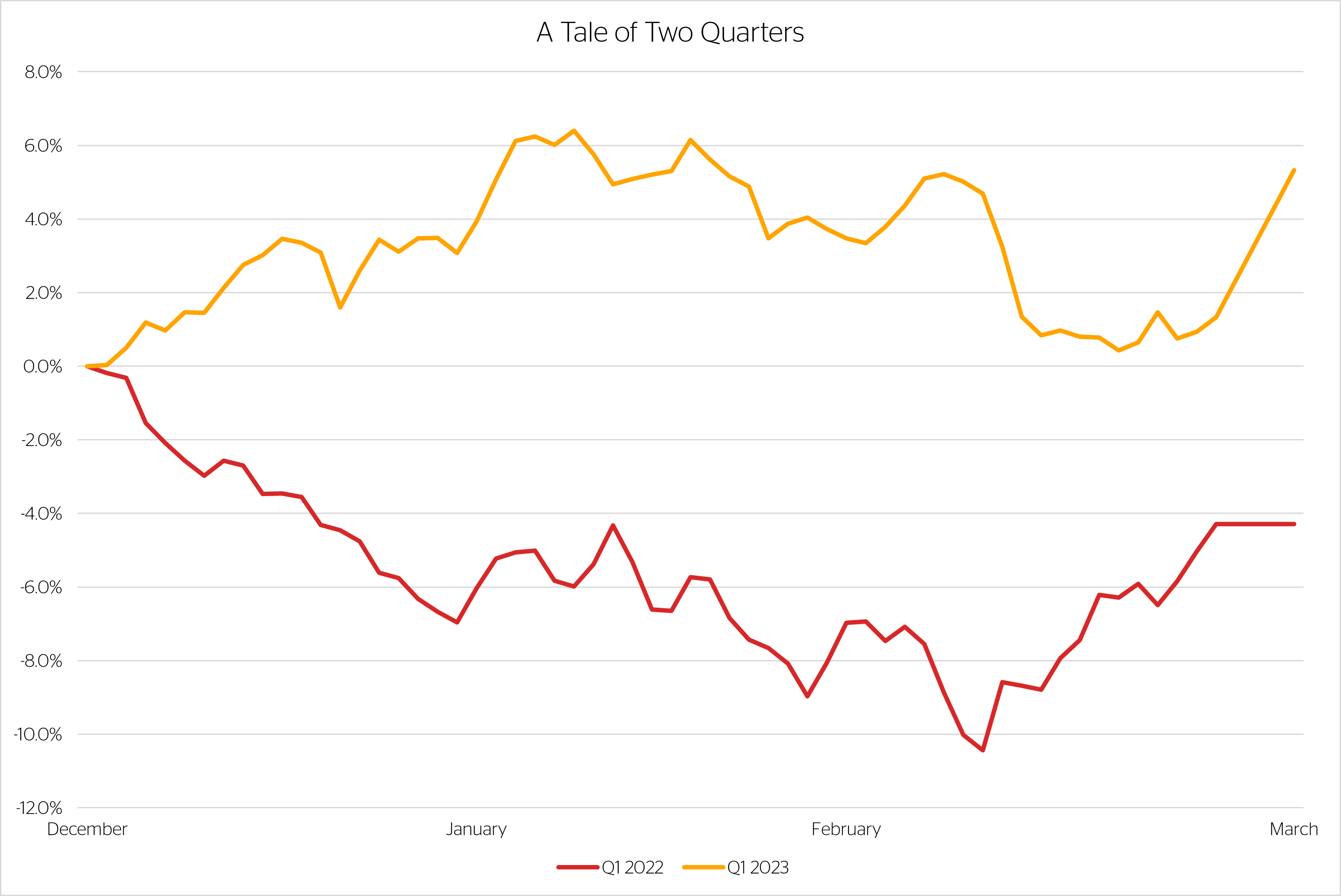

This time last year was very different in terms of performance reporting. For Q1 2022, the Growth strategy posted -4.3% (11), and at the depth of

the pain, the strategy was -10.5% (12) underwater. Conversely, the strategy posted +2.3% (13) for this first quarter of the year with highs of +6.4% (14).

The one thing both quarters exhibited was volatility. As somebody who looks at the underlying holdings within the strategies on a daily basis, investors will not be surprised to know that volatility is something we have weathered at heightened levels for the last 12 months, and to be honest, we do not expect this to abate in the near future due to our everchanging world.

For those who may not have read our Q1 newsletter last year (or perhaps read and have forgotten it), we highlighted the more severe impact that higher inflation and interest rates had on growth-centric equities and fixed income, in contrast to how this environment favoured value type equities or those assets which are more cyclical in nature.

For the visually-minded among us, the table below highlights the returns of the winners and losers across Q1 2022 and Q1 2023:

|

Q1 2023 |

Q1 2022 |

|

|

MSCI World Information Technology |

14.4% |

-7.6% |

|

MSCI The World Growth |

9.3% |

-7.1% |

|

Bloomberg Global Aggregate Credit Hedge |

2.2% |

-7.1% |

|

FTSE 100 |

1.3% |

2.9% |

|

MSCI World Value |

-3.8% |

2.2% |

|

MSCI World Energy |

-8.8% |

34.4% |

One of the reasons that we have seen differences in the performance of equity and fixed-income markets this year despite a similar macro backdrop, versus last, is in part because the market has gone past “peak panic” on inflation. Additionally, the war has unfortunately been raging on between Russia and Ukraine for over a year and to some extent has become part of everyday life.

Those who attended our presentation in March (a recording of which can be found on our website) or indeed those who have been avid readers of our commentaries will know that we have been adjusting our portfolios to try to navigate the pendulum between growth and value.

Portfolio changes for Q1 2023

- We trimmed all three global equity funds by -0.5%, taking Fundsmith Global Equity, GuardCap Global Equity and Lazard Global Equity Franchise to +9.5% each.

- We sold Polar Capital Global Technology and replaced this with Sanlam Global Artificial Intelligence (at +5%).

As investors will know, man’s ability to innovate has been a longstanding investment pillar in our portfolios. Over the years, Polar Capital Global Technology has given us fantastic exposure to the broad technology space and we really could not have asked for better stewards of your capital within this area of the market. Nevertheless, in January we made the decision to take our technology exposure one step further – to a sector looking ahead to the next decade.

Artificial intelligence (AI) sometimes gets blurred with automation and robotics. Automation and robotics look to make businesses more efficient, this includes, at the very basic level, replacing humans with machines – this is where most people focus.

The crux of AI, however, is employing collection and analysis to identify trends and efficiencies that businesses can build upon. As Bob Tannahill talked about in our March presentation, UnitedHealth, the medical insurer, is a big user of AI. It has developed a data analytics platform that uses natural language processing, through machine and deep learning models, to improve patient outcomes by predicting conditions and reducing the cost of care.

3. We sold Pictet Global Environmental Opportunities and replaced this with Schroder Global Energy Transition (+5%). We also initiated a new position in Schroder Global Energy (+5%).

The rationale for these trades all come down to the energy needs of the world in the near-, mid-, and long-term future. We must emphasise that Pictet GEO was not sold due to any issues with the Fund. The decision was driven by the portfolio having the highest correlation and crossover with the transition fund we were looking to introduce.

Schroder Global Energy concentrates on the traditional side of energy usage, focusing on the companies in the integrated oil, gas and associated service industries doing the most to adapt their businesses to achieve climate objectives.

Despite the very short holding period so far, coupled with the markets’ volatility shown in both the traditional and transition markets over the last quarter, the “blend” has performed as expected and most importantly has beaten the passive comparative.

As we look forward to the coming months, we do not expect the markets’ volatility to calm down in the near term, but we are hopeful that clarity in terms of inflation and interest rates will at some point bring some stability. As always, we remain thankful for your investment in our funds; if you need any further information, or just want to chat about your holdings, please feel free to contact us.

Global Blue Chip Portfolios:

Higher Risk

By Samuel Corbet

Objective: The Global Blue Chip portfolio invests into approximately 25-30 global blue chips that are in line with our long-term investment themes. The aim is to invest into such companies at an attractive valuation and hold them for the long term. The cash generated can be reinvested to provide capital growth or taken as an income stream.

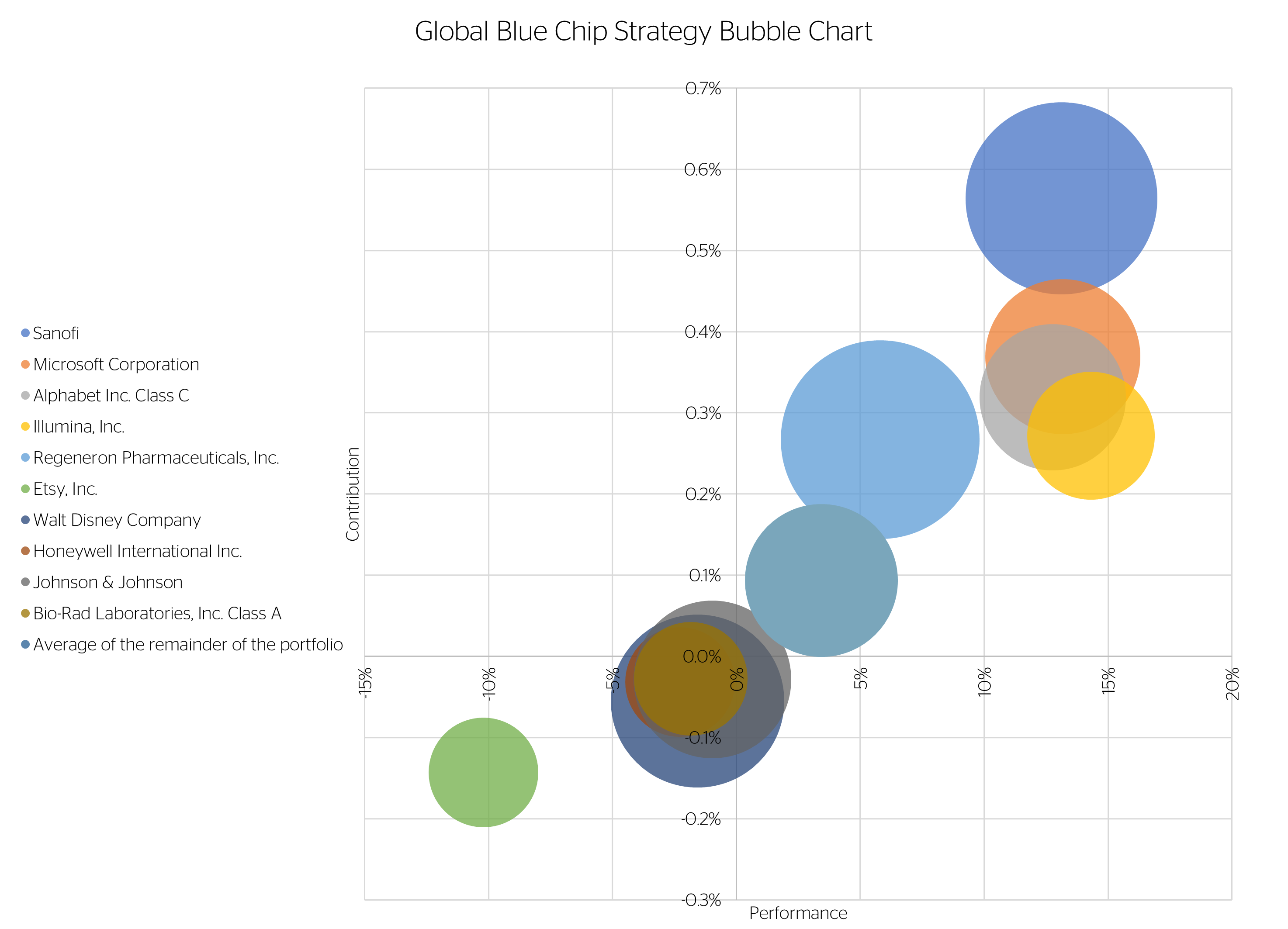

The collapse of SVB and the mini banking crisis that ensued brought a sudden halt to the risk-on rally in equities. Whilst the Fed and US Treasury were quick to stabilise the situation the ripples were felt far and wide resulting in the ‘bail out’ of Swiss banking giant Credit Suisse. Whilst the financial turmoil brought a level of caution to equity investor’s risk appetite, it failed to reverse their course in any meaningful way. We think this is more to do with sentiment than anything fundamental. The banking system is fragile, credit may become less available as a result, a contraction in the economy is inevitable… this is the prevailing narrative, and it is negative, and investor sentiment surveys still reflect this bearish view. Markets don’t capitulate when sentiment is already fearful, it would take a Donald Rumsfeld ‘unknown unknown’ to send them below their October 2022 lows today – that’s just the way markets work most of the time. But sentiment can change faster than the fundamentals. Investors could be lured back in, on the pretext that the Fed’s actions will quell inflation without further financial turmoil – a soft landing could happen! We’re not so sure, and we remain cautious. We’re also pleased with how the strategy has fared delivering a +4.0% (15) gain for investors against a market backdrop of +3.5% (16).

Turning to the underlying drivers, two of the top three are consumer discretionary businesses that can’t sate customer demand fast enough despite the fear of a looming recession.

BMW was the top contributor (returning 17.4% in GBP and contributor 0.8% to the overall performance).

The company held its annual conference during the quarter where it laid out its plan for the ramp up of its battery electric vehicles sales over the coming years with the expectation that these will represent 50% of total vehicles sold by 2030. The company guided to a EUR 7 billion free cash flow target for its automobile division – a significant jump from the EUR 4 billion target when we took our initial position.

LVMH (+23%, +0.7%) had another strong quarter with FY 2022 Louis Vuitton revenues surpassing EUR 20 billion for the first time. The company continues to invest in its brands and is gaining market share during a time where some of its peers are more financially constrained and paring back investment.

Oracle’s (+11.0%, +0.5%) strategic cloud business maintained high levels of growth and total cloud revenue continues to accelerate – bucking industry trends. The order book and accompanying capex outlook remains strong which bodes well for future results. We remain excited by the recent Cerner acquisition and the potential for Oracle to use its expertise to significantly improve patient outcomes through the creation (and roll out) of a universal electronic health record system.

Looking now at the detractors, the top three were healthcare businesses. Whilst these are defensive businesses and considered allies during financially uncertain times, certain stock specific issues have spooked investors.

Alnylam (-18%, 0.4%) investors were spooked when the company announced that the Food and Drug Administration (“FDA”) would convene an advisory committee regarding the company’s supplemental application for Onpattro in patients with cardiomyopathy. We remain confident in the wider validity of Alnylam’s TTR franchise and the outcome of upcoming trials should put any remaining concerns to bed.

For Johnson & Johnson (-14.0%, -0.4%). We believe that bearishness primarily reflected impatience and uncertainty surrounding the company’s ongoing talc class actions. Post-quarter end, the company announced a new proposal to settle these claims without admitting liability – the announcement was well received by investors.

Roche has had an unfortunate run of clinical trial failures over the past year raising concerns over its pipeline and subsequently its future growth prospects at a time when the Company warned that 2023 profits will fall $5 billion as demand for COVID related products continues to decline.

During the quarter, we introduced one new holding into the portfolio – PTC.

PTC is the leader in product lifecycle management software and also a major player in computer-aided design – two critical systems used in the design, production and support of products. Investors interested in learning more about the Company and our rationale for owning it can find further information in this quarter’s Stock in Focus. The acquisition was funded by the sale of our position in Henkel. Henkel has struggled in light of slower economic growth and inflationary pressure, and we have growing concerns over their pricing power and management’s lack of long-term strategy to address this. We are more comfortable having these funds utilised in stocks with higher growth potential over the long term.

Global Solutions

Higher Risk

By Shannon Lancaster

Objective: To generate capital growth over the long term (over 5-10 years). The strategy invests into 10-20 carefully selected third party equity funds; following the same, stringent investment process as the other multi-manager portfolios in our range. It is a highly focused portfolio which invests in companies providing goods and services dedicated to finding solutions to the challenges the world faces today.

As the first quarter of 2023 draws to a close, we reflect on a full year since Ravenscroft Global Solutions launched. Undoubtedly, the past 12 months proved to be one of the most challenging investing environments on record; having launched two weeks after Russia invaded Ukraine, the year that followed brought a lot of volatility and constant waves of negative market news.

The backdrop of economic turmoil and devastating situation in Ukraine, was certainly a challenge and test for the portfolio, which navigated the environment extremely well – testament to the work put into to its careful construction.

We selected each Fund to contribute something different to the portfolio, with a specific role to play, and, pleasingly, each behaved as we expected.

Since launch (from the 31st of March 2022 to the 31st of March 2023), Ravenscroft Global Solutions posted a return of -3.6% (17) versus the MSCI ACWI which posted -2.7%. (18)

As recession fears calmed in Q1 2023, global equities performed positively despite the collapse of Silicon Valley Bank, which caused significant volatility in the financial sector. Surprisingly, it wasn’t this sector that was the worst performing sector: energy and healthcare sectors lagged the most over the quarter, whilst technology stocks made some of the strongest gains.

Within emerging markets (EM), it was a similar story in terms of sector performance. EM, were positive over Q1 but lagged the MSCI World index. The start of the year brought with it renewed optimism about EM, given the re-opening of China’s economy, supportive property market measures and a loosening of the regulatory crackdown on domestic technology companies also bolstered investor sentiment. However, this was short-lived as February and March saw US-China tensions re-escalate.

Since launch, our fund selection within the “Emerging Equality” theme has outperformed the MSCI Emerging Market index. Aikya Global Emerging Markets was the top performer in the space due to its defensive underlying exposure in sectors like consumer staples and healthcare. Aikya seeks to generate healthy long-term returns with strong downside protection, achieved through investing in high-quality companies in emerging markets when they trade at sensible valuations.

Within the portfolio’s “Basic Needs” allocation, Candriam Oncology was a detractor for the quarter but over the past year it remains a top contributor to performance. The world is getting older and with age unfortunately comes the increased risk of ill health. Candriam provide us with an opportunity to invest in the fight against cancer, the number two cause of death worldwide. The team use well-researched investments in a global range of companies and strive for a broad advance in diagnosis and treatment of all cancer types. Their exposure is mostly to large-cap global businesses; this acted as the detractor this quarter due to the broader healthcare sector lagging the market as the lowest performer. Getting to a low-carbon economy is a massive task and will require huge investment if we are to achieve our climate targets by 2050. We have three funds that give us exposure to this “Energy Transition” theme.

Our top performing fund this year is Polar Capital Smart Energy which invests along the energy value chain featuring some exposure further down the market cap spectrum.

The Fund focused on energy transition segments with strong structural growth drivers such as clean power production, smart grid and storage solutions, electronic vehicles, building efficiencies and the energy efficiency of Big Data.

Across this quarter, our fund within the “Resource Scarcity” theme was a key contributor - Robeco Smart Materials. As our population grows in a resource-strained world, this theme is all about getting more out of less and Robeco have posted strong returns both this year and in 2022. They look at the world through clusters, investing in technologies, products or services relating to the extraction, transformation or efficient processing of innovative materials, technologies enabling more automation and efficiency in industrial manufacturing, as well as the recycling and reuse of materials. These are companies that will continue to enable sustainable economic growth going forward.

We have made no changes to the Fund since launch but are looking to increase its European exposure. The portfolio’s main geographical

exposure is the US due to the vast number of investable opportunities there; however, over time we expected this to change as new businesses evolve and funds come to market. An increase in European exposure helps us create a more balanced portfolio in terms of regional exposure and adds something new in terms of underlying companies and more value-tilted investments.

We remain constructive on the outlook for our underlying themes.

Given the urge to accelerate the energy transition, regulatory and government support and increased awareness of these global challenges, we believe there is a long runway for growth from the underlying funds within Ravenscroft Global Solutions.

In what has been an undeniably volatile 12 months for the markets, the portfolio has behaved well since launch and provided a smoother journey than many peers. We are pleased with portfolio’s performance and look forward to keeping you updated along the journey.

Thank you for your support and, as ever, if you have any questions please do not hesitate to get in touch.

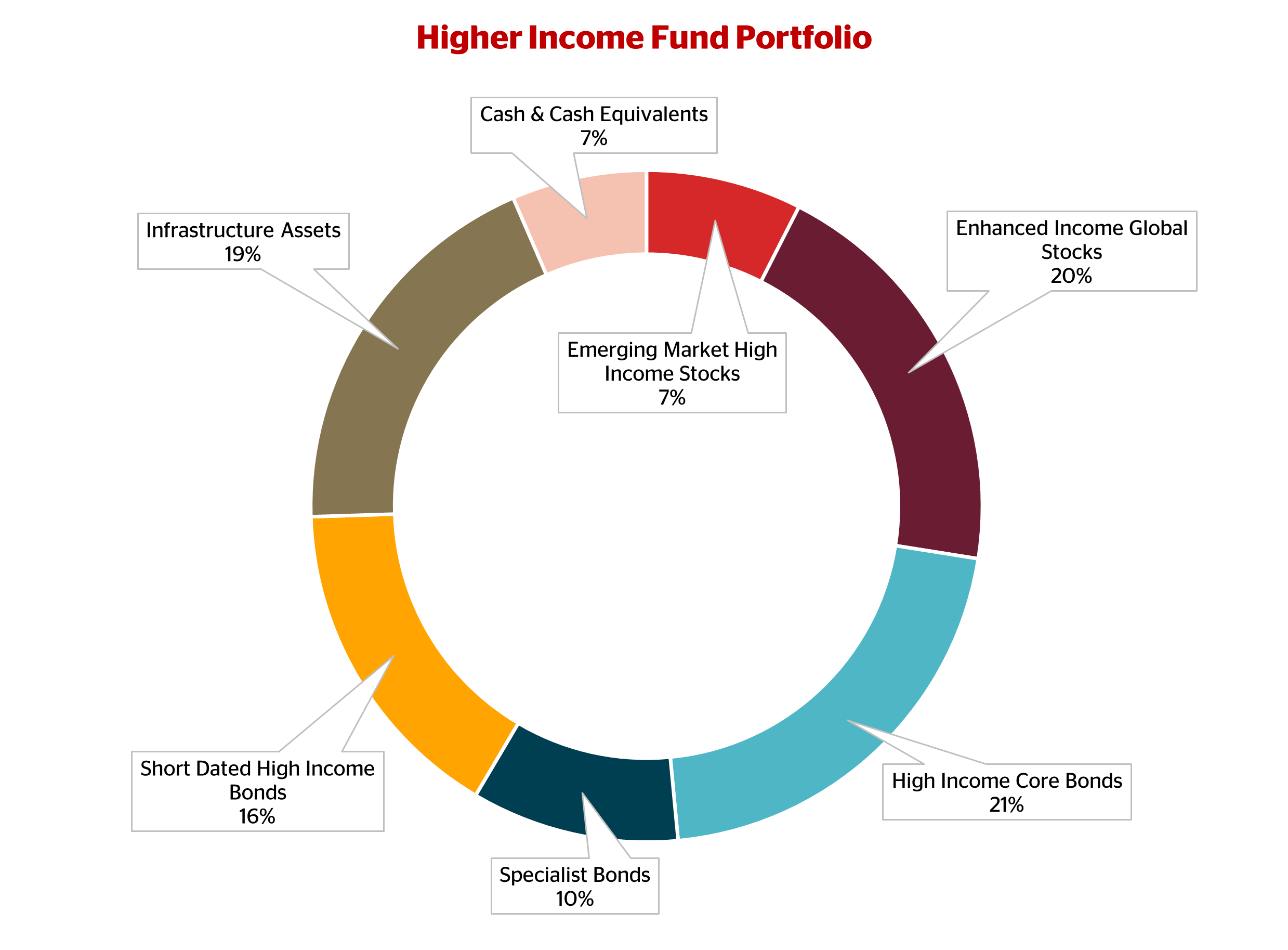

Fund in Focus: Higher Income Fund

Fancy a bit more income in your portfolio?

By Robert Tannahill

With central banks having increased interest rates at the quickest pace in years, earning income on your investments hasn’t been this rewarding in a long time. To help investors take advantage of the opportunities this change has produced, the team is launching a new Higher Income Fund (to complement the existing, cautious, Income Fund) for those investors who want a higher income from their portfolio.

As a team we have been running income strategies for nearly 15 years now and we have been talking about a higher income approach for a lot of that time. Unfortunately, in the post-financial-crisis world we have been in for much of the last decade (up to now), we didn’t think investors were being paid well enough to reach for additional income, so we stuck with the cautious approach. With the rapid increases in the interest rates we saw last year, and the tough year for bond markets that resulted, that has changed. Income-focused investors can now pick up some very attractive assets paying levels of income we haven’t seen in years. And to help you access that we are launching the Ravenscroft Higher Income Fund.

Fund comparison

|

Income Fund |

Higher Income Fund |

|

|

Current Income |

3.8% |

6.0% (Launch target) |

| Recommended Investment Period | Two to three years or longer | Three to five years or longer |

| Typical Investor Mindset | Cautious | Willing to strike a balance between capital volatility and return |

|

Risk Profile |

Lower | Medium |

How is it invested?

The Higher Income Fund follows our existing investment approach of looking for quality assets that are on the right side of the big structural changes and seeks to invest into them at sensible prices. Then, using the team’s experience of running income strategies combined with a broader remit than our existing cautious income approach, it aims to a build a portfolio that seeks to maximise income as its primary goal.

Top holdings

| Fund | Weight |

|

Fidelity Sustainable Enhanced Dividend |

10.0% |

|

Rathbones Ethical Bond |

10.0% |

|

Muzinich Emerging Markets Short Duration |

10.0% |

|

Royal London Short Duration Global High Yield |

9.0% |

|

Schroder Strategic Credit |

9.0% |

Find out more

The Higher Income strategy has been running as a segregated mandate since the start of the year and we are hoping to have it available as a Guernsey fund for investors, subject to regulatory approvals, in May. If you would like to find out more, please feel free to contact a member of the team.

Stock in Focus:

PTC

by Oliver Tostevin

In March we added PTC, a Boston-based software company, to the Global Blue Chip portfolio. The Blue Chip team turn over a great many stones in our pursuit of standout businesses that fit our requirements and sell at attractive prices. In this case, we were turning over stones in the general field of industrial software when we unearthed a shimmering pearl.

As for our interest in industrial software, a number of threads seemed to be pulling us in that direction. Various disruptive forces are at work in the world of industry and manufacturing – many of which you will have heard about, including from Ravenscroft. One such force is an ageing global population (also one of our core themes) and the reality that companies will have to become more efficient in the face of labour pressures. This is further aggravated by global supply chain fragilities made stark in the wake of the pandemic – a partial rollback of globalisation is already underway, driven by both business and politics. Into this mix throw climate change, with manufacturing and industry among the largest emitters of greenhouse gases. The demands for industrial businesses to (sustainably) do more with less are clear. And then there are the prescient words of venture capitalist Marc Andreesen: software is eating the world. Industrial companies without a robust digital transformation strategy are vulnerable in this brave new world, while those that get it right have opportunities to flourish. We believe that PTC is among the best-placed to help.

PTC’s two principal business lines are computer-aided design (CAD) and product lifecycle management (PLM) software.

One common aspect of the two is that they’re both very “sticky” systems – once a customer is using a practical CAD system, they’re unlikely to switch to another, and this is even more so with PLM. Moreover, these systems are mission critical and accessed via subscription, making for a highly recurring revenue base (more than 90% of PTC’s total).

PLM is the system of record for all aspects of a product’s lifecycle, playing a central role in product design management, manufacturing, materials procurement, servicing/maintenance and regulatory compliance, among other areas. Per PTC’s CEO, Jim Heppelmann, PLM has gone from “nice to have” to “must have” in recent years. Customers are increasingly looking for more capabilities from PLM as well as expanding their base of users out of engineering and into other departments in the name of digital transformation. Already the leader in this attractive space, PTC is taking hard-to-win market share due to the strength of its offering.

The adjacent CAD market in manufacturing is complementary, yet distinct. PTC is perhaps the number four player here despite its heritage as the original 3D CAD business. That said, PTC has a strong position in certain specialist high-end design applications in industrials, automotive, aerospace and electronics. PTC has been winning back market share in recent years. But things are even more exciting in the general CAD space, where system prices are lower and PTC has less presence. PTC’s Onshape product is the first genuinely cloud-native CAD system and we believe it to be the most disruptive system to appear since the mid-1990s. Very briefly, Onshape works on any device (including smartphones) without an installation. It enables real-time collaboration and sharing with everyone (a technically complex challenge and the driving force behind Adobe’s pending acquisition of Figma), and it updates with new features every three weeks. Onshape customers are delighted to discover that their pace of innovation accelerates. The opportunity to take market share is significant.

The third string to PTC’s bow is the cloud architecture that came with Onshape when they acquired the business in 2019.

CAD and PLM are two of the last major software systems that are yet to transition from onpremises servers to cloud companies, PTC is progressively re-writing its legacy systems to operate through Onshape’s architecture and is leading its peers in this respect. The company conservatively estimates this will add roughly four percentage points to annual revenue growth in the coming decade, given that cloud-based software simultaneously provides higher revenue and better customer value (such as we have seen at Adobe, Microsoft and Oracle).

Lastly, we consider Jim Heppelmann to be a very shrewd strategic operator, as evidenced by his acquisition record since taking command in 2010. In addition to the Onshape acquisition, Heppelmann has spent years positioning the company in areas such as augmented reality, the “industrial internet of things” and generative AI while integrating these capabilities into PTC’s product lines and seriously upping the ante on the customer proposition.

All of this makes for a highly profitable business with competitive advantages and economic resilience. And importantly, in our view, PTC’s growth opportunities in the coming decade are exciting but not yet fully appreciated by investors.

Boscher's (Bite-Sized) Big Picture:

The world order is changing but 2023 should be a better year for investors

By Kevin Boscher

The first quarter of 2023 has seen plenty of drama, but the general theme is that the global economic and market environment is in a volatile transition from an inflationary boom to a period of disinflation and weakening activity.

Having started the year off strongly thanks to markets pricing in peak rates and an easier monetary policy stance, equities quickly sold off again mid-quarter as the Fed and other central banks indicated that the inflation fight had not yet been won and that further rate hikes would be necessary. Government bonds, on the other hand, started to rally as growth faltered and concerns grew around the prospect of a tougher than- expected recession caused by the Fed’s over-tightening mistake. The sudden appearance of a banking crisis in early March saw a renewed period of risk aversion as equities sold off and sovereign bond yields fell sharply. A prompt and strong reaction to the banking problems from the US and European authorities seemed to calm markets; equities were able to recover some of their losses whilst bond yields have ended the quarter significantly lower than their January levels.

There is an intense debate over whether the bear market in stocks is over or not and whether the US economy is headed for a “hard” or “soft” landing.

The pessimist camp believes that the banking crisis in the US is not yet over and that it will precipitate a recession, which will be deeper and longer than would otherwise have been the case. Consequently, although earnings expectations have been materially downgraded over recent months, stocks are not yet discounting the contraction in earnings that lies ahead. The bears also think that the US economy remains too strong and question whether inflation is falling quickly enough to persuade the Fed to pause. This implies that rates will move and stay higher for much longer than markets currently expect, intensifying the recession and earnings hit. The bulls, on the other hand, believe that inflation and rates have peaked and that, as the Fed and other central banks pause their rate hikes and start to ease policy over the next few months, this will prove to be a very important catalyst for a sustainable rally in stocks and bonds. They also believe that as the Fed pivots, rates start to fall and global liquidity starts to improve, any recession will be relatively short lived – and investors will soon start to look through the gloom to an acceleration of activity later this year or early next.

I am in the “glass half-full” camp and lean towards the bullish argument for a number of reasons.

There are clear signs that US economic activity is falling quite rapidly and that employment pressures are starting to ease as an increasing number of companies lay off workers and wage growth moderates. Together with evidence that consumers have largely drawn down on their pandemic-bloated savings and that rents are turning lower, this should accelerate the disinflationary process and provide the Fed with the catalyst it needs to turn more dovish. In addition, a banking crisis is inherently disinflationary since banks are forced to shrink their loan books and reduce their balance sheets to improve their liquidity and protect their solvency. This hurts businesses, dampens consumer spending and squeezes corporate investment, leading to a credit crunch and slower growth. Historically, the Fed has always eased quickly and aggressively whenever faced with a banking crisis to counter deflationary pressures and limit financial contagion. This time around, inflationary pressures have forced the Fed to separate its roles of ensuring enough liquidity in the system whilst also tackling inflation; but as recession hits and disinflation accelerates, the Fed will be persuaded to act. Equities have been waiting for a Fed pivot for some time and stocks will likely be more sensitive to falling rates and easier financial conditions than weakening growth. As a result, investors will quickly start to discount an improving growth outlook while rising liquidity will aid both economic activity and market sentiment.

It is important that the Fed, other central banks and relevant authorities are committed to doing whatever it takes to restore confidence in the banking system and thereby contain any fallout. Banks are highly leveraged businesses and if depositors lose confidence and decide to take their money elsewhere, it is very difficult for a bank to survive – regardless of how much capital it has. With US regional banks still losing deposits at a rapid rate, the Fed is under pressure to suspend its QT program and ease policy. One of the key causes of the current banking problems is the rapid and aggressive tightening by the Fed, which is likely to result in a credit crunch and recession. Hence, any monetary easing by the Fed will alleviate some of the pressures that banks currently face in terms of a rising cost of funding and deteriorating asset quality. There is precedent here: the Fed was forced to reverse QT and cut rates in late 2018 because a liquidity shortage flared up in the banking system.

Another key consideration for markets and a point of debate is the likely trajectory of earnings and whether analysts have discounted sufficient bad news about the likely growth slowdown ahead. The truth is that it is very difficult to have much conviction about this since it depends on so many variables, including: what will the Fed do; has the banking crisis been contained; how deep and long will the recession be; and, how are companies managing their way through this challenging period?

Assuming that the macro backdrop develops as I have outlined, above, then it is likely that the market is already discounting most of the bad news around earnings. Clearly this could turn out to be wrong if the economic outlook deteriorates significantly.

It is also important to remember that part of any equity de-rating during a recession comes from a decline in the multiples that investors are prepared to pay for stocks. Equities have already fallen materially over the past year or so and valuations look much more attractive across a number of markets, sectors and companies. In addition, revenues and profits can hold up better than expected during inflationary times, since some companies are able to pass on increased costs to the end consumer

Although recessions are bad news for earnings, lower interest rates and bond yields tend to drive up asset values, including equities. A final point here is it is likely that some businesses and sectors are managing much better than others in this environment and that the earnings outlook will therefore vary considerably – which is good news for active stock pickers.

There are several other important considerations influencing the bullish vs bearish debate. As I have previously outlined, China re-opening is a major positive for the global economy and markets this year. A stronger Chinese economy will boost global trade, suck in imports from overseas, help offset some of the weaker growth from the US and Europe, and help drive up profits from multinationals that sell into China. An upturn in the Chinese business cycle is also positive for commodities and Emerging Markets. We will be looking to take advantage of this in our portfolios through a variety of investment opportunities, many of which are aligned to our long-term irrefutable themes.

Another potential positive for markets is that sentiment towards both the economy and stocks remains negative.

Many institutional investors are significantly underweight equities and overweight cash. This is a positive from a contrarian viewpoint and suggests that markets are already discounting a lot of bad news. It is notable that, over recent months, each new piece of news: from the Fed’s hawkish language, through to the banking problems and, more recently, OPEC’s surprise announcement to cut oil supply to underpin the oil price, seem to have been taken in markets’ stride. This also implies that, after a very difficult couple of years for investors, much of the selling power has been exhausted. Having said that, any material spike in energy prices would be an unwelcome problem and only add to growth and inflation concerns, whilst a tough recession and an escalation of the banking crisis could also see equities fall further. Finally, markets have been monitoring for a while whether the Bank of Japan is likely to abandon its yield curve control policy with the likely result that Japanese (and perhaps global) bond yields could spike higher at the same time as the yen strengthens materially due to the repatriation of Japanese savings. This could be very unsettling for markets and add to the volatility and needs to be monitored.

Beyond the next year or so, we are very conscious that the post-pandemic world appears to be changing in a number of ways, all of which will likely have a huge influence on the global economy and markets over the next decade or longer. Some of the key factors that are shaping our thoughts include the ageing demographic and shrinking work forces, income and wealth inequality, increasing geopolitical angst resulting in a fragmenting world and climate change

Nobody knows how these will evolve and interact and what it means for the macro environment and markets, but it will most likely lead to a prolonged period of elevated economic, market and inflation volatility. It will also present serious challenges for central banks and governments everywhere. However, it’s certainly not all doom and gloom; lots of new and exciting investment opportunities will arise as events unfold. It is also likely that a different investment strategy will be required to deliver superior investment returns to the one that has worked so well for the past decade or so.

A more flexible – and perhaps active – approach will be needed.

Moreover, it will be important for us to evolve and adapt our own process as conditions dictate. Nevertheless, we will stick with our core philosophies and thematic approach as we navigate our way through the change. I will write in more detail about this in my next article.

Markets like to climb the proverbial “wall of worry” and always have plenty of reasons for concern. The present time is no exception, but I remain constructive on the outlook for stocks and bonds in absolute terms. The end of one of the most aggressive periods of Fed tightening ever will be unambiguously bullish for both bonds and stocks, especially if disinflation prevails, as expected. That said, it is sensible to remain reasonably defensive and cautious until we see more clarity around Fed policy, banking problems, the earnings outlook and inflation. We have already increased exposure to bonds (mainly governments) and extended duration, which has been beneficial of late. We remain cautious towards corporate credit since a tougher than expected recession could lead to rising default risk and loan delinquencies. We are ready to increase exposure to equities once we become more confident in the outlook and have identified several interesting opportunities, many of which are trading on attractive valuations after recent declines. Finally, given the uncertain and changing outlook, we continue to look for the appropriate balance and diversification within our portfolios between the various asset classes, value and growth stocks, defensive assets and appropriate hedges. Despite the problematic macro backdrop, we are hopeful that 2023 will continue to be a year of recovery for markets.